North Dakota Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

Are you currently in a scenario where you require documents for either business or personal tasks nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides thousands of form templates, including the North Dakota Electrologist Agreement - Self-Employed Independent Contractor, which can be printed to meet federal and state requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the North Dakota Electrologist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

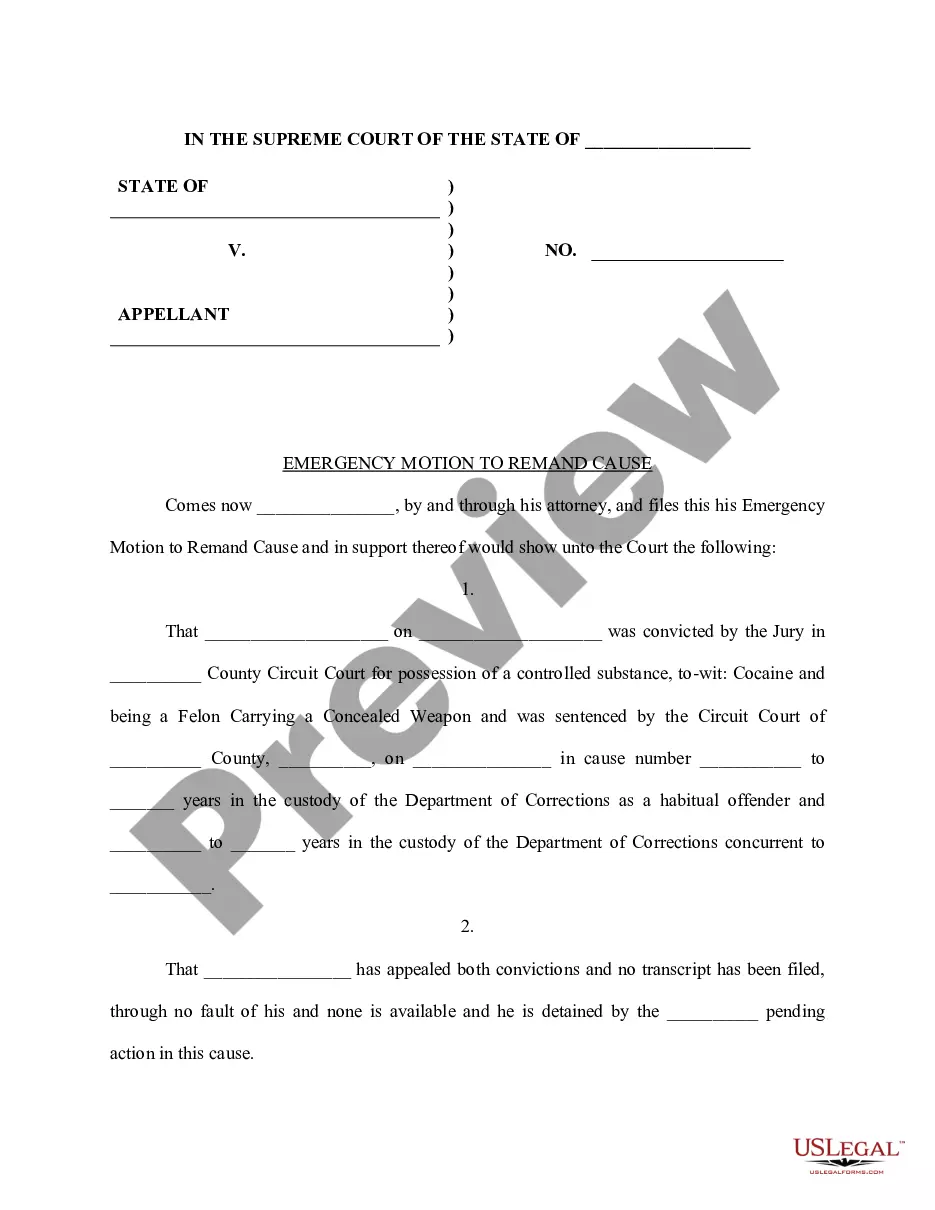

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup field to find the form that meets your needs and criteria.

Form popularity

FAQ

Creating an independent contractor agreement is straightforward. Start by defining the project's scope, detailing services to be provided, and specifying payment terms. It's also important to include clauses on confidentiality and termination. You can utilize UsLegalForms for templates and guidance to ensure that your North Dakota Electrologist Agreement - Self-Employed Independent Contractor meets legal requirements and protects your interests.

Yes, having a contract is essential for independent contractors, including those in the North Dakota Electrologist Agreement - Self-Employed Independent Contractor context. A clear contract outlines the scope of work, payment terms, and responsibilities, protecting both parties. It helps prevent misunderstandings and ensures that you have a legally binding agreement. Additionally, using a reputable platform like UsLegalForms can simplify the contract creation process.

Filling out an independent contractor agreement requires attention to detail. Begin with the names of both parties and the purpose of the agreement. Then, describe the services to be provided, including payment rates and timelines. Ensure to include termination clauses and other essential terms, as this document solidifies your North Dakota Electrologist Agreement - Self-Employed Independent Contractor. Consider using resources like uslegalforms for guidance.

Filling out an independent contractor form involves providing basic information, including your name, address, and Social Security number. Clearly outline the services offered and any specific conditions related to the job. Ensure to include tax identification details where necessary. This form serves as a foundation for your North Dakota Electrologist Agreement - Self-Employed Independent Contractor, making accuracy essential.

To write an independent contractor agreement, start with a clear introduction that defines the parties involved, including the client and contractor. Then, outline the scope of work, payment terms, and deadlines. It is crucial to include confidentiality clauses and any applicable local laws regarding employment. Using a template designed for a North Dakota Electrologist Agreement - Self-Employed Independent Contractor can simplify this process.

North Dakota does not legally require an operating agreement for an LLC, but having one is highly beneficial. An operating agreement outlines the management structure and operating procedures of your business. This document can help prevent disputes among members and clarify roles within your LLC. For those entering agreements as a self-employed independent contractor, a clear understanding helps set expectations.

Yes, independent contractors typically file taxes as self-employed individuals. This means they report their income on a Schedule C form, along with any expenses related to their work. For those utilizing a North Dakota Electrologist Agreement - Self-Employed Independent Contractor, it is essential to keep detailed records of earnings and expenses. Filing as self-employed allows for greater control over deductions and tax planning, which can benefit many professionals in the electrology field.