North Dakota Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

If you wish to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the largest repository of legal documents available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the North Dakota Account Executive Agreement - Self-Employed Independent Contractor. Every legal document template you download is yours indefinitely. You will have access to every form you downloaded within your account. Click on the My documents section and choose a document to print or download again. Be proactive and download, and print the North Dakota Account Executive Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to access the North Dakota Account Executive Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to obtain the North Dakota Account Executive Agreement - Self-Employed Independent Contractor.

- You can also access documents you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

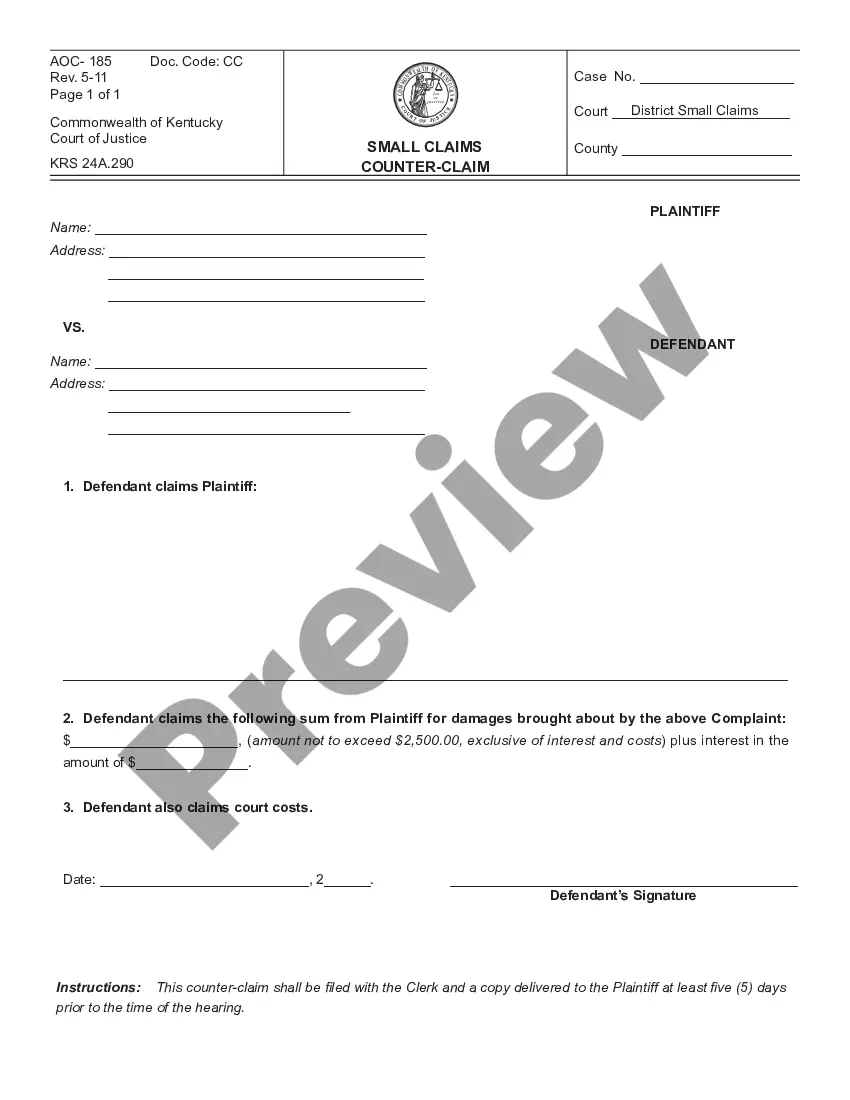

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variants of the legal form template.

Form popularity

FAQ

Typically, the hiring party drafts the independent contractor agreement. This party may include specific terms relating to work scope, payment, and expectations. However, both parties should review the agreement to ensure all aspects meet their needs. When creating a North Dakota Account Executive Agreement - Self-Employed Independent Contractor, utilizing a fully customizable template from USLegalForms can simplify the process and ensure all key elements are included.

In North Dakota, an operating agreement is not a legal requirement for an LLC. However, creating one is highly recommended for any business owner, including those managing independent contractors. An operating agreement clarifies ownership and operational procedures, which can be beneficial in the event of disputes. If you're establishing a North Dakota Account Executive Agreement - Self-Employed Independent Contractor, considering an operating agreement can provide added clarity and structure.

While technically possible, it is not advisable to be a 1099 employee without a contract. Without a documented agreement, you might face challenges concerning payment and the scope of work. A well-defined North Dakota Account Executive Agreement - Self-Employed Independent Contractor can safeguard your interests and clarify your contributions. It is wise to utilize platforms like uslegalforms for constructing dependable agreements.

If you're self-employed, having a contract is not just beneficial; it is often necessary for maintaining clarity in your business relationships. A North Dakota Account Executive Agreement - Self-Employed Independent Contractor outlines your services, ensures timely payments, and mitigates potential disputes. It serves as a protection for both you and your clients. Uslegalforms can provide templates to assist in this process.

Legal requirements for independent contractors can vary, but typically they need to meet specific criteria to ensure compliance. You must also provide your own tools and have the freedom to set your own hours. For independent contractors in North Dakota, a clear North Dakota Account Executive Agreement - Self-Employed Independent Contractor ensures that you meet all necessary legal obligations. Always consult legal resources for the latest requirements.

Yes, having a contract as an independent contractor is crucial. It formalizes your working arrangement and spells out your responsibilities and payment terms. A well-crafted North Dakota Account Executive Agreement - Self-Employed Independent Contractor protects both parties and clarifies expectations. To streamline this process, consider using platforms like uslegalforms.

If you operate without a contract, your rights may be limited, especially with respect to payment and work expectations. However, common law still provides some rights to independent contractors. You may be able to claim payment for work completed, but it is harder to enforce specific terms. Therefore, securing a detailed North Dakota Account Executive Agreement - Self-Employed Independent Contractor is highly advisable.

Writing an independent contractor agreement, specifically a North Dakota Account Executive Agreement - Self-Employed Independent Contractor, involves outlining the terms of your working relationship. Start by detailing the scope of work, payment terms, and deadlines. It is also essential to specify the responsibilities of each party involved. For added guidance, consider using platforms like uslegalforms, which offer templates tailored for various needs.

Yes, independent contractors file taxes as self-employed individuals. This means you report your income and expenses using Schedule C along with your regular tax return. It's essential to keep accurate records of your earnings and business expenses to ensure a smooth filing process. For guidance on structuring contracts or filings, consider utilizing resources from USLegalForms, specifically targeting the North Dakota Account Executive Agreement - Self-Employed Independent Contractor.

Yes, you can open a business account as an independent contractor. Many banks offer business accounts specifically for self-employed individuals. Typically, you will need to provide proof of your business structure, such as a copy of your North Dakota Account Executive Agreement - Self-Employed Independent Contractor. This account will help manage your finances separate from personal expenses, making bookkeeping easier.