North Dakota Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

It is possible to spend hours on the Internet searching for the lawful papers format that meets the federal and state requirements you need. US Legal Forms supplies a huge number of lawful forms that are evaluated by professionals. You can easily download or printing the North Dakota Term Sheet - Convertible Debt Financing from the support.

If you have a US Legal Forms profile, you are able to log in and click on the Obtain option. Following that, you are able to total, revise, printing, or sign the North Dakota Term Sheet - Convertible Debt Financing. Each lawful papers format you buy is your own forever. To get another copy of the obtained form, visit the My Forms tab and click on the related option.

If you work with the US Legal Forms website the first time, keep to the easy directions beneath:

- Initially, make sure that you have chosen the correct papers format for that area/city of your liking. Browse the form information to ensure you have chosen the proper form. If available, utilize the Preview option to look through the papers format as well.

- If you want to locate another edition of your form, utilize the Lookup field to find the format that meets your needs and requirements.

- After you have identified the format you need, just click Buy now to carry on.

- Pick the rates strategy you need, key in your references, and register for your account on US Legal Forms.

- Full the transaction. You may use your bank card or PayPal profile to purchase the lawful form.

- Pick the structure of your papers and download it for your gadget.

- Make alterations for your papers if possible. It is possible to total, revise and sign and printing North Dakota Term Sheet - Convertible Debt Financing.

Obtain and printing a huge number of papers themes utilizing the US Legal Forms website, which offers the greatest assortment of lawful forms. Use professional and express-specific themes to take on your organization or personal needs.

Form popularity

FAQ

The following are just a couple of the possible disadvantages of using convertible notes as a financing mechanism. If they don't convert, the notes eventually come due. This can result in the end of the startup if the note holders aren't willing to negotiate, and the startup doesn't have the means to pay off the notes.

If the company fails after issuing a convertible note and defaults on its obligations, its noteholders will probably be unable to get their initial seed money or investment back. If there's anything to be gotten, convertible noteholders will fall in line after secured debt holders and before shareholders.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

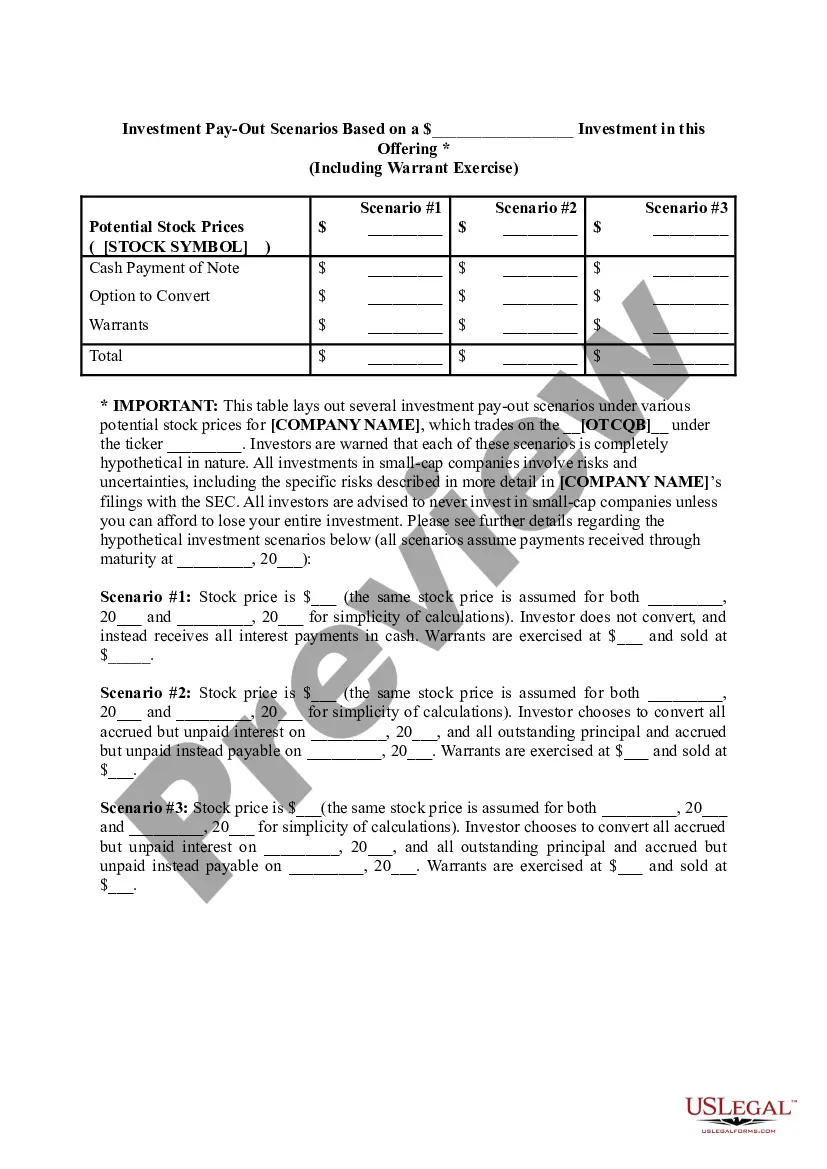

EXAMPLE: A startup company with 1,000,000 shares of common stock closes a seed funding round of $1,000,000 in the form of a convertible note, with a valuation cap of $5,000,000 pre-money valuation on the next round of financing.

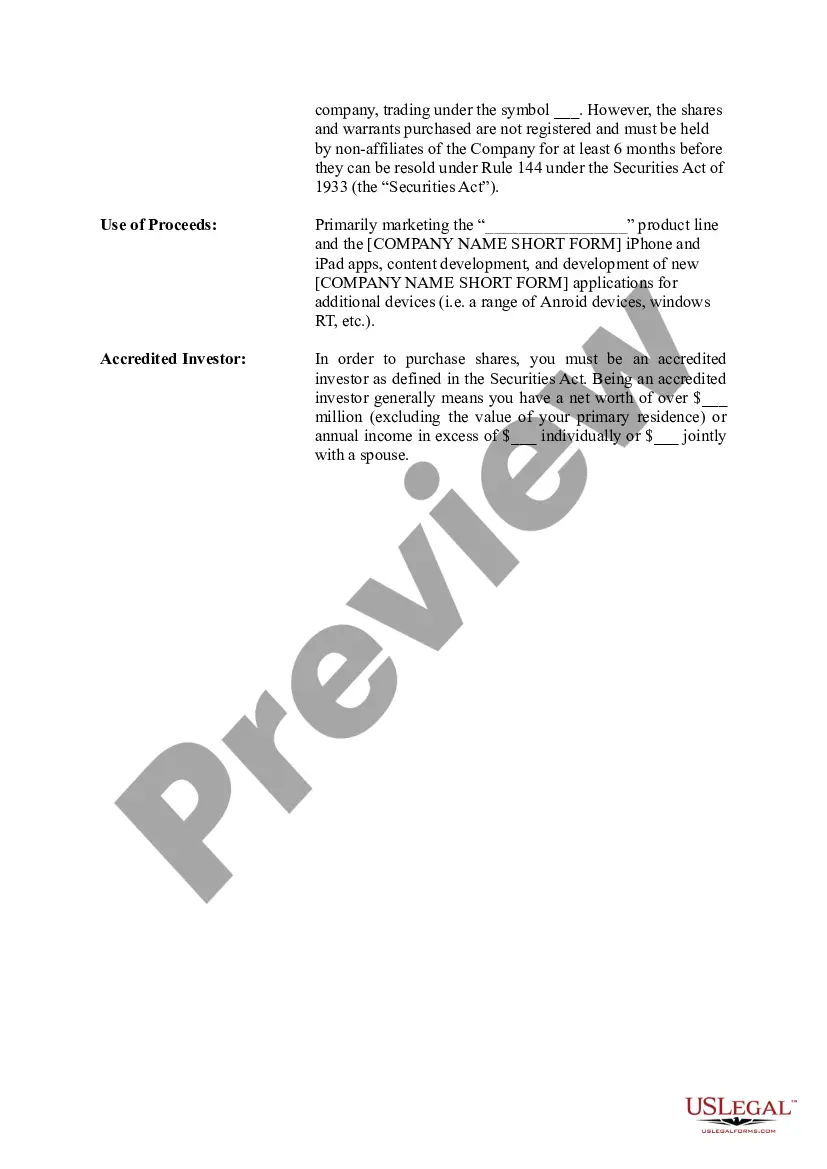

When a company borrows money from investors and plans to convert it to equity or ownership in the company at a later time, that's convertible debt. The borrower and lender decide the type of equity and a set time when the loan converts based on the company's value when the loan begins.

A convertible note is a short-term debt agreement that converts into equity at a future date. Usually, this happens when one of these events takes place: The company raises enough capital to reach a pre-determined benchmark. The term of the loan expires.

The Minimum amount of Investment required is Rs 25 lakhs. CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.