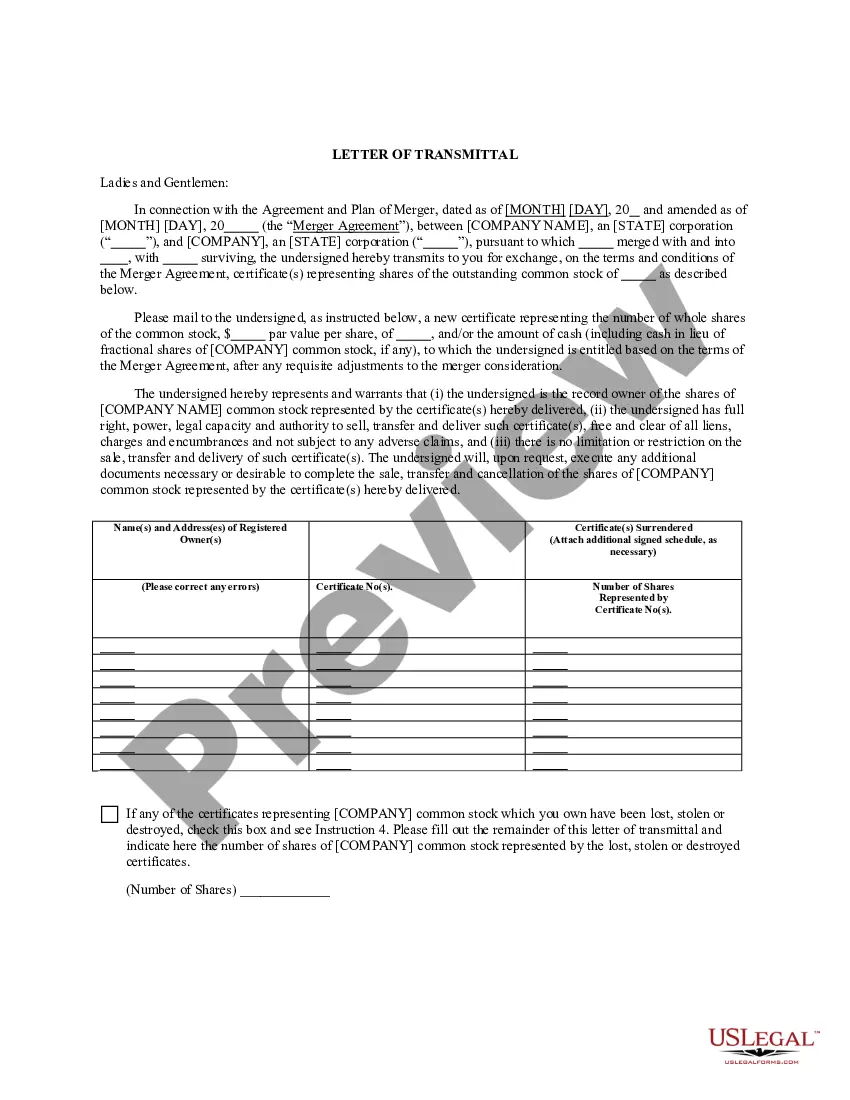

North Dakota Letter of Transmittal

Description

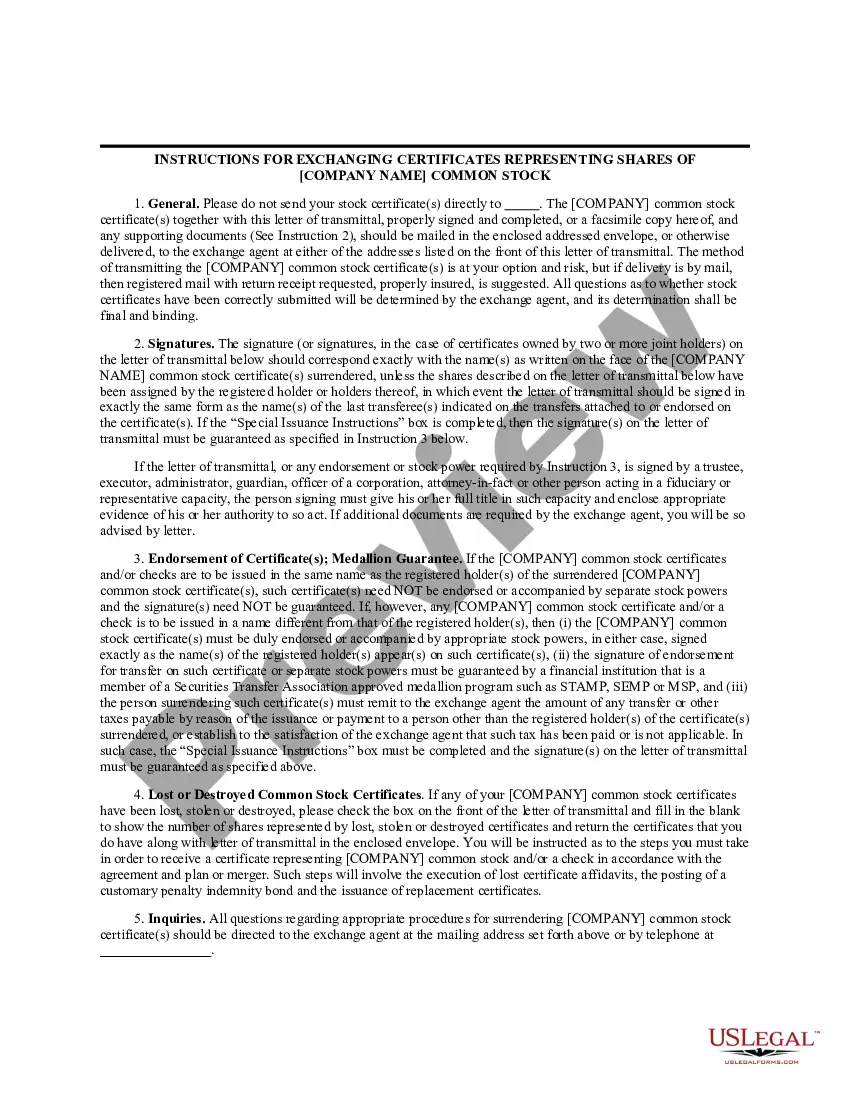

How to fill out Letter Of Transmittal?

US Legal Forms - one of several most significant libraries of legitimate forms in the States - offers an array of legitimate document themes you are able to acquire or produce. Using the web site, you will get a large number of forms for organization and specific reasons, categorized by groups, suggests, or keywords and phrases.You can get the most up-to-date versions of forms like the North Dakota Letter of Transmittal within minutes.

If you currently have a membership, log in and acquire North Dakota Letter of Transmittal from your US Legal Forms collection. The Obtain button can look on every single form you see. You have accessibility to all earlier downloaded forms from the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, allow me to share basic instructions to help you get started out:

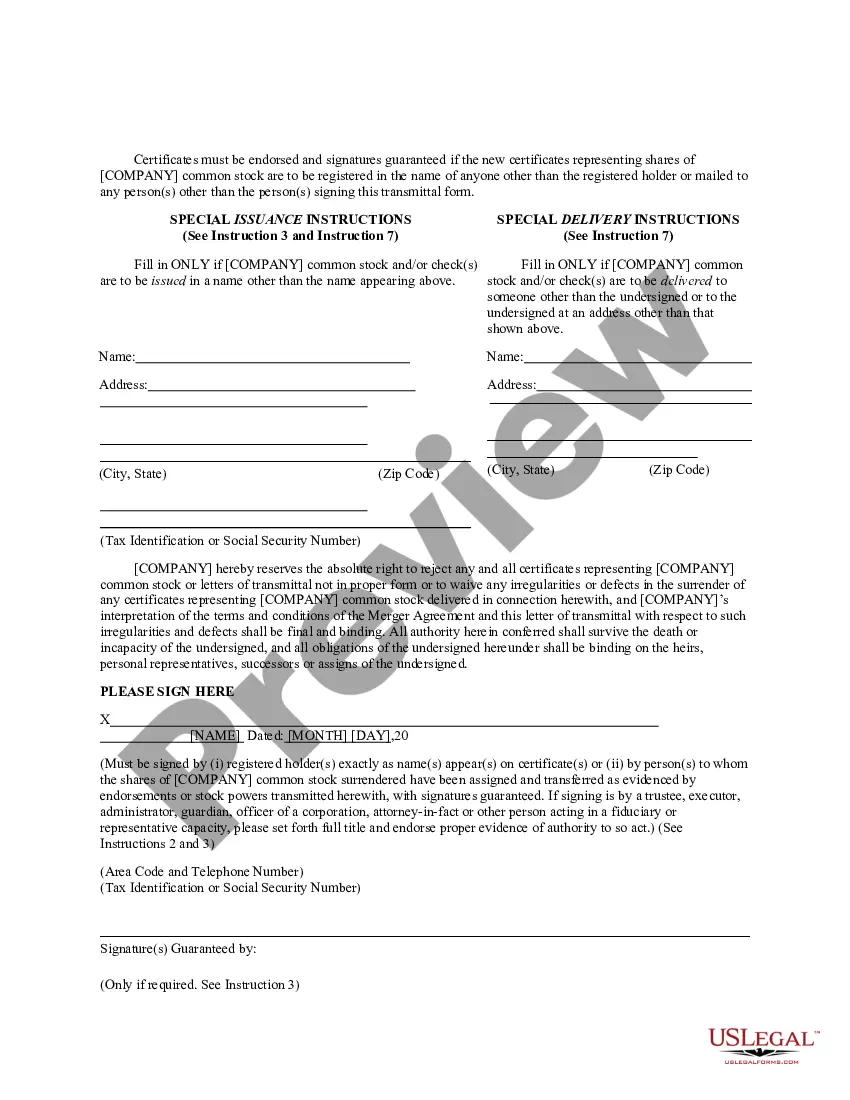

- Make sure you have picked out the proper form for the town/area. Click the Preview button to review the form`s information. Browse the form information to actually have selected the appropriate form.

- When the form doesn`t fit your demands, make use of the Lookup area towards the top of the display to get the one which does.

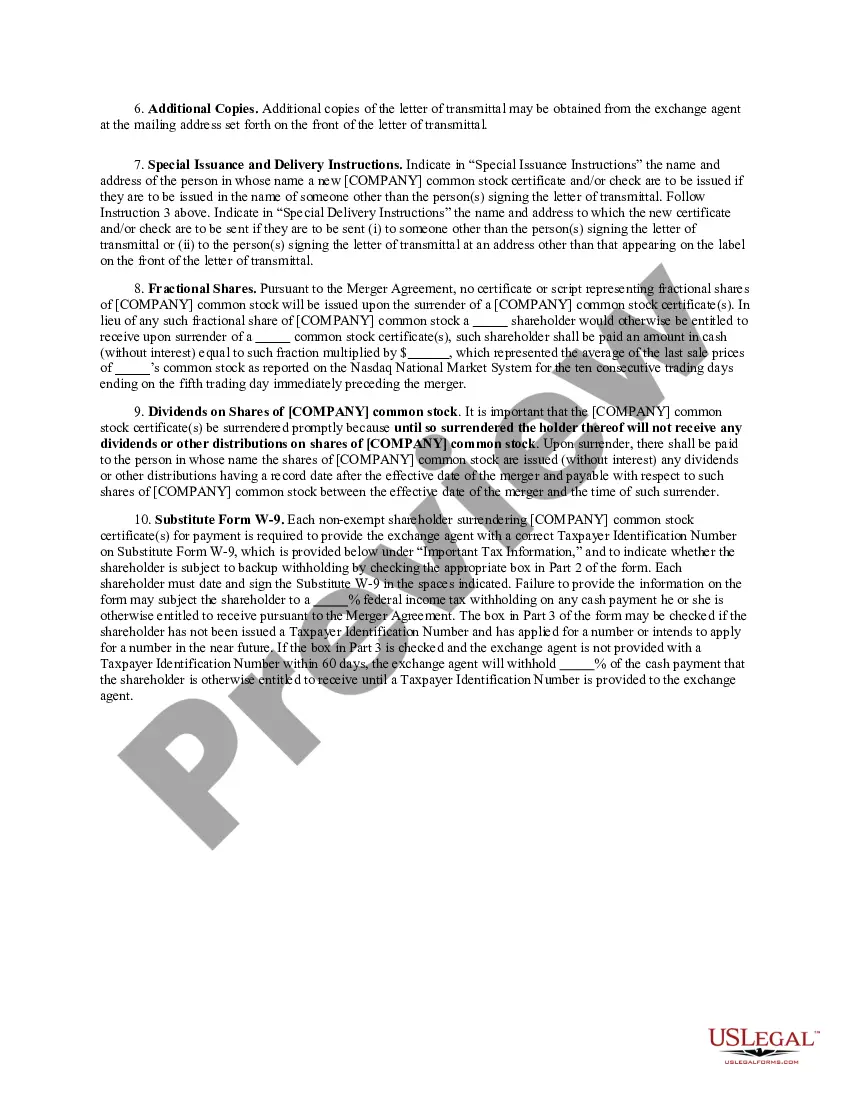

- If you are happy with the form, verify your option by clicking the Get now button. Then, opt for the rates strategy you prefer and supply your qualifications to sign up for the bank account.

- Approach the deal. Use your bank card or PayPal bank account to finish the deal.

- Select the file format and acquire the form on the system.

- Make adjustments. Load, change and produce and sign the downloaded North Dakota Letter of Transmittal.

Every single web template you included with your account lacks an expiration particular date which is the one you have for a long time. So, if you want to acquire or produce yet another backup, just check out the My Forms area and then click about the form you need.

Gain access to the North Dakota Letter of Transmittal with US Legal Forms, probably the most comprehensive collection of legitimate document themes. Use a large number of expert and express-certain themes that fulfill your company or specific requirements and demands.

Form popularity

FAQ

Form 500 may be used by a taxpayer to do one of the following: Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer's confidential tax information to another individual or firm not otherwise entitled to the information. Form 500 - Authorization To Disclose Tax Information & Designation Of ... nd.gov ? documents ? forms ? misc-forms nd.gov ? documents ? forms ? misc-forms

Employers must electronically file Form 306 ? Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more. Income Tax Withholding in North Dakota nd.gov ? business ? income-tax-withh... nd.gov ? business ? income-tax-withh...

The North Dakota Voluntary Disclosure Program (Program) allows a taxpayer that has been conducting business activities in North Dakota or has been collecting but not remitting North Dakota sales tax to voluntarily come forward and resolve potential tax liabilities.

You must file an income tax return if you are a nonresident who owns a business operating in North Dakota and: You are required to file a federal return AND the business generates income you are required to report on your federal return.

A North Dakota tax power of attorney (Form 500), otherwise known as the ?Office of North Dakota State Tax Commissioner Authorization to Disclose Tax Information and Designation of Representative Form,? is used to designate a person as a representative of your interests in tax matters before the concerned tax authority.

The North Dakota Office of State Tax Commissioner mandates the filing of Form 1099. If the payee is a resident or non-residence of North Dakota. In case the payee is a non-resident of North Dakota, Form 1099 should be filed only if the income is sourced in North Dakota. North Dakota 1099 filing requirements | ND Form 1099-NEC, MISC, INT ... taxbandits.com ? form-1099-series ? north-... taxbandits.com ? form-1099-series ? north-...

North Dakota Transmittal Of Wage And Tax Statement.

North Dakota Transmittal Of Wage And Tax Statement. Form 307 - North Dakota Transmittal of Wage and Tax Statement nd.gov ? forms ? it-withholding nd.gov ? forms ? it-withholding PDF