North Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Discovering the right legitimate papers template could be a have difficulties. Obviously, there are a variety of templates accessible on the Internet, but how will you discover the legitimate kind you want? Take advantage of the US Legal Forms site. The service provides a huge number of templates, like the North Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that can be used for enterprise and private demands. Every one of the varieties are checked out by pros and meet state and federal specifications.

Should you be presently registered, log in for your accounts and click the Obtain button to get the North Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Utilize your accounts to look throughout the legitimate varieties you may have purchased in the past. Visit the My Forms tab of your own accounts and obtain another duplicate of your papers you want.

Should you be a brand new customer of US Legal Forms, listed below are straightforward guidelines so that you can adhere to:

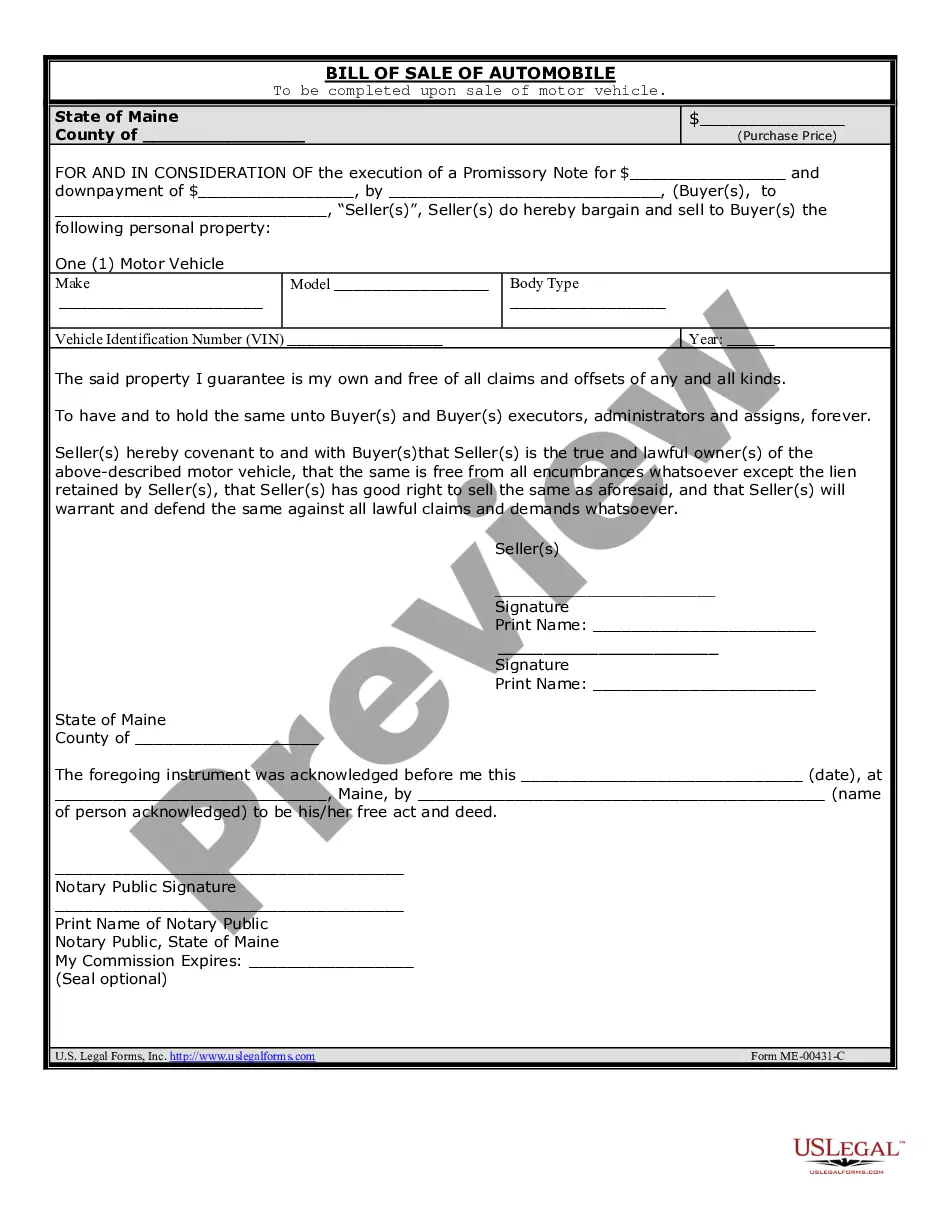

- Initially, make sure you have selected the appropriate kind for your town/state. It is possible to look over the shape using the Preview button and study the shape explanation to ensure it is the right one for you.

- When the kind does not meet your expectations, take advantage of the Seach area to discover the right kind.

- When you are sure that the shape is suitable, select the Get now button to get the kind.

- Pick the costs prepare you would like and enter in the essential information and facts. Build your accounts and pay for the transaction using your PayPal accounts or charge card.

- Pick the document structure and down load the legitimate papers template for your system.

- Complete, revise and print and signal the obtained North Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

US Legal Forms is definitely the greatest catalogue of legitimate varieties for which you will find various papers templates. Take advantage of the service to down load professionally-made documents that adhere to condition specifications.

Form popularity

FAQ

For example, if the donee had the power to select only amongst the decedent's children, that is a special power of appointment.

A marital deduction trust is a trust where transfers of property between married partners are free of federal transfer tax. A marital deduction trust can take one of two forms: A life estate coupled with a general power of appointment given to the spouse, or. A Qualified Terminable Interest Property (QTIP) trust.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

A Marital Trust is an irrevocable trust that allows for estate tax deferral and possibly elimination. On the other hand, a family trust is generally revocable and will not achieve the same estate tax benefits.

A QTIP trust offers more control to the grantor but less control to the surviving spouse compared to marital trust. The surviving spouse cannot choose final beneficiaries and has limited control over the assets, receiving only trust income in ance with the IRS laws.

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

As noted above, when a trust calculates the distributable net income, it essentially prevents any instance of double taxation of the funds issued by a trust. The formula to calculate the figure is as follows: Distributable Net Income (DNI) = Taxable Income - Capital Gains + Tax Exemption.