North Dakota Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

Are you currently in a placement the place you need to have files for both organization or personal purposes almost every day time? There are a variety of lawful document web templates available online, but finding kinds you can trust is not effortless. US Legal Forms delivers thousands of form web templates, such as the North Dakota Complaint regarding Insurer's Failure to Pay Claim, which are written to meet state and federal needs.

Should you be previously familiar with US Legal Forms internet site and possess your account, merely log in. Following that, you may acquire the North Dakota Complaint regarding Insurer's Failure to Pay Claim template.

Unless you have an account and want to begin using US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is to the right town/state.

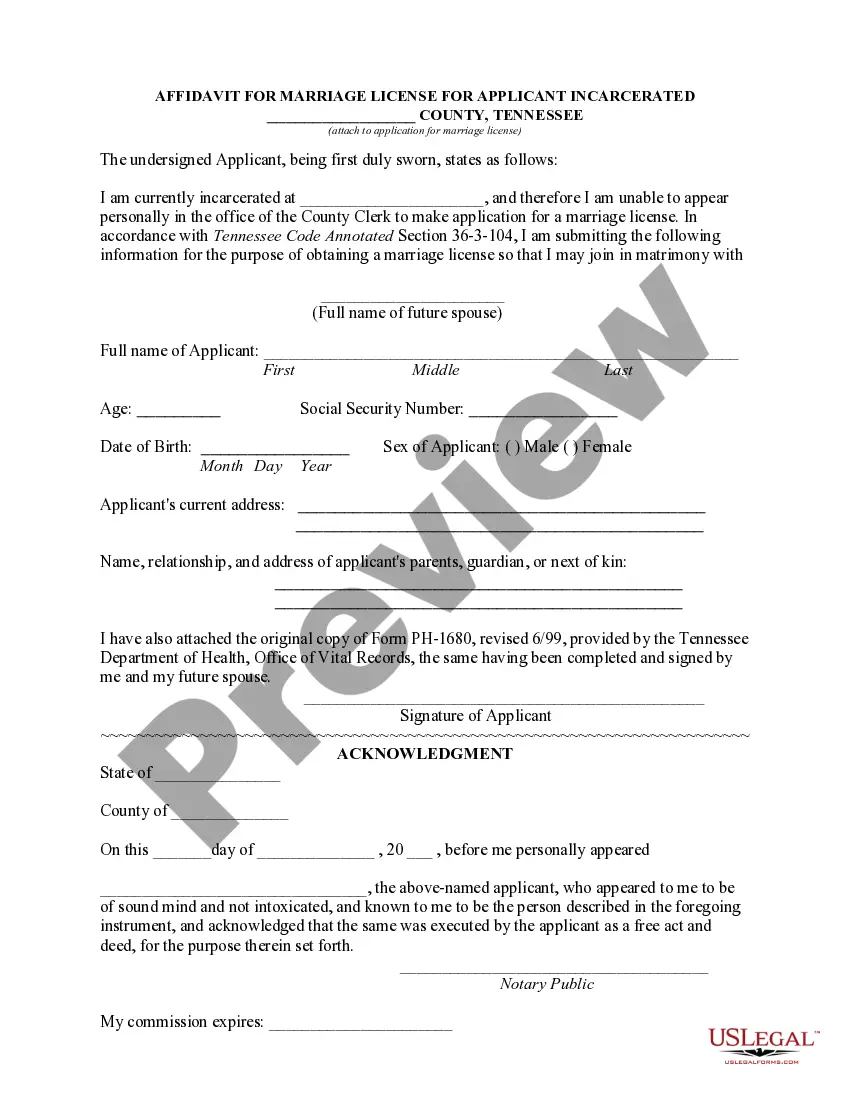

- Use the Preview option to examine the form.

- Browse the description to ensure that you have selected the correct form.

- When the form is not what you are searching for, utilize the Search discipline to find the form that meets your needs and needs.

- Whenever you obtain the right form, click on Get now.

- Opt for the costs strategy you want, submit the required details to generate your bank account, and purchase your order with your PayPal or credit card.

- Choose a hassle-free data file format and acquire your duplicate.

Find each of the document web templates you possess purchased in the My Forms menus. You can get a extra duplicate of North Dakota Complaint regarding Insurer's Failure to Pay Claim at any time, if possible. Just click on the essential form to acquire or printing the document template.

Use US Legal Forms, probably the most extensive selection of lawful kinds, to conserve time as well as steer clear of mistakes. The support delivers professionally made lawful document web templates which you can use for a variety of purposes. Produce your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

Broker advocacy. If your claim is rejected, your broker can be your advocate. ... Internal dispute resolution. If your broker can't get the insurer to overturn the decision, the next step is requesting your insurer launch a formal internal dispute resolution process. ... External dispute resolution. ... Court proceedings.

My policy number is ______________. My complaint concerns______________ [The reason for your complaint, followed by your explanation of what happened ]. To solve my problem, I would like _____________ [The specific action you want the plan to take]. I look forward to your reply and a resolution of my complaint.

The format of a complaint letter follows the format of a formal letter. To write a complaint letter, you can start with the sender's address followed by the date, the receiver's address, the subject, salutation, body of the letter, complimentary closing, signature and name in block letters.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

State exactly what you want done and how long you're willing to wait for a response. Be reasonable. Don't write an angry, sarcastic, or threatening letter. The person reading your letter probably isn't responsible for the problem, but may be very helpful in resolving it.

If you need to contact NDID, we encourage you to do so via email at insurance@nd.gov. If you are unable to contact NDID via email, please call our main phone number at (701) 328-2440 or our Consumer Hotline at (800) 247-0560. Information and updates about NDID can be found on our website at .insurance.nd.gov.

Dear [Contact Person]: This letter is to [notify you {or} follow up on our conversation of {date}] about a problem I am having with the [name of product or service performed] that I [bought, leased, rented or had repaired] at your [name of location] location on [date].

Tips for writing a successful complaint letter Structure. ... Address the letter to a real person. ... Be honest and straightforward. ... Maintain a firm but respectful tone, and avoid aggressive, accusing language. ... Include your contact information. ... Tell them what you want. ... Do not threaten action. ... Keep copies and records.