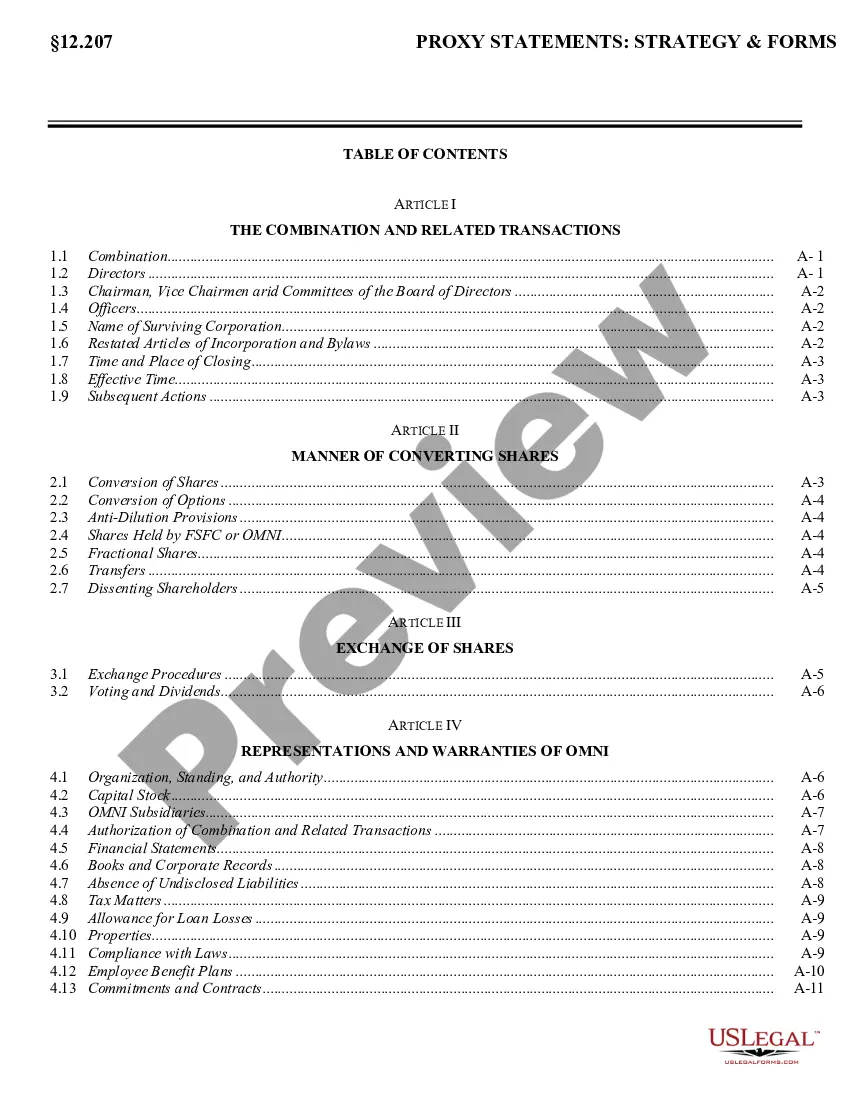

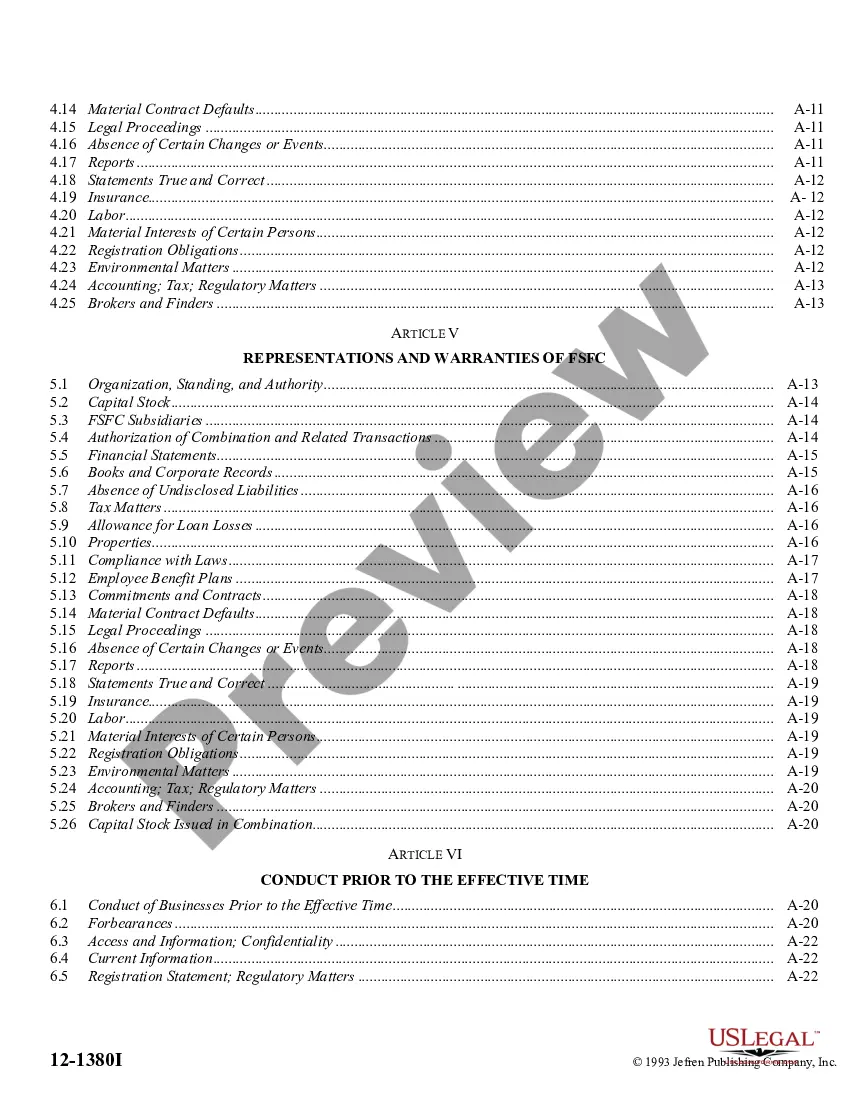

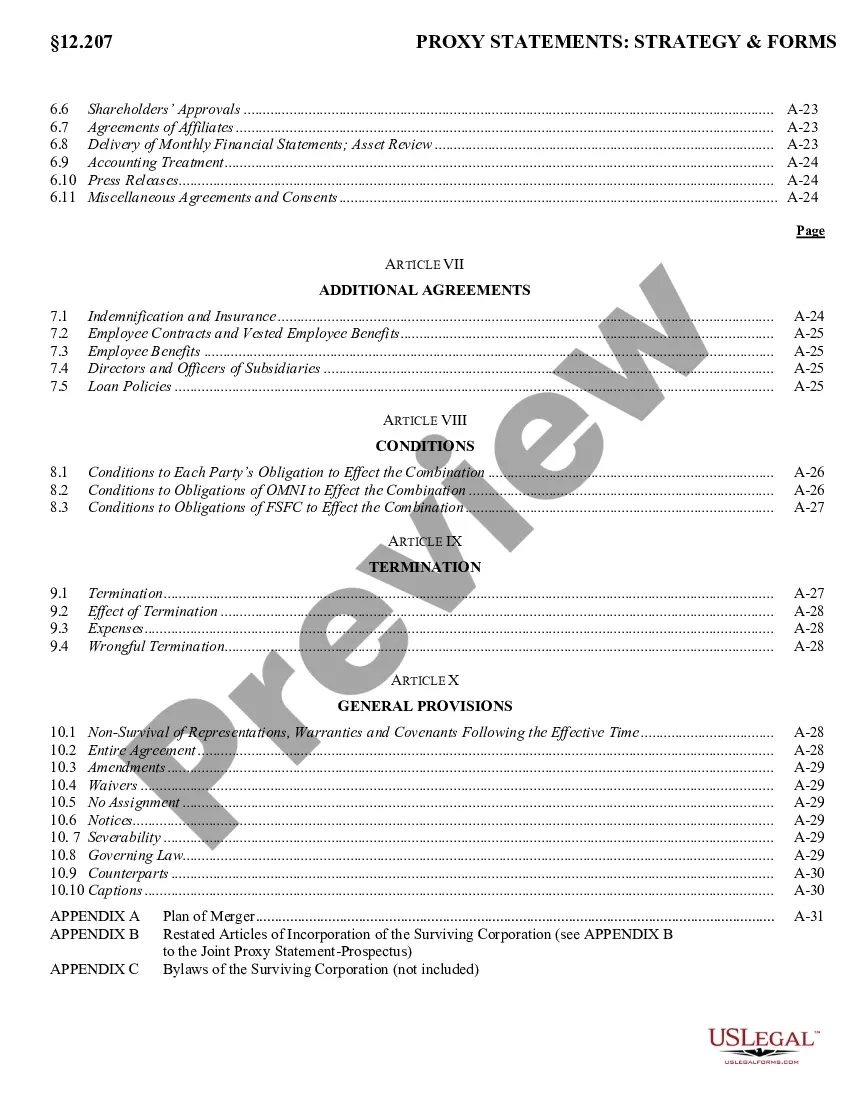

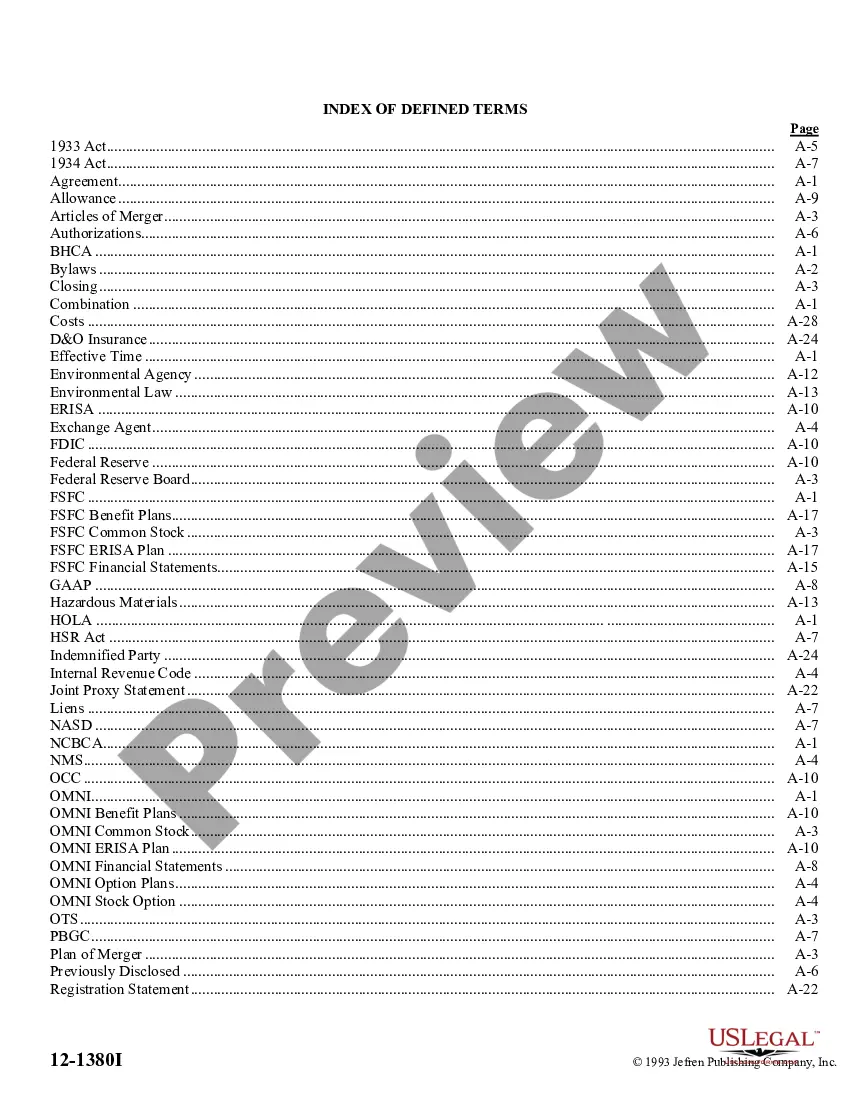

North Dakota Agreement of Combination

Description

How to fill out Agreement Of Combination?

US Legal Forms - among the greatest libraries of lawful varieties in the USA - offers a variety of lawful document themes you are able to download or print out. Using the internet site, you can find 1000s of varieties for company and personal functions, sorted by groups, claims, or keywords and phrases.You will discover the most recent types of varieties much like the North Dakota Agreement of Combination within minutes.

If you have a membership, log in and download North Dakota Agreement of Combination from your US Legal Forms catalogue. The Down load switch will show up on every kind you view. You get access to all formerly downloaded varieties in the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, here are basic instructions to get you began:

- Ensure you have picked the correct kind to your area/state. Select the Preview switch to analyze the form`s information. Look at the kind outline to actually have selected the proper kind.

- In case the kind doesn`t satisfy your specifications, utilize the Search area towards the top of the monitor to obtain the one which does.

- If you are content with the shape, affirm your choice by visiting the Buy now switch. Then, pick the pricing program you prefer and supply your qualifications to register for an account.

- Procedure the purchase. Utilize your credit card or PayPal account to complete the purchase.

- Choose the structure and download the shape in your product.

- Make adjustments. Fill up, edit and print out and sign the downloaded North Dakota Agreement of Combination.

Each web template you included with your bank account lacks an expiration particular date and it is yours eternally. So, if you would like download or print out another copy, just go to the My Forms segment and then click around the kind you will need.

Gain access to the North Dakota Agreement of Combination with US Legal Forms, probably the most substantial catalogue of lawful document themes. Use 1000s of specialist and condition-specific themes that meet up with your business or personal requires and specifications.

Form popularity

FAQ

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

If you elect to file and pay your Income Tax Withholding electronically, you must use the E-File Application to register for Withholding E-File (Form 301-EF). This form can be filled in on-line. Print and sign the application and mail to the address shown in the instructions.

Employers must electronically file Form 306 ? Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more.

Employers should begin using the revised withholding rates as soon as possible. The supplemental withholding rate is reduced from 1.84% to 1.5%. (2023 North Dakota Income Tax Withholding Rates and Instructions, p. 58.)

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

The Form 306, North Dakota Income Tax Withholding return must be filed by every employer, even if compensation was not paid during the period covered by this return. Form 306 and the tax due on it must be submitted electronically if the amount withheld during the previous calendar year was $1,000 or more.

How much does it cost to get a CDL ItemCostKnowledge Test$5 per attempt (One attempt allowed per day)Commercial Learner Permit$15 ($20 for non-domiciled)Endorsements$3 EachRoad Test$5

Apply for a North Dakota Tax ID (EIN) Number. To obtain your Tax ID (EIN) in North Dakota start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.