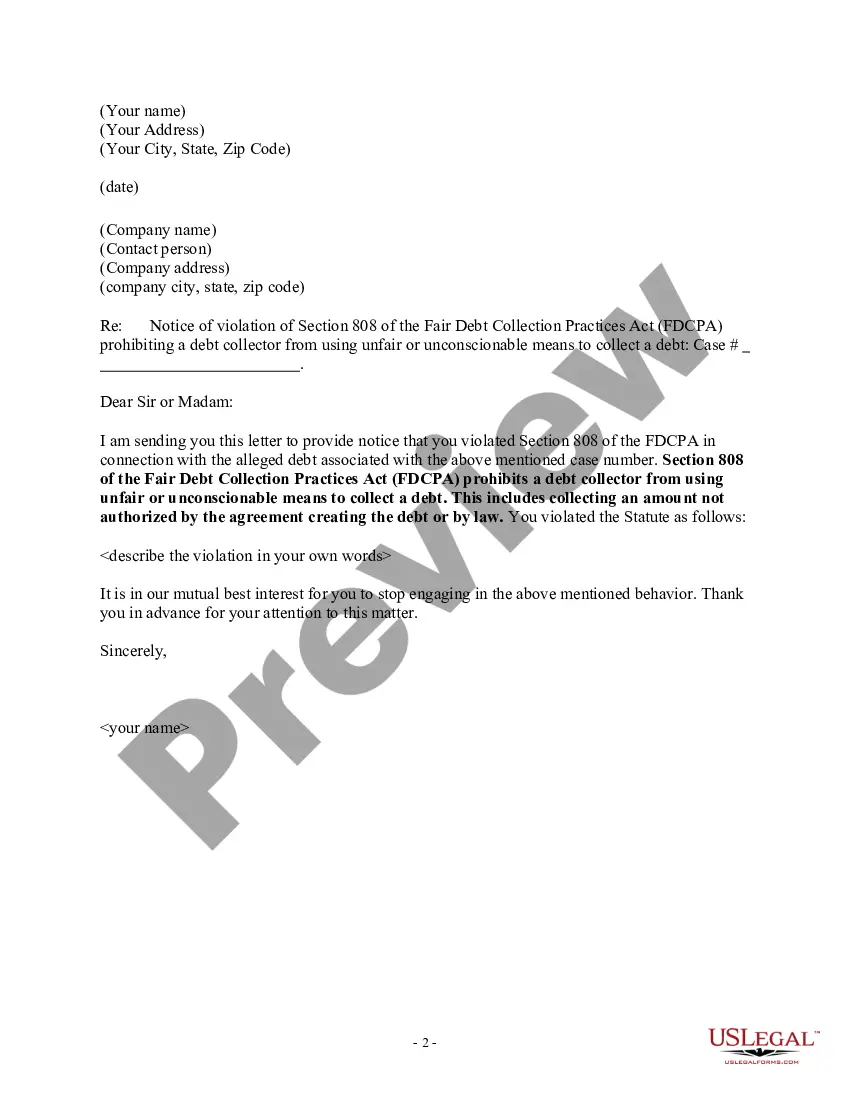

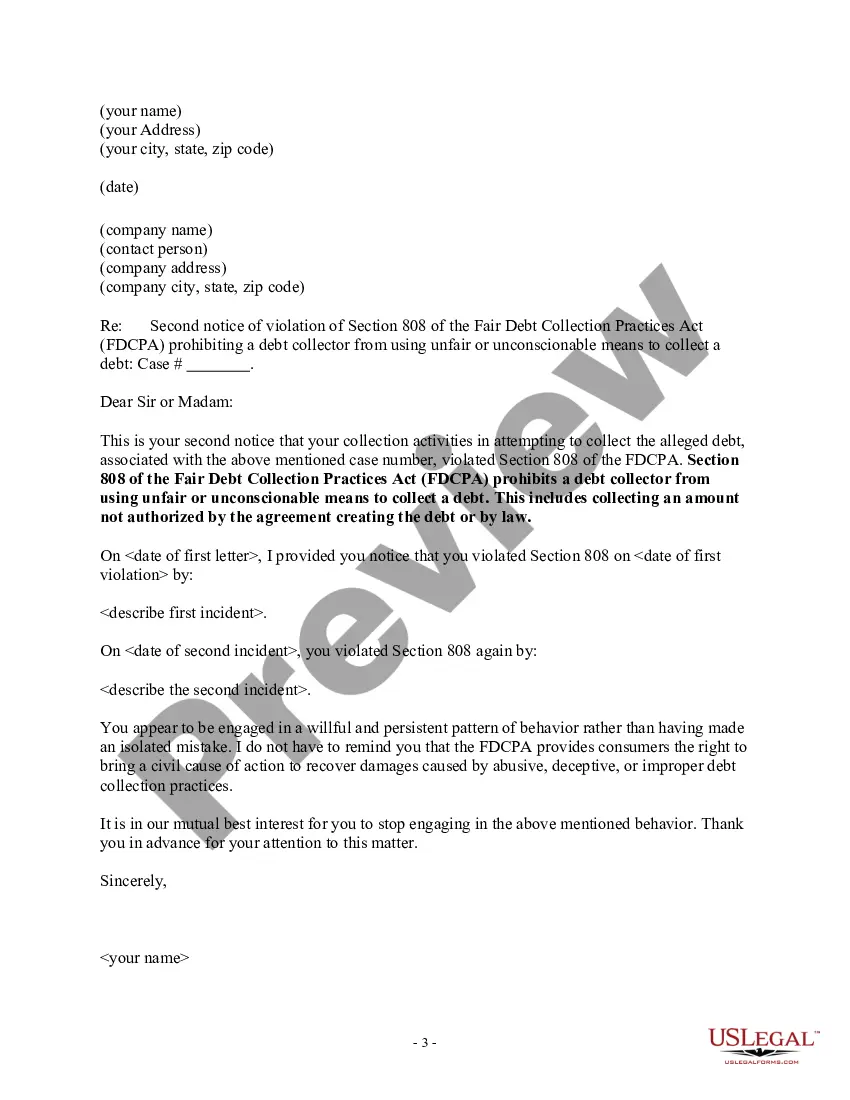

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

North Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Are you presently in a situation where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates available online, yet finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the North Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, crafted to meet federal and state regulations.

Once you acquire the appropriate form, click on Acquire now.

Select the pricing plan you prefer, complete the necessary information to create your account, and process the order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct jurisdiction/area.

- Utilize the Review button to examine the form.

- Read the description to ensure you have chosen the correct form.

- If the form isn't what you are looking for, use the Research section to find the form that fits your needs.

Form popularity

FAQ

Overview: In general, a North Dakota small claims or state district court judgment expires ten years from the date the judgment was first docketed. However, the judgment may be renewed one time.

Only creditors with a valid court order can garnish wages in the state of North Dakota. This may be the original creditor you had the debt with or a debt buyer or debt collection agency. Creditors for certain debts can garnish your wages without a court order.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

How long is your judgment valid? In North Carolina, a judgment is valid for ten years from the date it was awarded by the Court. The judgment can be renewed for another ten years, giving a judgment creditor additional time to try to collect the money owed.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

Time limits/Statute of LimitationsIf your creditor does not start the court action within 6 years of the debt being due, the action can be held to be statute-barred by the court.