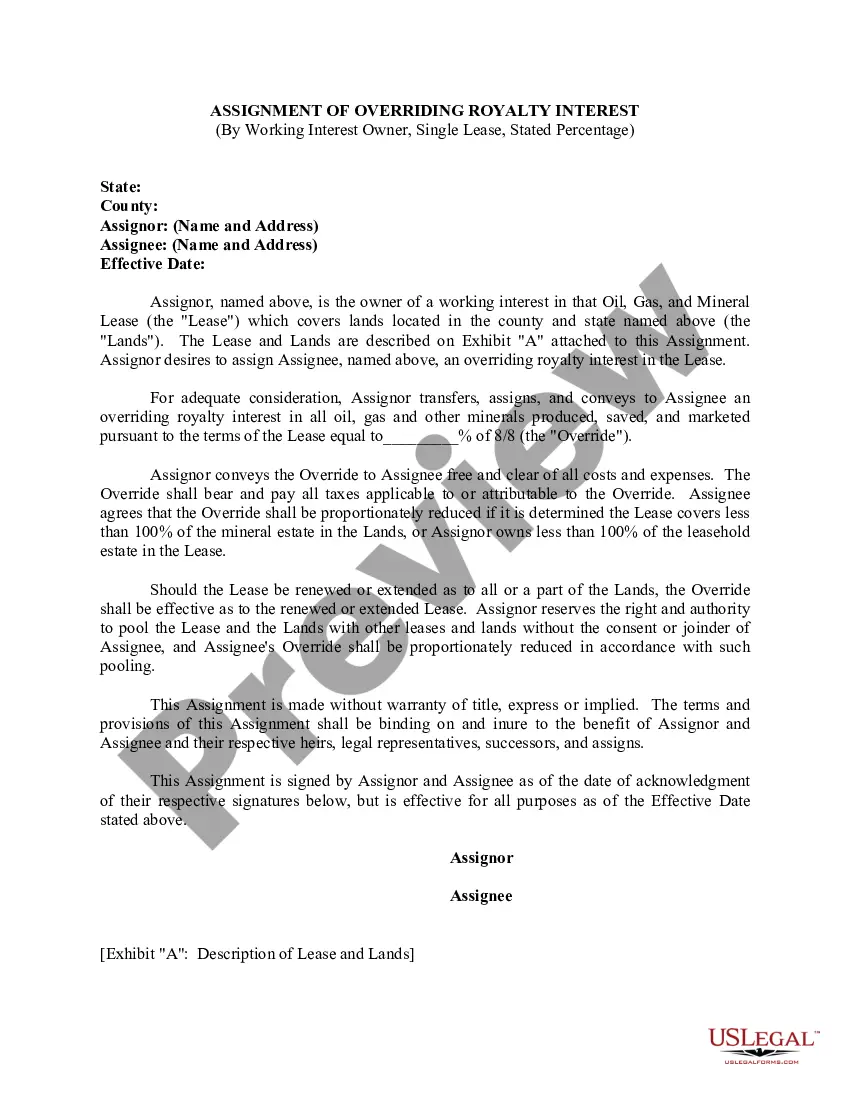

North Dakota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

How to fill out Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

It is possible to spend time on-line attempting to find the lawful file web template that suits the federal and state needs you need. US Legal Forms offers 1000s of lawful varieties that are reviewed by professionals. You can actually acquire or print the North Dakota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage from our support.

If you already have a US Legal Forms profile, you may log in and click the Down load option. Following that, you may total, modify, print, or indicator the North Dakota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage. Each and every lawful file web template you acquire is yours eternally. To obtain one more version for any purchased develop, go to the My Forms tab and click the corresponding option.

If you use the US Legal Forms internet site for the first time, stick to the simple recommendations below:

- First, be sure that you have selected the proper file web template for the county/city of your choice. Browse the develop description to make sure you have chosen the appropriate develop. If readily available, use the Review option to check with the file web template at the same time.

- If you want to get one more model of the develop, use the Search area to obtain the web template that suits you and needs.

- Once you have discovered the web template you desire, click Buy now to proceed.

- Pick the costs strategy you desire, enter your qualifications, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal profile to fund the lawful develop.

- Pick the file format of the file and acquire it for your product.

- Make adjustments for your file if needed. It is possible to total, modify and indicator and print North Dakota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

Down load and print 1000s of file layouts making use of the US Legal Forms site, which offers the most important selection of lawful varieties. Use skilled and express-certain layouts to handle your company or person needs.

Form popularity

FAQ

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Working Interest (WI) Value ? Since the overriding royalty interest (ORRI) is a portion of the working interest, the WI value is the major determinant of the value of overriding mineral rights. The WI owner incurs all of the costs associated with exploration and development activity.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Overriding Royalty Interest Example The mineral estate can be severed from the surface, beginning two separate chains of title. The mineral owner has the right to explore and develop the minerals, but the vast majority do not have the finances or knowledge to drill and operate a well.