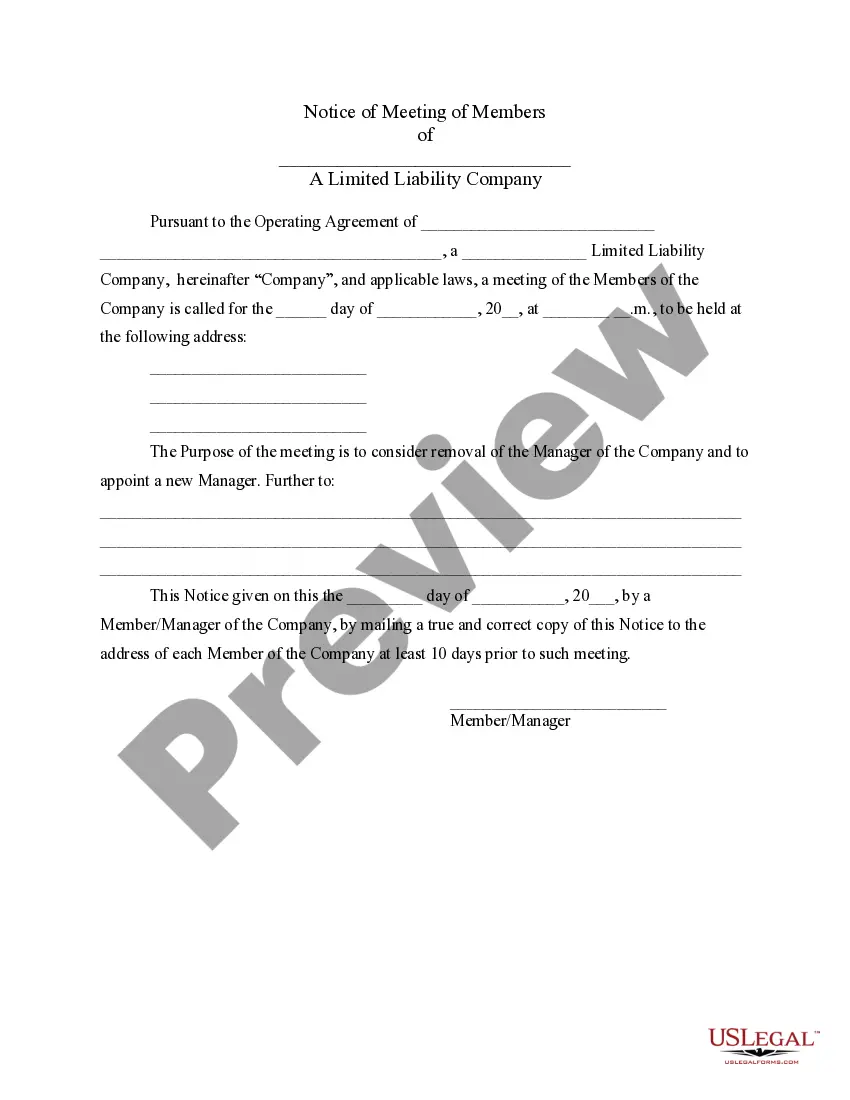

North Dakota Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager

Description

How to fill out Notice Of Meeting Of Members Of LLC Limited Liability Company To Consider Removal Of Manager And Appoint New Manager?

Discovering the right lawful file design might be a have a problem. Naturally, there are plenty of web templates available on the net, but how would you obtain the lawful form you need? Utilize the US Legal Forms internet site. The service provides thousands of web templates, for example the North Dakota Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager, that you can use for enterprise and personal requirements. All the types are inspected by specialists and meet federal and state specifications.

When you are previously signed up, log in to the account and click the Down load option to obtain the North Dakota Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager. Use your account to look from the lawful types you possess ordered formerly. Visit the My Forms tab of the account and have an additional version of your file you need.

When you are a fresh customer of US Legal Forms, here are basic recommendations for you to adhere to:

- First, make sure you have selected the proper form for your personal town/state. You are able to look through the shape using the Review option and study the shape information to ensure this is the right one for you.

- In case the form will not meet your expectations, use the Seach industry to find the appropriate form.

- When you are sure that the shape would work, go through the Buy now option to obtain the form.

- Choose the costs strategy you need and enter in the essential details. Design your account and buy the transaction with your PayPal account or bank card.

- Opt for the data file structure and obtain the lawful file design to the system.

- Comprehensive, revise and print out and indication the acquired North Dakota Notice of Meeting of Members of LLC Limited Liability Company to consider removal of manager and appoint new manager.

US Legal Forms is definitely the largest catalogue of lawful types for which you can find different file web templates. Utilize the service to obtain expertly-made files that adhere to condition specifications.

Form popularity

FAQ

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

LLC owners are referred to as members, and ownership can include only one member or many members, with members comprising individual people, other business entities or both.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

LLC owners are generally called members. Many states don't restrict ownership, meaning anyone can be a member including individuals, corporations, foreigners, foreign entities, and even other LLCs.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

In a member-managed LLC, all members (owners) are involved in decision-making. If you are a single-member LLC, youthe ownerare the manager. Major decisions, such as loans and contracts, require a majority of the vote for approval.

Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation. Shareholders will usually only be on the hook if they cosigned or personally guaranteed the corporation's debts.

Under all LLC statutes, the general rule is that the members of the LLC are not personally liable for obligations of the LLC, subject to such exceptions as personal guarantees or piercing of the organizational veil.

"Piercing the corporate veil" refers to a situation in which courts put aside limited liability and hold a corporation's shareholders or directors personally liable for the corporation's actions or debts. Veil piercing is most common in close corporations.