North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor

Description

How to fill out Graphic Artist Agreement - Self-Employed Independent Contractor?

Have you ever found yourself in a situation where you need documents for either business or personal purposes almost constantly.

There are numerous legal document templates available online, but locating reliable ones is not simple.

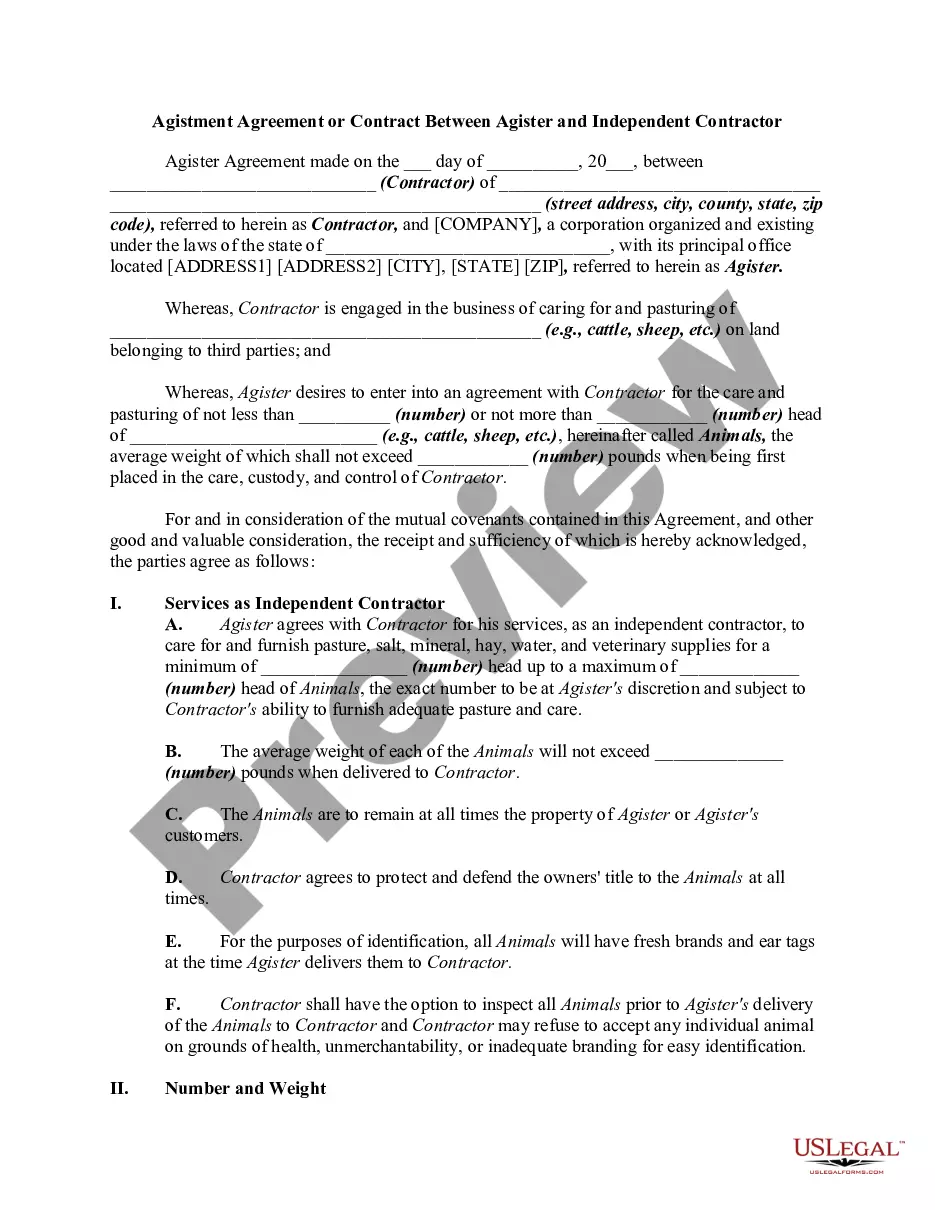

US Legal Forms offers a vast array of form templates, such as the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

If you find the right form, click on Acquire now.

Select the pricing plan you prefer, complete the required information to create your account, and process the payment using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download another copy of the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor anytime if needed. Click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/state.

- Utilize the Review option to evaluate the form.

- Check the outline to ensure that you have selected the correct form.

- If the form is not what you need, use the Lookup section to find the form that meets your needs and requirements.

Form popularity

FAQ

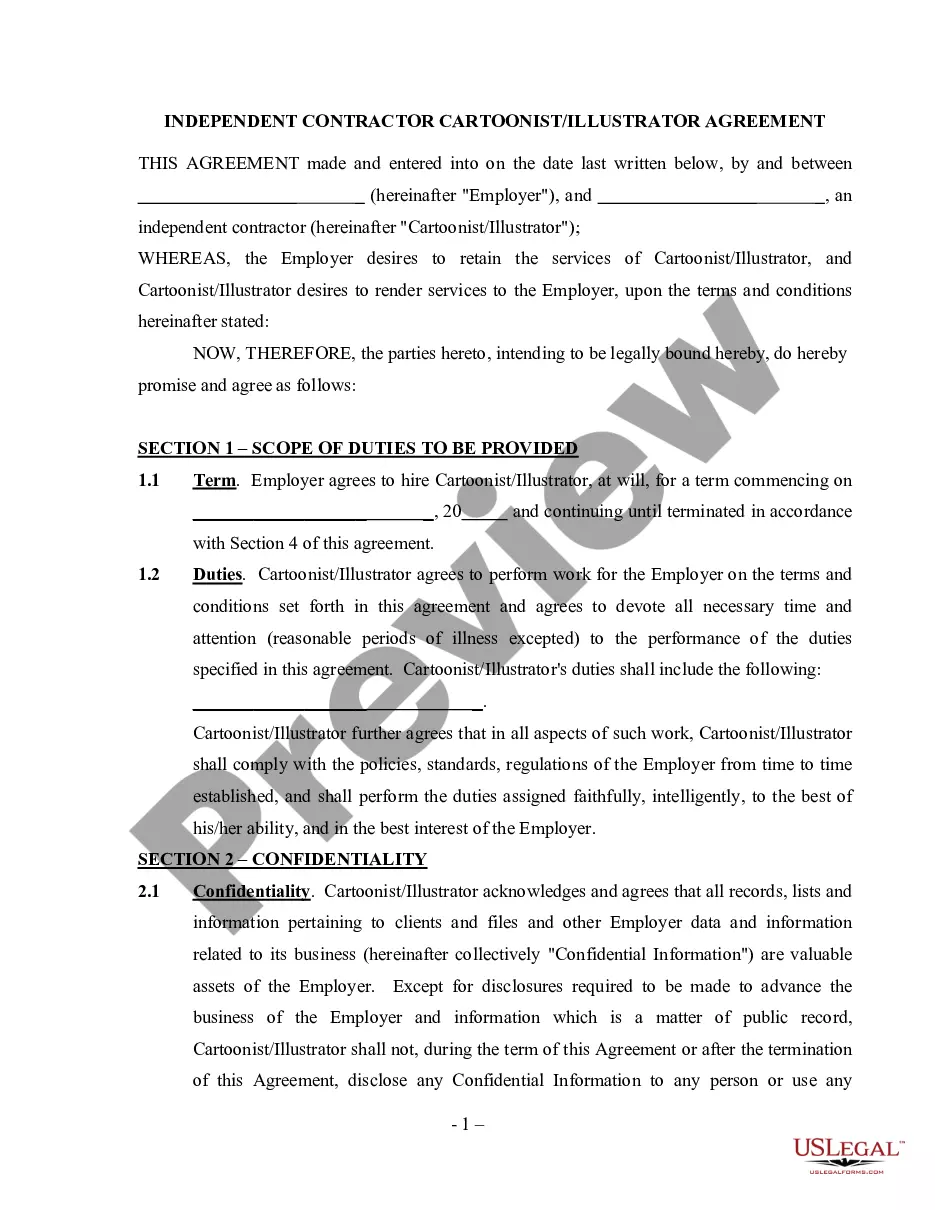

An independent contractor is someone who provides services to another entity while maintaining control over how to perform those services. Key factors include the level of independence, financial arrangement, and the degree of supervision. To ensure compliance with legal standards, you should consider using a North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor, which outlines the relationship clearly.

An artist can indeed be classified as an independent contractor, depending on how they engage with clients. Independent contractors maintain control over their work and often manage multiple projects at once. To formalize this relationship, using a North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor is highly recommended.

Absolutely, a graphic designer can be self-employed. This self-employment model allows them to operate their own business and choose the clients they want to work with. However, to protect their rights and clarify expectations, they should create a North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor.

Yes, graphic designers often work as independent contractors. This arrangement allows them to take on multiple clients and manage their own schedules. Being classified as an independent contractor means they typically have greater flexibility but need to ensure they meet the necessary legal requirements. Utilizing a North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor can help clarify this relationship.

To write an independent contractor agreement, begin by outlining the scope of work you expect from the contractor. Include details such as payment terms, timelines, and deliverables. It is crucial to specify the legal rights and responsibilities of both parties. For an optimal document, consider utilizing the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor available on UsLegalForms.

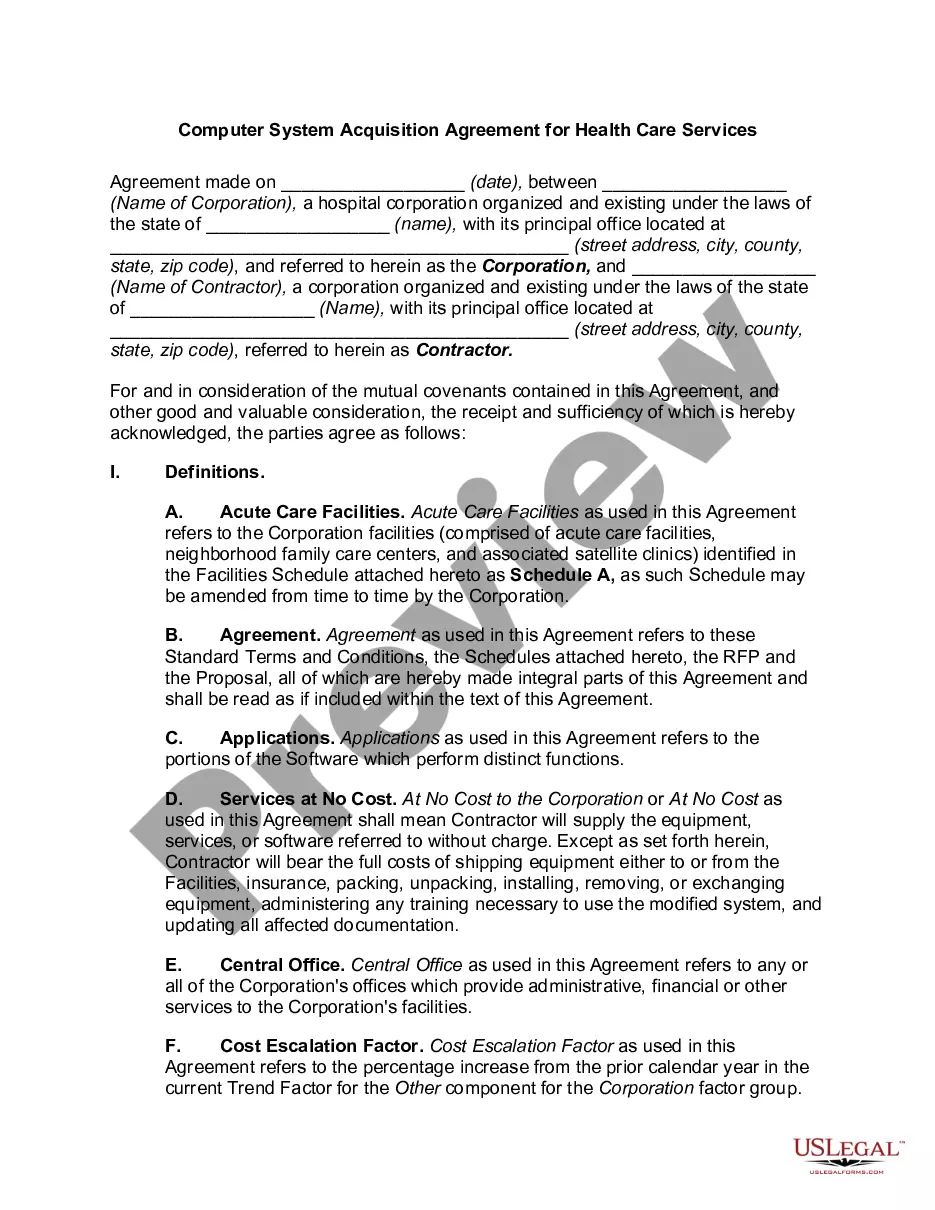

Creating a North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor involves outlining the terms of your working relationship clearly. Start by identifying the scope of work, payment terms, and deadlines. Additionally, include clauses regarding confidentiality, ownership of work, and termination conditions. Using a reliable platform like US Legal Forms can simplify this process by providing templates and guidance tailored to your specific needs.

Writing a contract agreement for an artist requires clear and concise communication of the project scope, expected outcomes, and deadlines. Include payment terms that match the artist's services and stipulate ownership rights of the created work. By using the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor, you can access a well-structured template designed for artists, ensuring that all essential details are covered for successful projects.

Filling out an independent contractor agreement involves detailing your working relationship, compensation, and project specifics. Start with clear definitions of roles and responsibilities, followed by payment methods and deadlines. You may find using the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor beneficial, as it provides a solid framework tailored to artists working independently. Don't forget to have both parties sign and date the agreement at the end.

To fill out an independent contractor form, start by accurately entering your personal information, including your name and business details. Next, outline the nature of your services and establish payment terms that reflect the agreed-upon rates. Be sure to include relevant dates, and review the entire document for clarity. Utilizing the North Dakota Graphic Artist Agreement - Self-Employed Independent Contractor can streamline this process and ensure you cover all necessary elements.