North Dakota Joint Filing of Rule 13d-1(f)(1) Agreement

Description

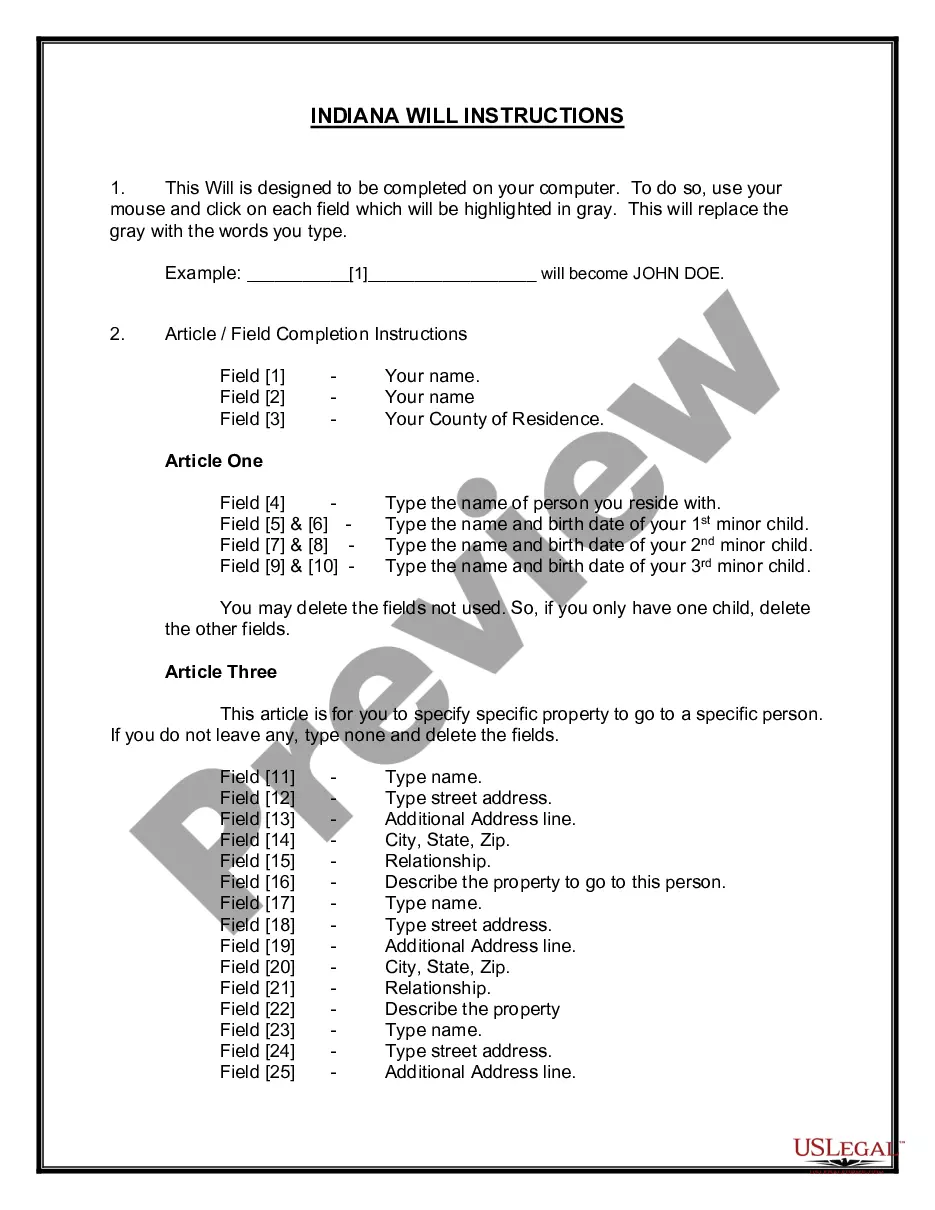

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

US Legal Forms - one of many biggest libraries of lawful varieties in the States - delivers a wide array of lawful papers layouts you can download or printing. Utilizing the website, you may get thousands of varieties for organization and personal functions, categorized by groups, says, or search phrases.You will discover the most up-to-date versions of varieties such as the North Dakota Joint Filing of Rule 13d-1(f)(1) Agreement within minutes.

If you already possess a subscription, log in and download North Dakota Joint Filing of Rule 13d-1(f)(1) Agreement from your US Legal Forms collection. The Download switch will show up on every kind you view. You have accessibility to all previously downloaded varieties from the My Forms tab of your own profile.

If you would like use US Legal Forms initially, here are simple directions to help you started out:

- Be sure you have chosen the best kind for the town/state. Click the Preview switch to analyze the form`s content. Read the kind explanation to actually have chosen the proper kind.

- When the kind does not satisfy your demands, utilize the Look for discipline towards the top of the monitor to get the one that does.

- Should you be happy with the shape, verify your decision by visiting the Buy now switch. Then, choose the prices plan you favor and provide your qualifications to register to have an profile.

- Procedure the transaction. Use your credit card or PayPal profile to accomplish the transaction.

- Choose the formatting and download the shape on the product.

- Make alterations. Load, revise and printing and indicator the downloaded North Dakota Joint Filing of Rule 13d-1(f)(1) Agreement.

Each web template you put into your bank account lacks an expiration time which is your own permanently. So, if you would like download or printing an additional version, just go to the My Forms area and click around the kind you require.

Obtain access to the North Dakota Joint Filing of Rule 13d-1(f)(1) Agreement with US Legal Forms, the most considerable collection of lawful papers layouts. Use thousands of skilled and condition-specific layouts that satisfy your small business or personal needs and demands.

Form popularity

FAQ

Once the disclosure has been filed with the SEC, the public company and the exchange(s) on which the company trades are notified of the new beneficial owner. Schedule 13D is intended to provide transparency to the public regarding who these shareholders are and why they have taken a significant stake in the company.

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

Joint filings are typically used by groups of affiliated stockholders such as venture capital funds and their general partners and managing entities, but can be used by unrelated stockholders as well. An agreement to file jointly can apply to more than one filing. Schedule 13D and 13G Filings Best Practice Summary - LeapLaw leaplaw.com ? bps ? 13D_13G leaplaw.com ? bps ? 13D_13G

Exempt investors (Rule 13d-1(d)). This refers to a category of investors who may make their initial filing on Schedule 13G to report that their beneficial ownership exceeds 5% of a voting class of registered equity securities. SEC Adopts Amendments to Beneficial Ownership Reporting ... cooley.com ? news ? insight ? 2023-10-30-s... cooley.com ? news ? insight ? 2023-10-30-s...

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility. SEC Accelerates Schedule 13D/G Filing Deadlines and Issues ... shearman.com ? perspectives ? 2023/10 ? se... shearman.com ? perspectives ? 2023/10 ? se...

13D filings are often seen by investors as a signal that the targeted stock is undervalued and poised to appreciate. Schedule 13Gs are filed by entities or individuals who are ?passive? investors, with no activist intentions.

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F. 13F Instead of 13D: Activists Make Smaller Purchases - Investopedia investopedia.com ? news investopedia.com ? news

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

The Bottom Line. SEC Form 13F is required to be filed by institutional managers who manage $100 million or more in assets. The goal is to bring transparency into the financial holdings of such large managers.

(a) Any person who, after acquiring directly or indirectly the beneficial ownership of any equity security of a class which is specified in paragraph (i) of this section, is directly or indirectly the beneficial owner of more than five percent of the class shall, within 10 days after the acquisition, file with the ...