North Dakota Overtime Authorization Form

Description

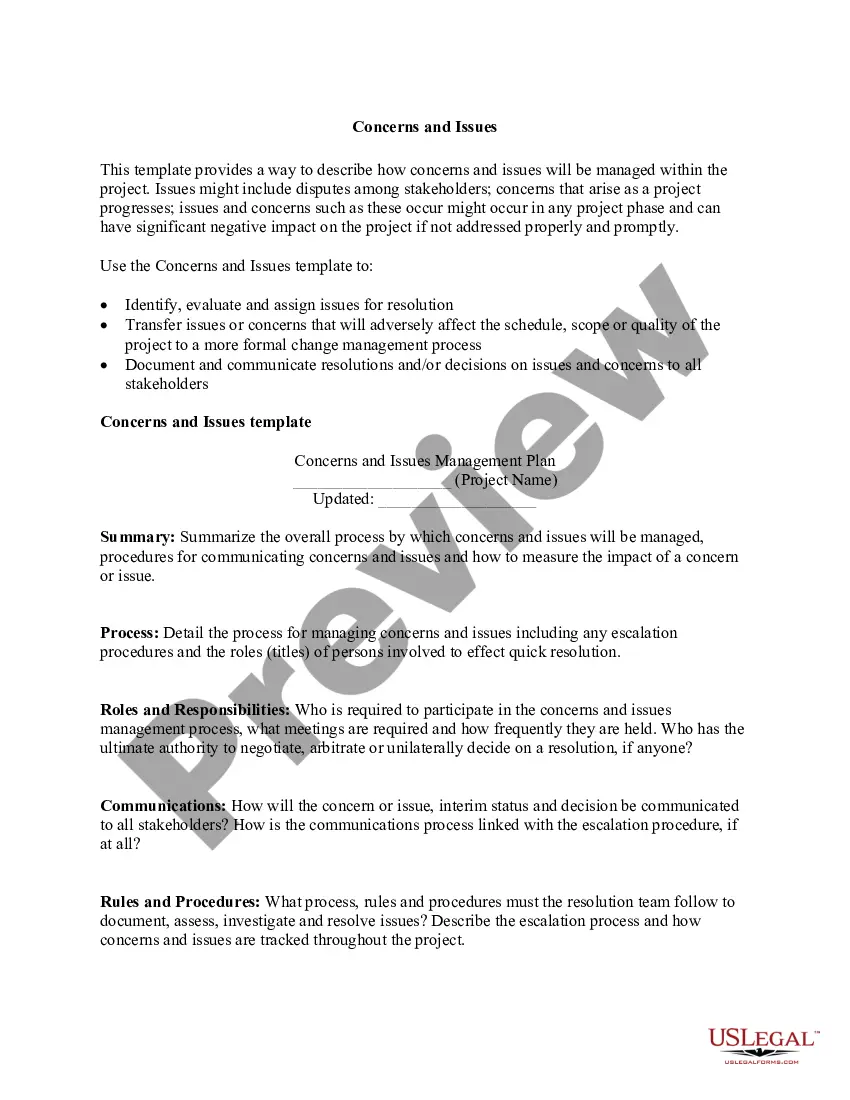

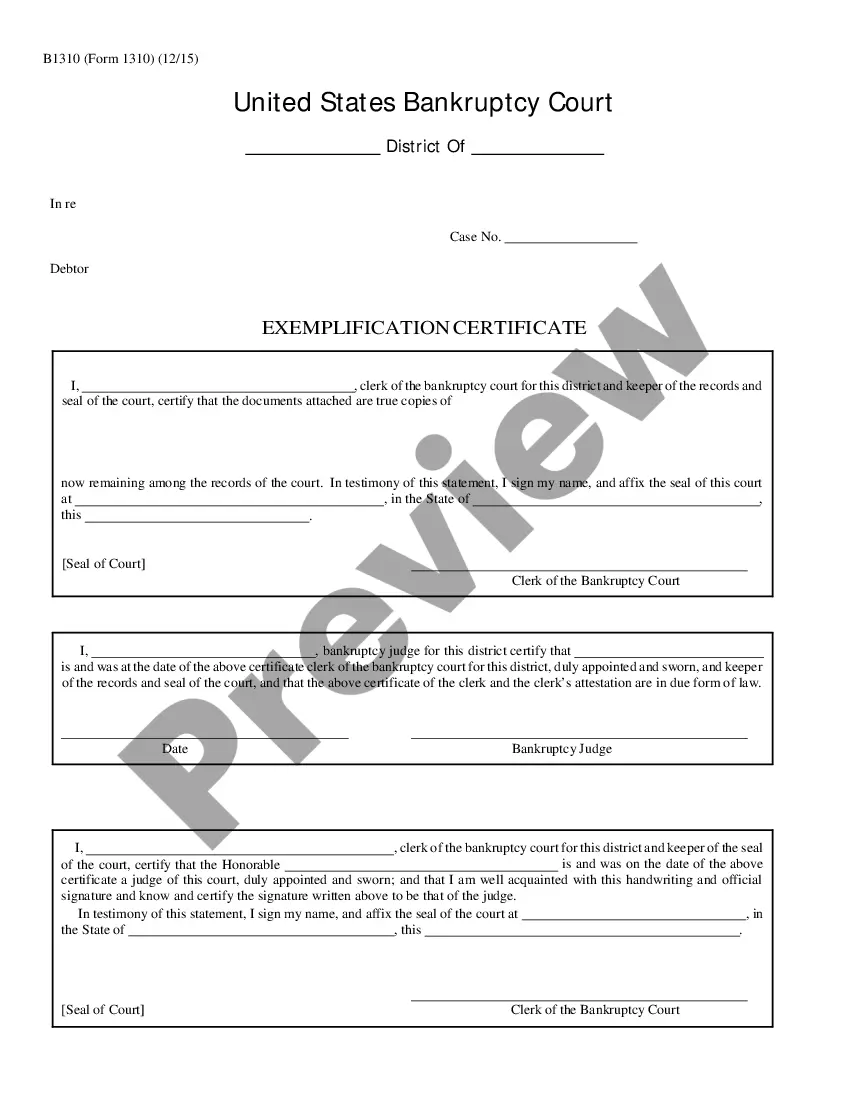

How to fill out Overtime Authorization Form?

Selecting the appropriate valid document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you obtain the valid form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the North Dakota Overtime Authorization Form, which can be utilized for both business and personal purposes.

You can review the document by using the Preview button and read the form description to confirm it is the right one for you.

- All forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Download button to access the North Dakota Overtime Authorization Form.

- Use your account to search through the valid forms you have purchased previously.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Non-exempt employees (including those paid a day rate) must be paid 1.5 times their regular hourly rate for all hours worked over 40 in a single workweek. Daily overtime is not required under North Dakota state law.

How Many Hours Is Considered Full-Time? Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

Under North Dakota's overtime law, an employer must pay each employee overtime in the amount of 11/2 times the employee's regular pay rate for hours worked in excess of 40 per 7-day workweek (ND Admin. Code Sec. 46-02-07-02). Overtime need only be computed for actual hours worked.

Generally, overtime is to be paid at 1-1/2 times the regular rate of pay for hours worked in excess of 40 in a work week (a consistent, consecutive 7 day period defined by the employer, unless the employer is a hospital or residential care establishment which may adopt a 14 day overtime period).

Overtime Hours are hours worked past 40 per week. The easiest calculation for overtime pay involves hourly employees. The formula can be expressed as (Regular Rate Straight Time) + ((Regular Rate 1.5) Overtime Hours). Salaried employees are also entitled to overtime pay under the FLSA.

127, Bismarck, ND 58505-0599. 2022 Mail Form 307 with paper information returns to: Office of State Tax Commissioner, PO Box 5624, Bismarck, ND 58506-5624.

Overtime pay is calculated: Hourly pay rate x 1.5 x overtime hours worked. Here is an example of total pay for an employee who worked 42 hours in a workweek: Regular pay rate x 40 hours = Regular pay, plus. Regular pay rate x 1.5 x 2 hours = Overtime pay, equals.

Employees can be required to work overtime, whether paid or unpaid, only if this is provided for in their contract of employment.

Generally, overtime is to be paid at 1-1/2 times the regular rate of pay for hours worked in excess of 40 in a work week (a consistent, consecutive 7 day period defined by the employer, unless the employer is a hospital or residential care establishment which may adopt a 14 day overtime period).