North Dakota Articles of Incorporation Amendment

Description

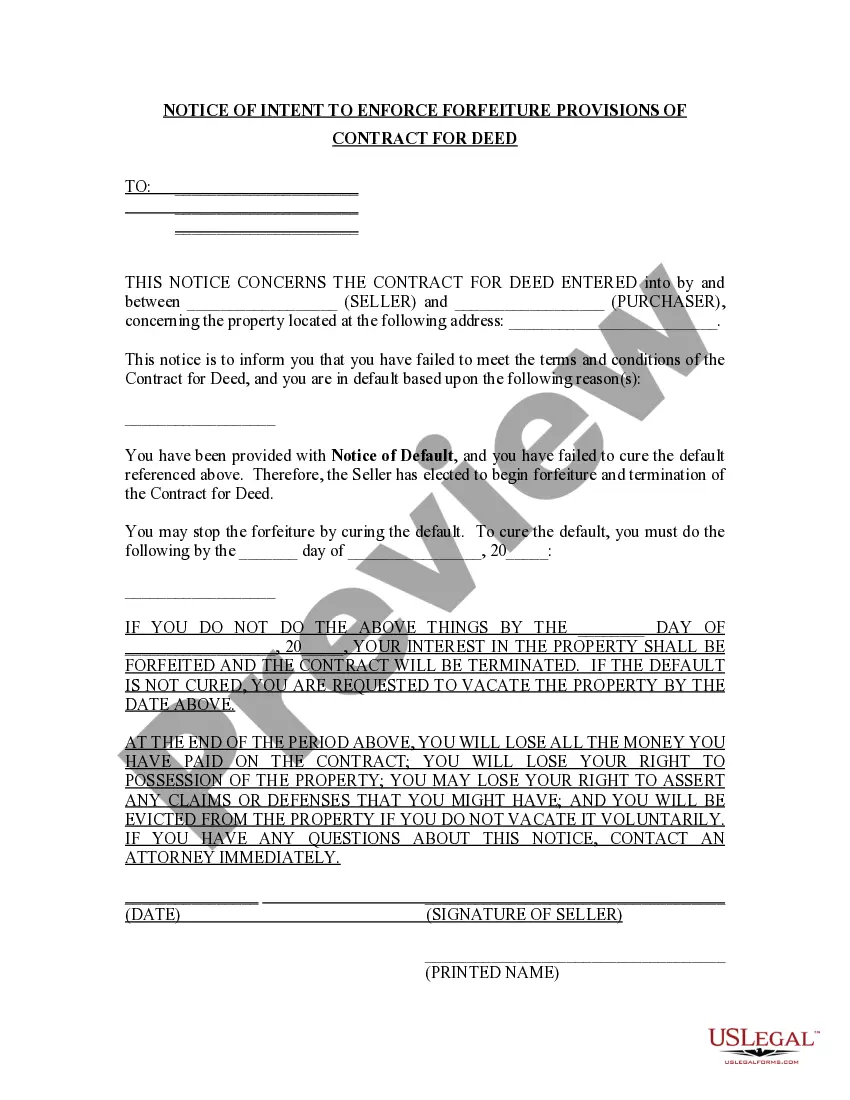

How to fill out Articles Of Incorporation Amendment?

Choosing the right authorized record design might be a have a problem. Of course, there are plenty of themes available on the net, but how would you get the authorized kind you require? Make use of the US Legal Forms internet site. The service gives a huge number of themes, for example the North Dakota Articles of Incorporation Amendment, that you can use for business and private demands. All of the types are checked by experts and meet state and federal specifications.

Should you be already listed, log in to the accounts and click the Download switch to get the North Dakota Articles of Incorporation Amendment. Utilize your accounts to appear with the authorized types you might have bought in the past. Proceed to the My Forms tab of your accounts and get one more duplicate of the record you require.

Should you be a new consumer of US Legal Forms, allow me to share straightforward recommendations that you can comply with:

- Very first, ensure you have chosen the correct kind for your personal city/state. It is possible to look through the form making use of the Review switch and browse the form explanation to ensure it is the best for you.

- If the kind does not meet your needs, take advantage of the Seach discipline to get the right kind.

- When you are certain that the form is suitable, click the Acquire now switch to get the kind.

- Opt for the rates prepare you want and type in the necessary details. Build your accounts and pay money for the order utilizing your PayPal accounts or charge card.

- Select the document format and obtain the authorized record design to the product.

- Full, change and print out and indication the obtained North Dakota Articles of Incorporation Amendment.

US Legal Forms is definitely the largest local library of authorized types that you can find different record themes. Make use of the company to obtain expertly-created documents that comply with express specifications.

Form popularity

FAQ

North Dakota LLC Formation Filing Fee: $135 To form an LLC in North Dakota, you'll need to file Articles of Organization with North Dakota's Business Registration Unit. They cost $135 to file.

You must file Florida LLC Articles of Amendment by mail, fax or in person with the Florida Division of Corporations. Accompanying the filing, you must submit a $25 processing fee. You must also include a Cover Letter which lists the name of the LLC and the name and contact information of the filer.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

North Dakota has a graduated individual income tax, with rates ranging from 1.10 percent to 2.90 percent. North Dakota also has a 1.41 percent to 4.31 percent corporate income tax rate.

Changing Address Related To The Business ? North Dakota does not require businesses to file an amendment every time there are changes in the principal office address and/or mailing addresses. Instead, your company can just notify the Secretary of State by phone or in writing.

Apply for a North Dakota Tax ID (EIN) Number. To obtain your Tax ID (EIN) in North Dakota start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.

Not every North Dakota business needs a license. However, many types of business either can or must get one or more licenses. Different types of licenses and permits are issued by different state agencies. You can find more information by going to the Licensing Information section of the nd.gov website.

To form a corporation in North Dakota, you must file articles of incorporation with the Secretary of State and pay a fee. Upon filing, the Secretary of State issues a certificate of incorporation. The corporation's existence begins when the certificate is issued, unless the articles specify a later date.