Kentucky Instructions for Completing IRS Form 4506-EZ

Description

How to fill out Instructions For Completing IRS Form 4506-EZ?

Have you been within a placement that you need papers for both company or individual uses nearly every time? There are plenty of legal papers themes available on the Internet, but discovering kinds you can trust is not easy. US Legal Forms provides a large number of kind themes, like the Kentucky Instructions for Completing IRS Form 4506-EZ, that happen to be published in order to meet federal and state needs.

Should you be previously informed about US Legal Forms web site and also have an account, basically log in. Following that, you are able to download the Kentucky Instructions for Completing IRS Form 4506-EZ design.

If you do not come with an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is for the right town/region.

- Use the Review button to examine the form.

- See the outline to ensure that you have selected the proper kind.

- If the kind is not what you are looking for, make use of the Lookup discipline to discover the kind that meets your needs and needs.

- Whenever you find the right kind, just click Purchase now.

- Pick the costs program you desire, fill in the necessary info to generate your account, and pay money for the transaction with your PayPal or credit card.

- Select a practical paper structure and download your duplicate.

Find all of the papers themes you possess bought in the My Forms food list. You can aquire a more duplicate of Kentucky Instructions for Completing IRS Form 4506-EZ any time, if necessary. Just select the essential kind to download or print the papers design.

Use US Legal Forms, the most comprehensive collection of legal varieties, to save lots of efforts and stay away from faults. The services provides skillfully produced legal papers themes which can be used for a variety of uses. Produce an account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

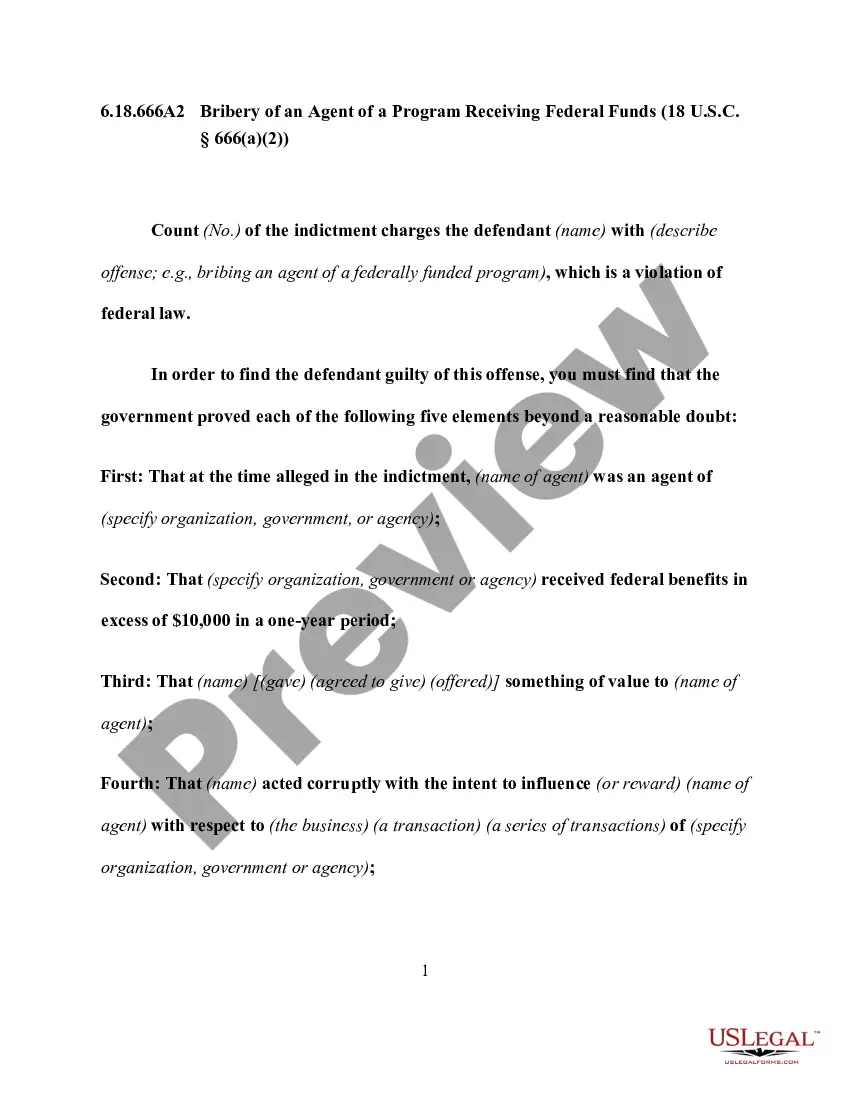

Individuals can use Form 4506T-EZ to request a tax return transcript for the current and the prior three years that includes most lines of the original tax return. The tax return transcript will not show payments, penalty assessments, or adjustments made to the originally filed return.

Complete these lines on the form: Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

Remember, ordering a transcript online is the quickest option. Just go to IRS.gov and use the Get Transcript tool.

Paper Request Form ? IRS Form 4506-T Complete lines 1 ? 4, following the instructions on page 2 of the form. Line 3: enter the non-filer's street address and zip or postal code. ... Line 5 provides non-filers with the option to have their IRS Verification of Non-filing Letter mailed directly to a third party by the IRS.

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

Form 4506-T must be signed and dated by the taxpayer listed on line 1a or 2a (If you filed a joint tax return, only one filer is required to sign). You must check the box in the signature area to acknowledge you have the authority to sign and request the information.