North Dakota Restated Certificate of Incorporation

Description

How to fill out Restated Certificate Of Incorporation?

It is possible to commit time online trying to find the authorized file web template that fits the state and federal specifications you will need. US Legal Forms gives a huge number of authorized forms that are reviewed by professionals. It is simple to acquire or print out the North Dakota Restated Certificate of Incorporation from the support.

If you currently have a US Legal Forms bank account, you are able to log in and click the Download key. Afterward, you are able to total, change, print out, or indication the North Dakota Restated Certificate of Incorporation. Every authorized file web template you get is your own forever. To have another version associated with a acquired form, check out the My Forms tab and click the corresponding key.

If you use the US Legal Forms website initially, adhere to the basic directions beneath:

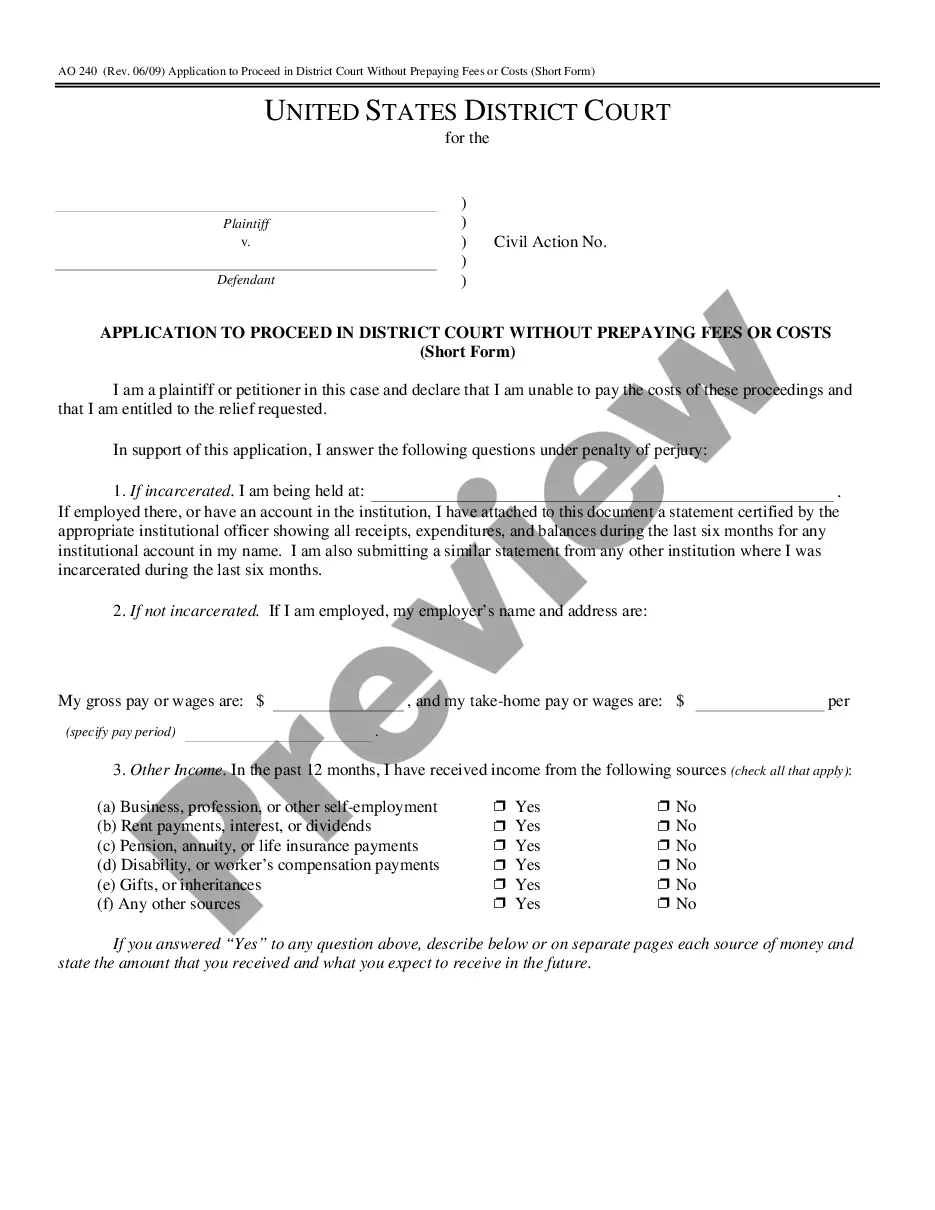

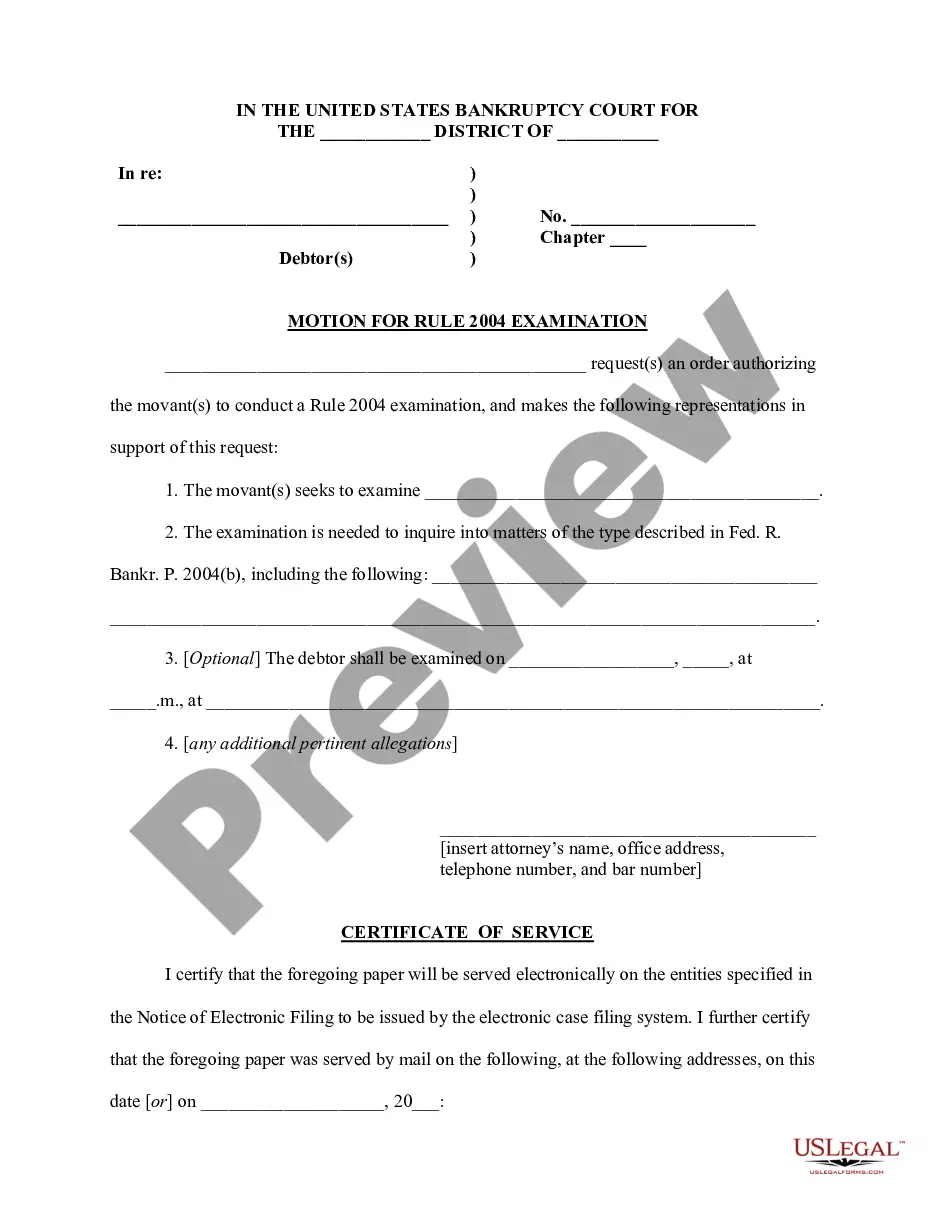

- Very first, make sure that you have chosen the correct file web template to the county/area of your choosing. Browse the form information to ensure you have chosen the correct form. If available, use the Review key to search through the file web template as well.

- If you want to find another variation in the form, use the Look for discipline to obtain the web template that meets your needs and specifications.

- Upon having located the web template you need, simply click Get now to carry on.

- Pick the pricing strategy you need, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You may use your bank card or PayPal bank account to cover the authorized form.

- Pick the file format in the file and acquire it in your system.

- Make modifications in your file if necessary. It is possible to total, change and indication and print out North Dakota Restated Certificate of Incorporation.

Download and print out a huge number of file templates using the US Legal Forms website, that provides the largest selection of authorized forms. Use specialist and status-specific templates to tackle your business or specific needs.

Form popularity

FAQ

To dissolve your North Dakota LLC by filing Articles of Dissolution by Organizers, there is a $20 fee. To file the Articles of Dissolution by Members, there is a $20 filing fee and you must also file the Notice of Dissolution which costs $10.

An annual report must be completed on FirstStop and may be filed online with a credit card payment or it may be printed and mailed with a check, cashier's check, or money order payable to "Secretary of State."

Not every North Dakota business needs a license. However, many types of business either can or must get one or more licenses. Different types of licenses and permits are issued by different state agencies. You can find more information by going to the Licensing Information section of the nd.gov website.

Apply for a North Dakota Tax ID (EIN) Number. To obtain your Tax ID (EIN) in North Dakota start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.

Reinstating your North Dakota corporation is an easy, straightforward process. Just file the past due annual report, report fee, and reinstatement fee within one year of revocation. North Dakota allows filing in person, by mail, or by fax. North Dakota SOS accepts VISA, Master Card, or Discover.

North Dakota has a graduated individual income tax, with rates ranging from 1.10 percent to 2.90 percent. North Dakota also has a 1.41 percent to 4.31 percent corporate income tax rate.

North Dakota LLC Formation Filing Fee: $135 To form an LLC in North Dakota, you'll need to file Articles of Organization with North Dakota's Business Registration Unit. They cost $135 to file.

To form a corporation in North Dakota, you must file articles of incorporation with the Secretary of State and pay a fee. Upon filing, the Secretary of State issues a certificate of incorporation. The corporation's existence begins when the certificate is issued, unless the articles specify a later date.