North Dakota Reclassification of Class B common stock into Class A common stock

Description

How to fill out Reclassification Of Class B Common Stock Into Class A Common Stock?

If you want to full, obtain, or print out legal record web templates, use US Legal Forms, the biggest selection of legal kinds, which can be found on-line. Use the site`s simple and easy practical research to find the documents you need. Different web templates for enterprise and person functions are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the North Dakota Reclassification of Class B common stock into Class A common stock with a handful of clicks.

Should you be presently a US Legal Forms customer, log in in your bank account and click on the Down load key to obtain the North Dakota Reclassification of Class B common stock into Class A common stock. You can even gain access to kinds you previously downloaded in the My Forms tab of your respective bank account.

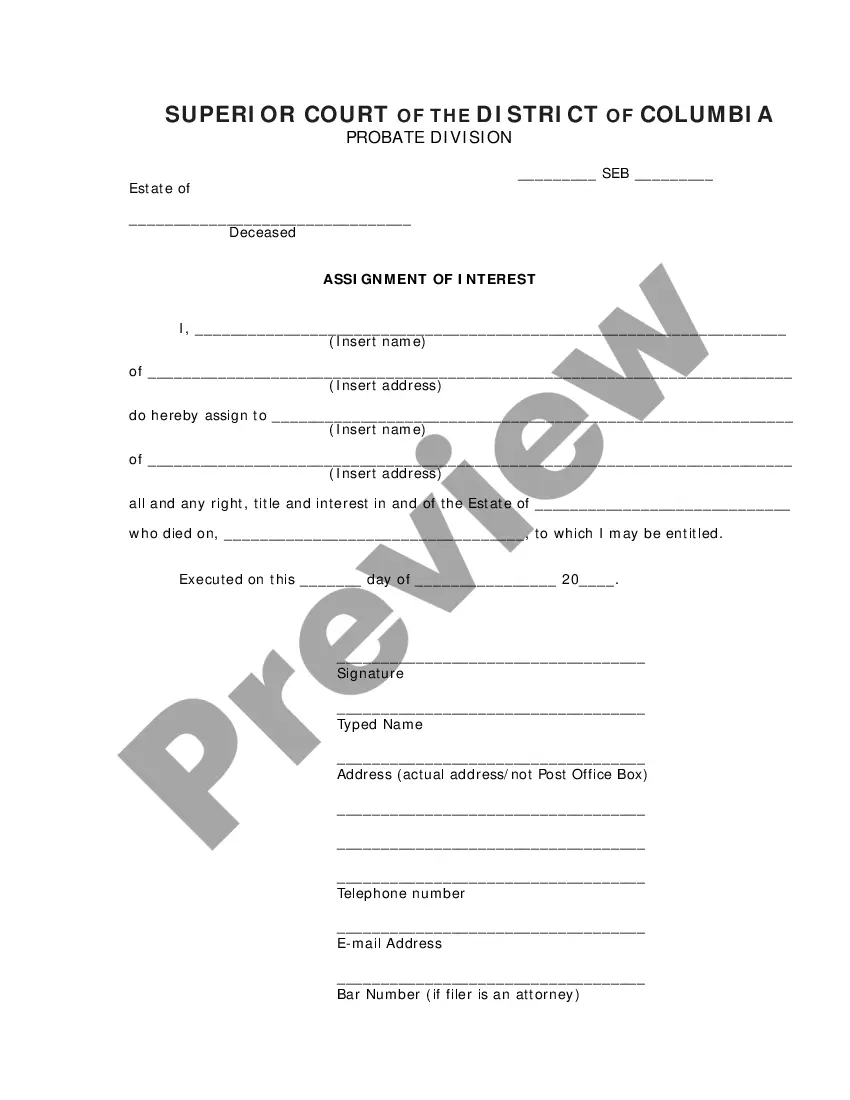

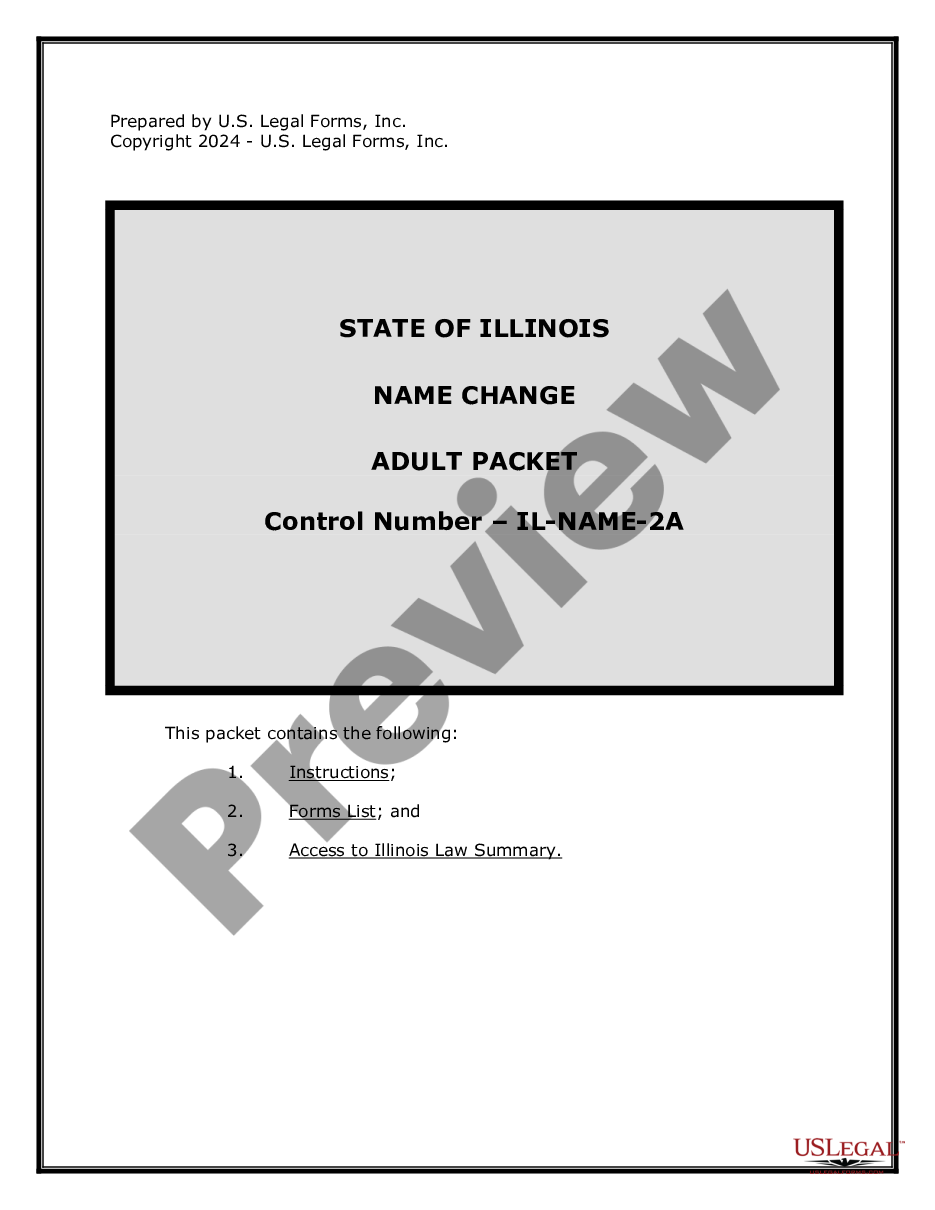

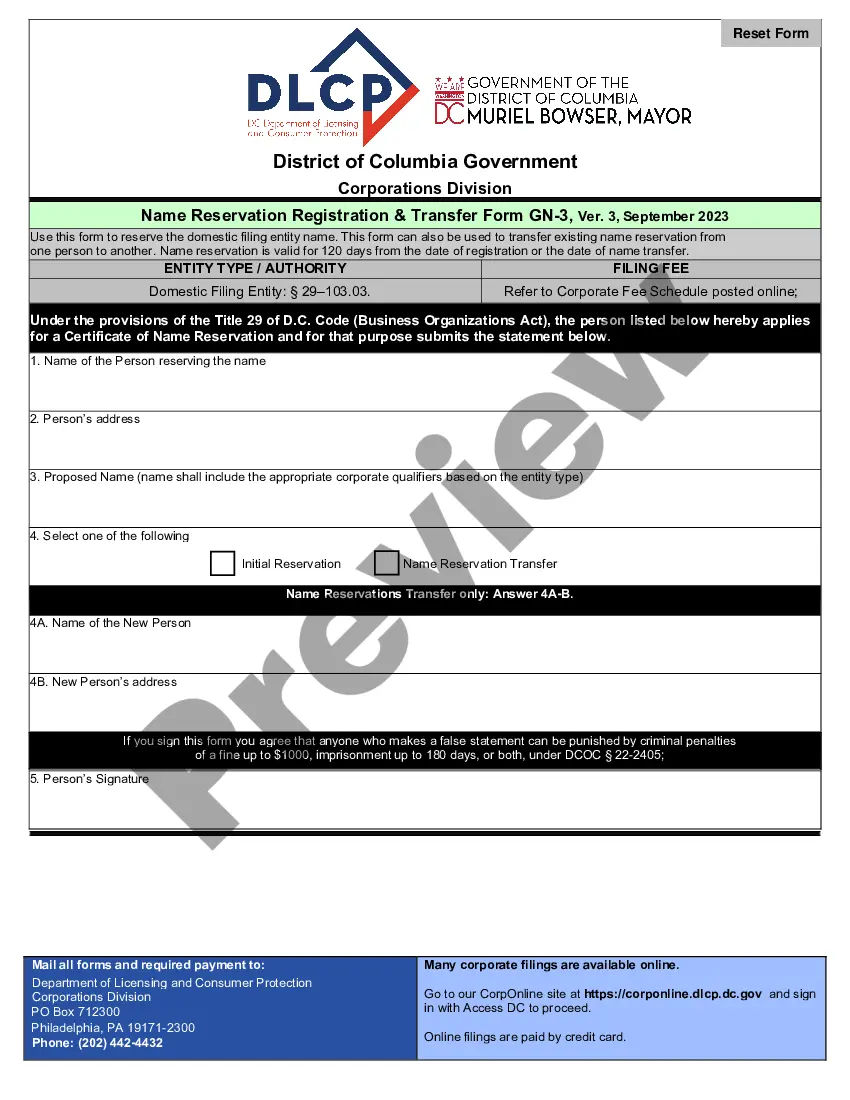

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for that proper city/region.

- Step 2. Take advantage of the Preview option to examine the form`s articles. Do not forget to read through the information.

- Step 3. Should you be not satisfied with the develop, take advantage of the Look for discipline towards the top of the display screen to get other variations of the legal develop format.

- Step 4. Upon having found the form you need, click the Buy now key. Choose the prices program you like and add your credentials to sign up to have an bank account.

- Step 5. Approach the transaction. You may use your credit card or PayPal bank account to perform the transaction.

- Step 6. Pick the formatting of the legal develop and obtain it on the gadget.

- Step 7. Complete, change and print out or indication the North Dakota Reclassification of Class B common stock into Class A common stock.

Each and every legal record format you purchase is your own property for a long time. You may have acces to each and every develop you downloaded within your acccount. Click on the My Forms segment and select a develop to print out or obtain once again.

Contend and obtain, and print out the North Dakota Reclassification of Class B common stock into Class A common stock with US Legal Forms. There are millions of expert and condition-certain kinds you can use for your personal enterprise or person requirements.

Form popularity

FAQ

Class B shares typically have lower dividend priority than Class A shares and fewer voting rights. However, different classes do not usually affect an average investor's share of the profits or benefits from the company's overall success.

Key Takeaways. A company or stock with a dual-class structure has two or more classes of shares with different voting rights. Typically insiders are given access to a class of shares that provide greater control and voting rights, while the general public is offered a class of shares with little or no voting rights.

Conversion. Each Class B ordinary share is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

How to reclassify shares Make sure the articles of association allow share redesignations. ... Propose an ordinary resolution to redesignate shares. ... Submit an SH08 form. ... Update the register of members. ... Issue new share certificates. ... Reflect the changes in the next confirmation statement. ... Inform HMRC.

By converting existing shares from one class to another, a company can adjust the rights of different shareholders as and when the need arises, without increasing the total number of shares in issue.

share is a share class that charges a sales load in a mutual fund. This means investors pay a charge when they redeem from the fund. This is different from a frontloaded fund, which requires payment upon purchase.

The difference between Class A shares and Class B shares of a company's stock usually comes down to the number of voting rights assigned to the shareholder. Class A shareholders generally have more clout. Despite Class A shareholders almost always having more voting rights, this isn't actually a legal requirement.