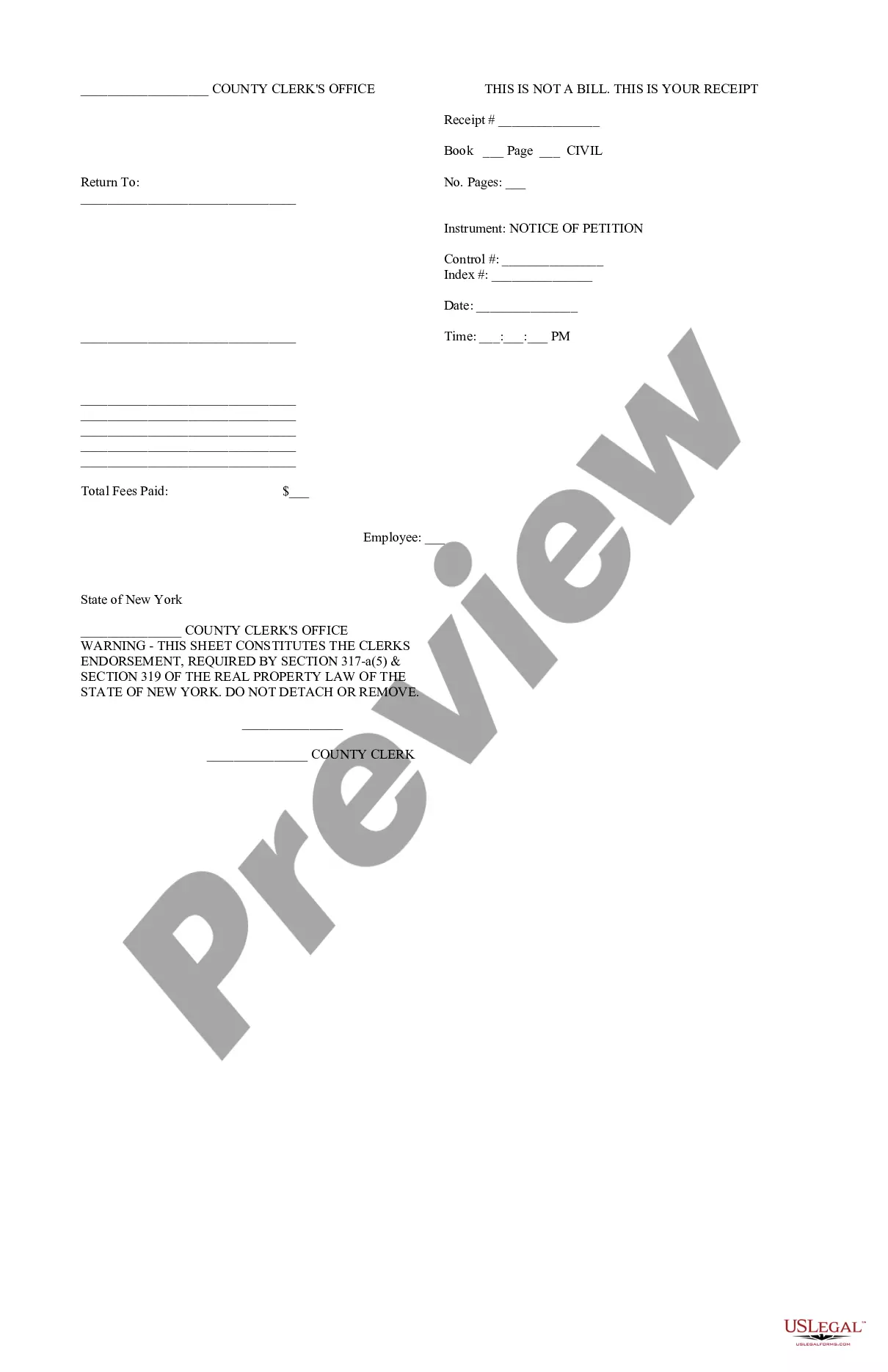

This form is a Letter To a New Employer from a previous employer of a new hire that advises the new company of the former employee's ongoing nondisclosure obligations toward his former employer with regard to highly sensitive and confidential business information and proprietary technology. Additionally, it requests that the new employer verify that the former employee will not be placed in a job position that will risk disclosure of the company's protected information.

North Dakota Letter To New Employer

Description

How to fill out Letter To New Employer?

US Legal Forms - one of several greatest libraries of legal forms in America - delivers a wide array of legal file web templates you can download or print out. Using the site, you will get a large number of forms for enterprise and person purposes, sorted by types, claims, or search phrases.You can get the most up-to-date models of forms much like the North Dakota Letter To New Employer within minutes.

If you have a subscription, log in and download North Dakota Letter To New Employer from the US Legal Forms local library. The Obtain button can look on each and every kind you look at. You have accessibility to all formerly saved forms in the My Forms tab of the account.

If you would like use US Legal Forms the first time, allow me to share basic directions to obtain started out:

- Be sure to have chosen the proper kind for the city/county. Select the Review button to analyze the form`s information. Look at the kind information to ensure that you have selected the correct kind.

- When the kind does not suit your specifications, make use of the Search field at the top of the monitor to get the one that does.

- If you are satisfied with the form, verify your choice by clicking the Acquire now button. Then, choose the prices prepare you favor and provide your accreditations to register for the account.

- Procedure the purchase. Make use of your Visa or Mastercard or PayPal account to complete the purchase.

- Find the structure and download the form on your device.

- Make alterations. Fill up, edit and print out and indication the saved North Dakota Letter To New Employer.

Each design you included with your account lacks an expiration particular date and is also your own permanently. So, if you wish to download or print out another copy, just check out the My Forms section and click on about the kind you want.

Gain access to the North Dakota Letter To New Employer with US Legal Forms, one of the most considerable local library of legal file web templates. Use a large number of specialist and status-particular web templates that meet up with your company or person requires and specifications.

Form popularity

FAQ

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

If you elect to file and pay your Income Tax Withholding electronically, you must use the E-File Application to register for Withholding E-File (Form 301-EF). This form can be filled in on-line. Print and sign the application and mail to the address shown in the instructions. Income Tax Withholding Guidelines and Registration nd.gov ? businessreg ? employees ? tax nd.gov ? businessreg ? employees ? tax

Employers must electronically file Form 306 ? Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more.

North Dakota levies one of the lowest progressive state income taxes in the country, with rates ranging from 1.10% to 2.90%. This top rate is among the lowest of the states that have an income tax. North Dakota Paycheck Calculator - SmartAsset smartasset.com ? taxes ? north-dakota-paycheck-c... smartasset.com ? taxes ? north-dakota-paycheck-c...

North Dakota has a graduated individual income tax, with rates ranging from 1.10 percent to 2.90 percent. North Dakota also has a 1.41 percent to 4.31 percent corporate income tax rate. North Dakota Tax Rates & Rankings taxfoundation.org ? location ? north-dakota taxfoundation.org ? location ? north-dakota

The Form 306, North Dakota Income Tax Withholding return must be filed by every employer, even if compensation was not paid during the period covered by this return. Form 306 and the tax due on it must be submitted electronically if the amount withheld during the previous calendar year was $1,000 or more. Form 306 - Income Tax Withholding Return nd.gov ? forms ? business ? it-withholding nd.gov ? forms ? business ? it-withholding