North Dakota Consulting Contract Questionnaire - Self-Employed

Description

How to fill out Consulting Contract Questionnaire - Self-Employed?

If you need thorough, acquire, or producing authentic document templates, utilize US Legal Forms, the largest selection of legal forms that you can access online.

Take advantage of the site's user-friendly and convenient search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of your legal form and download it to your device.

- Employ US Legal Forms to find the North Dakota Consulting Contract Questionnaire - Self-Employed with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to retrieve the North Dakota Consulting Contract Questionnaire - Self-Employed.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

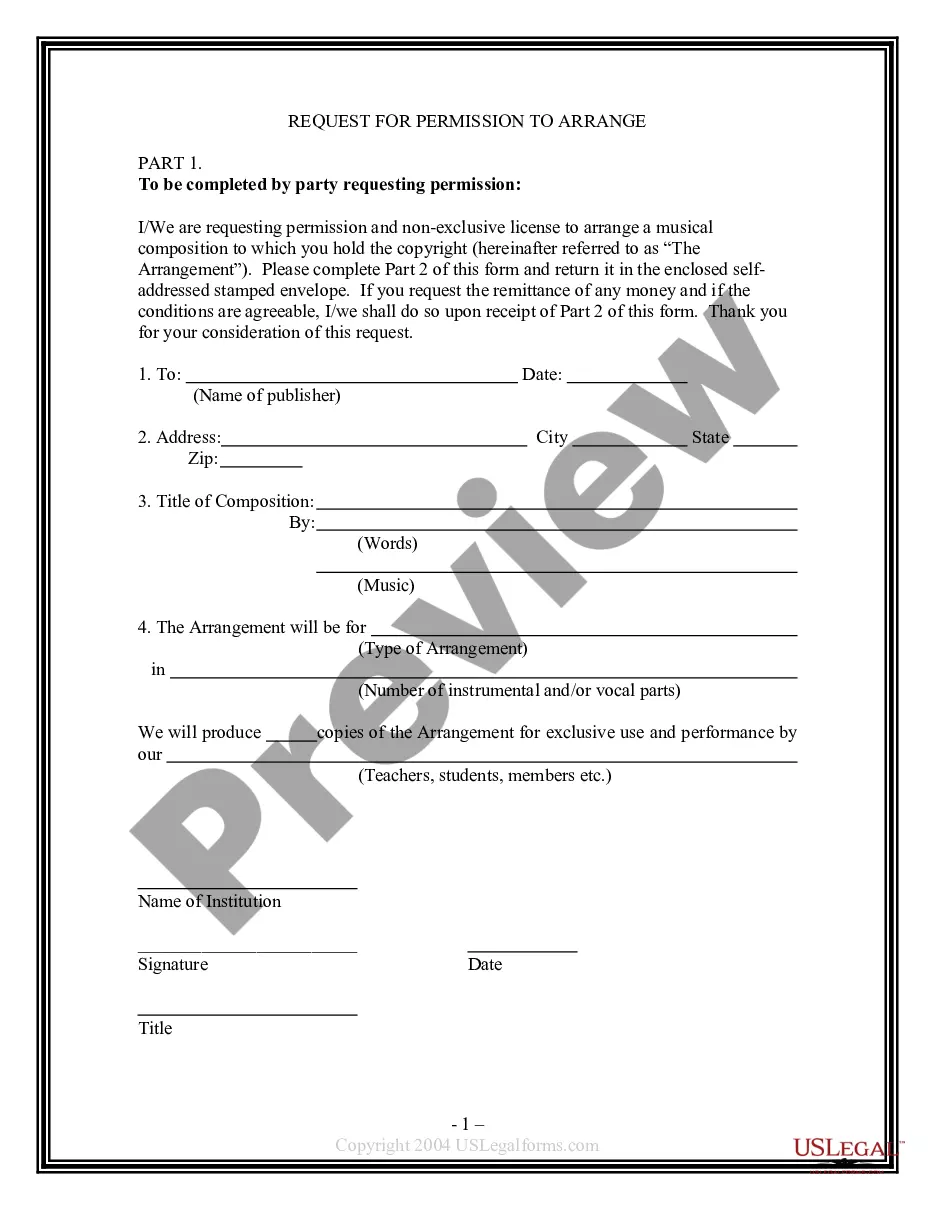

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you find the form you want, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

This is really a seven-step process.Step 1: Tell HMRC. Within three months of starting your business, you need to tell HMRC you're self-employed.Step 2: Get some insurance.Step 3: Pick a name.Step 4: Open a bank account.Step 5: Make sure you comply.Step 6: Get your bookkeeping sorted.Step 7: Where will you work?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Freelance writers who work on a gig basis by themselves are both self-employed and will also be registered as sole traders. Business consultants running their own small business can register as a limited company, but be self-employed.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Another big draw of being a self-employed consultant is the ability to set your own rates, with freelancers and contractors able to command higher rates than the salaries they had as full-time employees. In addition, self-employed consultants are also able to do things their way.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How To Be a Consultant: 10 Steps to Self EmploymentStep 1: Identify the Niche in Which You Have Knowledge and Experience.Step 2: Acquire the Certifications and Licenses.Step 3: Decide Your Short and Long Term Goals.Step 4: Choose Your Target Market.Step 5: Research Your Target Market.Step 6: Consider a Home Office.More items...?

A consultant is someone who acts as an individual or through a service company and provides services to your business on a self-employed basis. A consultant is not your employee and therefore does not have an Employment contract.