North Dakota Division Order

Description

How to fill out Division Order?

Choosing the right legal papers design could be a have difficulties. Obviously, there are a variety of web templates available on the net, but how do you find the legal form you want? Make use of the US Legal Forms internet site. The service offers 1000s of web templates, such as the North Dakota Division Order, that can be used for business and personal needs. All the forms are checked by professionals and fulfill federal and state specifications.

In case you are already signed up, log in to your account and click on the Down load key to obtain the North Dakota Division Order. Use your account to look throughout the legal forms you might have ordered earlier. Proceed to the My Forms tab of the account and get yet another duplicate of the papers you want.

In case you are a whole new customer of US Legal Forms, listed below are easy instructions that you should adhere to:

- First, be sure you have chosen the proper form for your city/region. You can look over the shape while using Review key and look at the shape description to make sure it is the best for you.

- If the form is not going to fulfill your expectations, utilize the Seach industry to obtain the appropriate form.

- Once you are positive that the shape is proper, click on the Get now key to obtain the form.

- Choose the costs program you need and type in the essential information and facts. Design your account and pay money for your order utilizing your PayPal account or credit card.

- Pick the data file formatting and down load the legal papers design to your gadget.

- Total, change and print and indicator the obtained North Dakota Division Order.

US Legal Forms is the largest local library of legal forms in which you can discover various papers web templates. Make use of the company to down load professionally-produced documents that adhere to state specifications.

Form popularity

FAQ

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

First International Bank & Trust's MineralTracker recently produced and presented a 40-page summary to the North Dakota Land Board estimating the total value of North Dakota-owned oil and gas mineral rights at $2.8 billion, an 18% increase from prior year.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states.

Nov. 17, 2022, at p.m. BISMARCK, N.D. (AP) ? An estimate of oil and gas mineral rights owned by North Dakota pegs their value at $2.8 billion, an 18% increase from last year, ing to an appraisal released Thursday to the state Land Board.

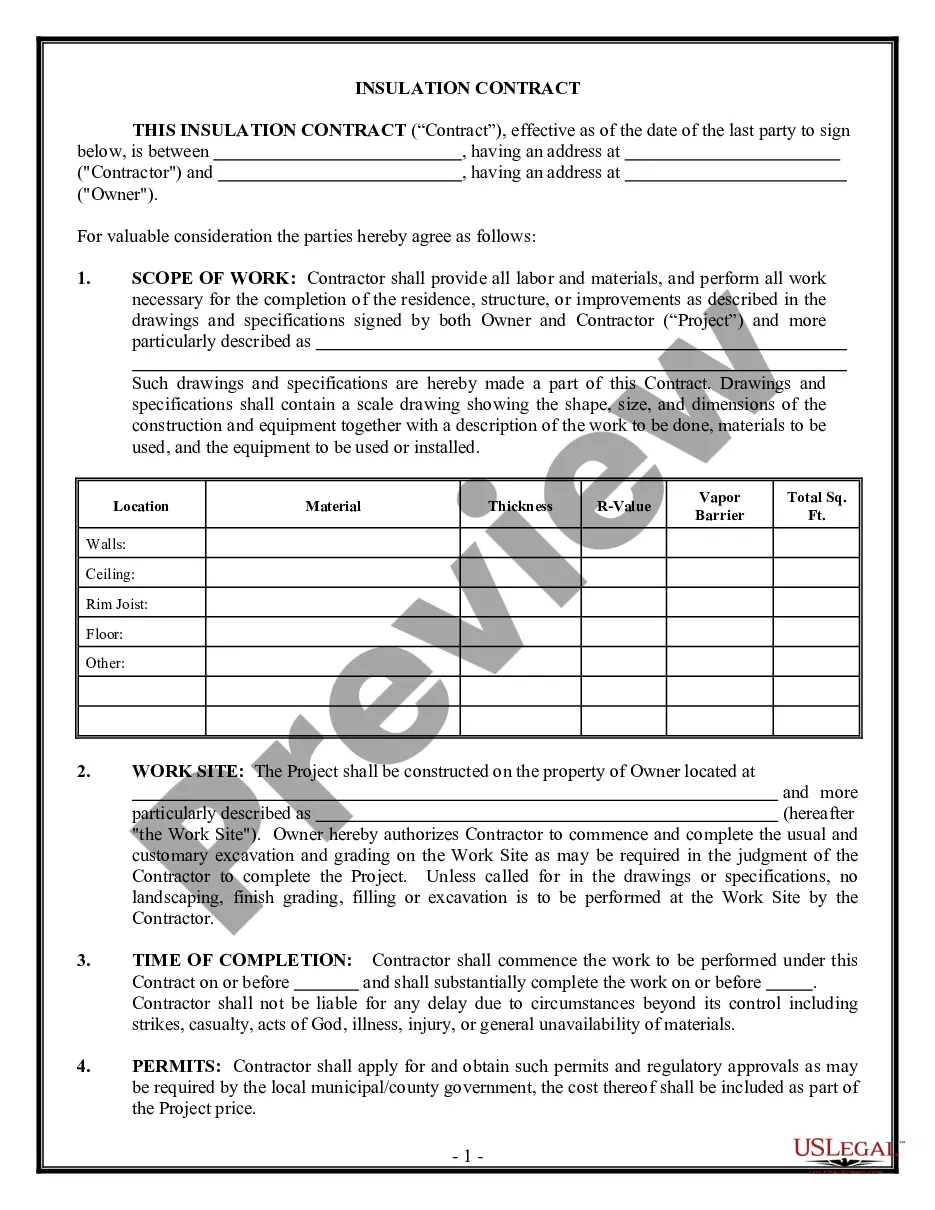

A Division order is an instrument that records an owner's interest in a specific well. It should include the name of the well, the well number, interest type, and your decimal interest.