North Dakota Psychic Services Contract - Self-Employed Independent Contractor

Description

How to fill out Psychic Services Contract - Self-Employed Independent Contractor?

Have you ever been in a location where you often require documents for business or specific reasons? There are numerous legal document templates accessible online, but finding dependable ones can be challenging.

US Legal Forms offers a vast array of template types, such as the North Dakota Psychic Services Agreement - Self-Employed Independent Contractor, which can be tailored to meet state and federal requirements.

If you are already acquainted with the US Legal Forms site and have an account, simply Log In. After that, you can download the North Dakota Psychic Services Agreement - Self-Employed Independent Contractor template.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the North Dakota Psychic Services Agreement - Self-Employed Independent Contractor anytime, if necessary. Just click on the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Acquire the form you require and confirm it is for the correct city/region.

- Utilize the Preview option to examine the document.

- Review the description to ensure you have chosen the right form.

- If the form does not match your needs, use the Lookup field to find a form that suits your requirements.

- Once you locate the correct form, click Acquire now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Absolutely, an independent contractor is a type of self-employed individual. When you operate under a North Dakota Psychic Services Contract - Self-Employed Independent Contractor, your work designation as an independent contractor confirms your self-employment status. This classification gives you flexibility but also requires you to manage your taxes and business responsibilities independently.

To be considered self-employed, you must earn income through your business activities without being an employee of another entity. This can include freelance work, contract jobs, or operating a business, such as those provided under the North Dakota Psychic Services Contract - Self-Employed Independent Contractor. Generally, if you control your work and handle your taxes, you fit the self-employed category.

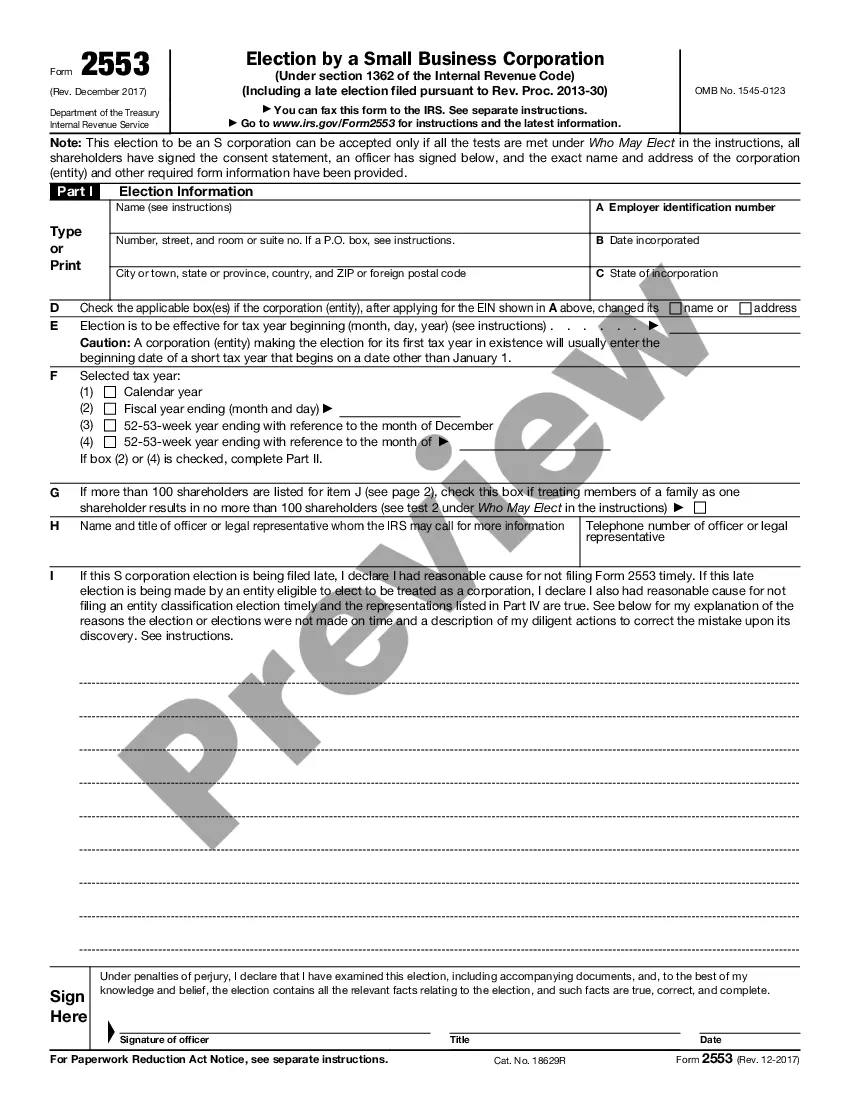

Yes, receiving a 1099 form often signifies that you are classified as a self-employed individual under the North Dakota Psychic Services Contract - Self-Employed Independent Contractor. This means you earn income through contracts rather than as a traditional employee. If you meet the criteria for self-employment, your 1099 reflects that status.

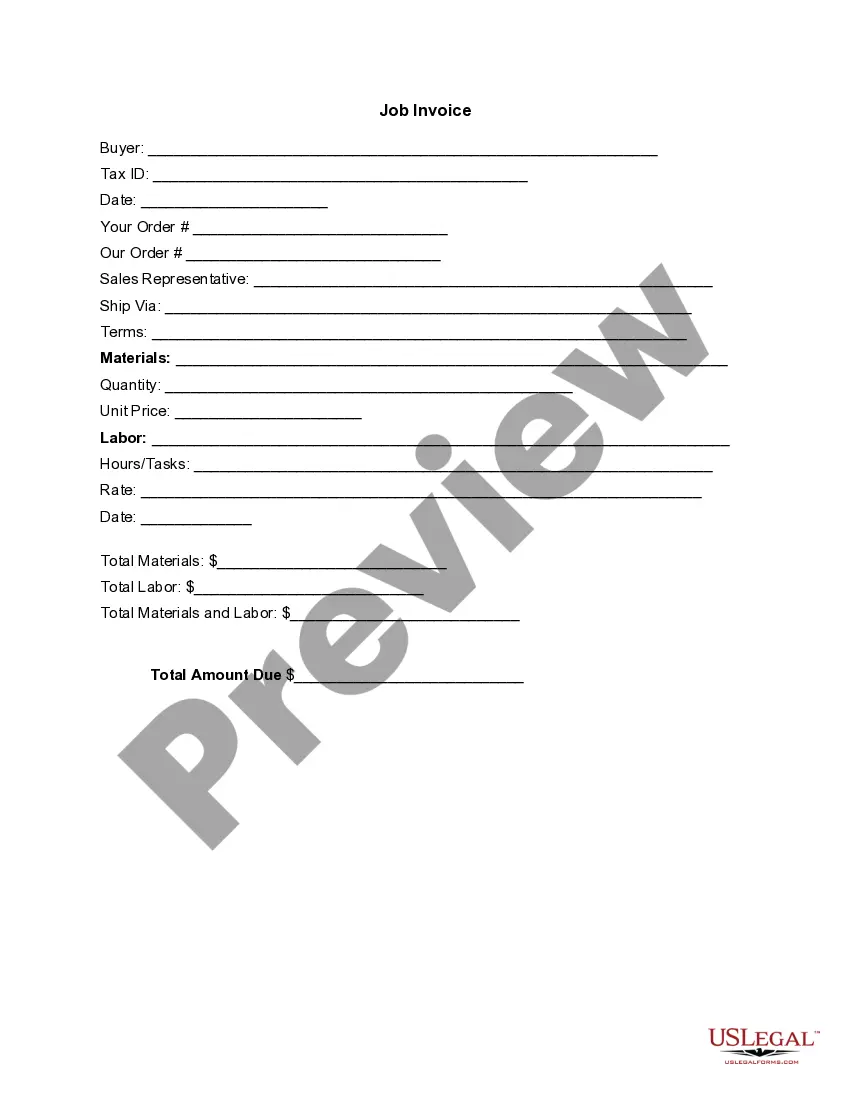

Filling out an independent contractor form involves providing basic personal information, gathering your business details, and specifying the services you will offer. Be clear and detailed about the terms you agree to, especially if referencing the North Dakota Psychic Services Contract - Self-Employed Independent Contractor. If you find the process overwhelming, consider utilizing platforms like uslegalforms for guidance.

As an independent contractor, you typically need to fill out a W-9 form to provide your taxpayer identification number to the client. You might also need to complete any additional state-specific forms, particularly those related to the North Dakota Psychic Services Contract - Self-Employed Independent Contractor. Always check for any other required documentation before starting your work. This ensures you remain compliant with local laws.

Writing an independent contractor agreement begins with a clear title that identifies it as such. Next, include the names and contact details of both parties, followed by a detailed description of the services to be provided. When drafting, ensure you incorporate aspects of the North Dakota Psychic Services Contract - Self-Employed Independent Contractor. This helps set clear expectations and protects both parties.

To fill out an independent contractor agreement, start by providing your name and the name of the client. Clearly define the scope of work, payment terms, and deadlines. Then, include any specific clauses relevant to the North Dakota Psychic Services Contract - Self-Employed Independent Contractor, such as confidentiality and termination rights. Finally, both parties should sign and date the agreement.

In North Dakota, the requirement for a contractor license can depend on the type of services you offer. While not all independent contractors need a formal license, some specific industries may have particular requirements. For psychic services, it's best to check local regulations to ensure compliance. Utilizing the North Dakota Psychic Services Contract can provide clarity on any licensing requirements pertinent to your contracting activities.

Yes, independent contractors in the US need work authorization to operate legally. This authorization varies based on the type of services you provide, including psychic services in North Dakota. Make sure you follow immigration laws if you are a foreign national. Ensuring your compliance with local regulations protects both you and your clients.

Becoming authorized to perform services as an independent contractor in the US requires understanding the specific regulations and obtaining the necessary licenses. This process includes registration with relevant state authorities and adhering to any industry-specific rules. In North Dakota, the North Dakota Psychic Services Contract offers a comprehensive approach to ensure compliance with the legal framework governing your services.