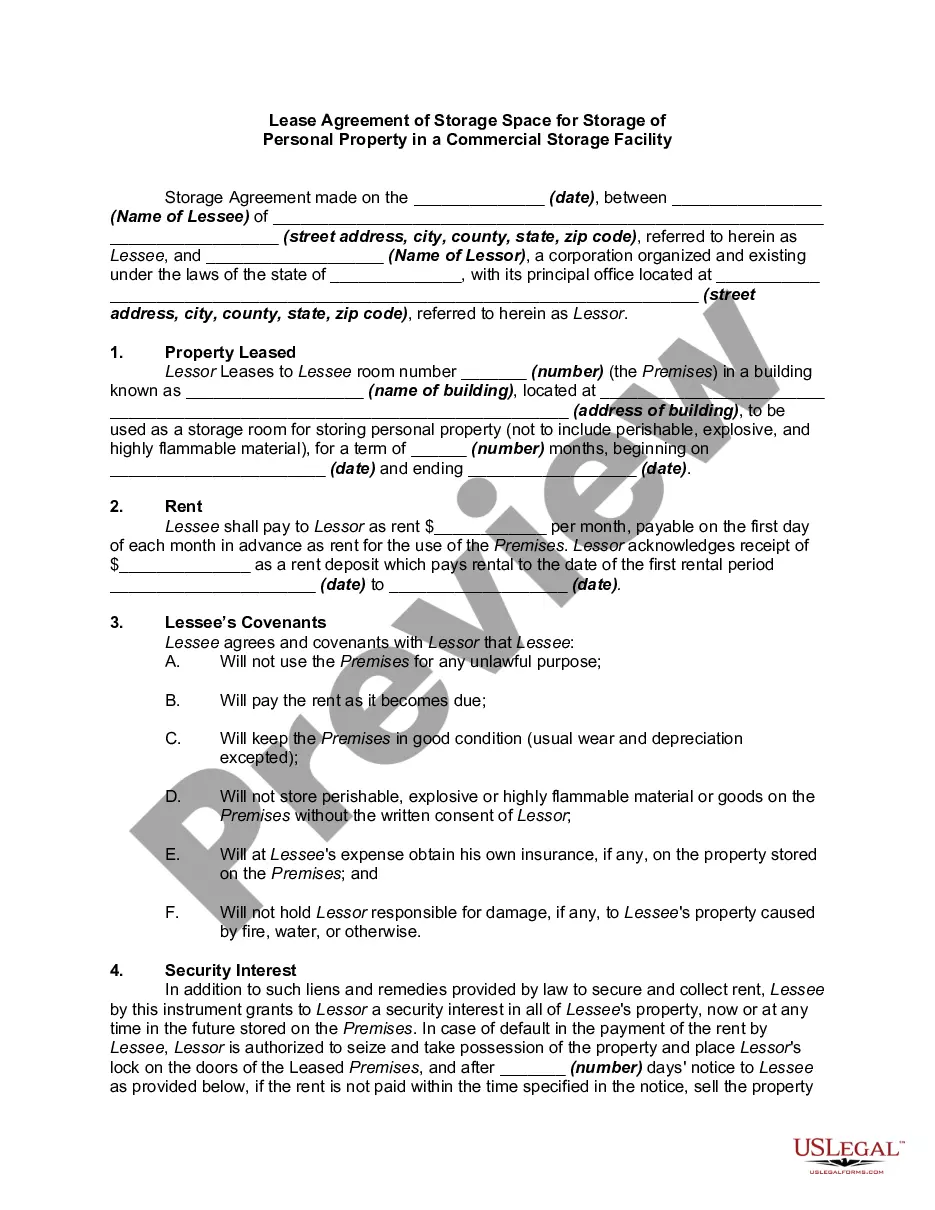

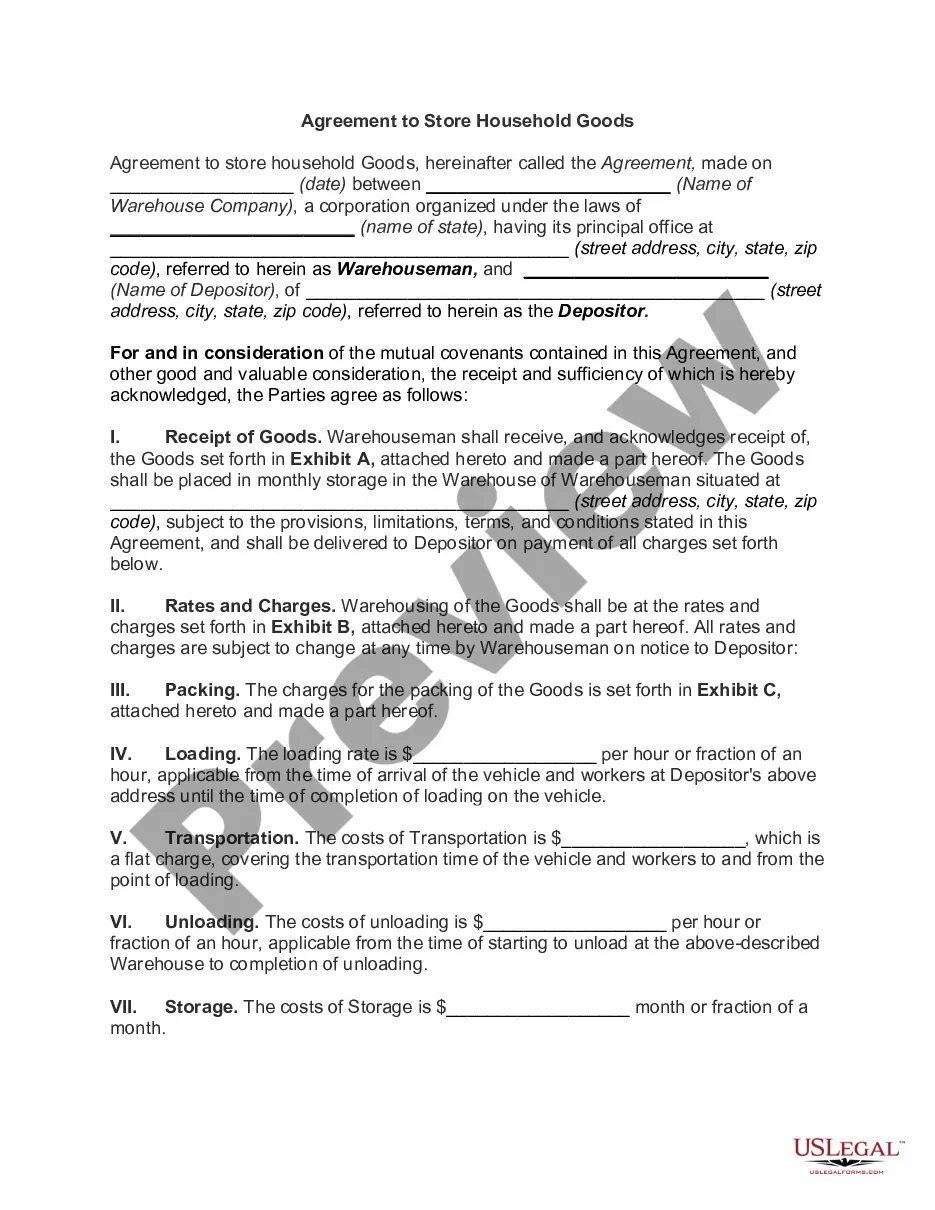

North Dakota Storage Agreement for Household Goods

Description

How to fill out Storage Agreement For Household Goods?

You can spend countless hours online looking for the legal form template that complies with both state and federal requirements.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can easily download or print the North Dakota Storage Agreement for Household Goods from the service.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the North Dakota Storage Agreement for Household Goods.

- Every legal document template you acquire is yours indefinitely.

- To fetch another copy of the obtained form, visit the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the appropriate document format for the chosen county/city.

- Review the form description to verify that you have chosen the correct document.

Form popularity

FAQ

Goods that are subject to sales tax in North Dakota include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

North Dakota does not explicitly require verification by a notary on a bill of sale, except in the case of the state-drafted vehicle bill of sale.

Basic food items and servicesNorth Dakota has a set sales tax of 5 percent across the state, but cities can add their own on top of that up to 3.5 percent.

A North Dakota motor vehicle bill of sale is a legal document used to prove the sale and of a vehicle in the State of North Dakota. The form shows information pertaining to the buyer, the seller, the vehicle, and serves as proof of a change of ownership. This document must be notarized.

No, a bill of sale is not required for private owner vehicle sales in North Dakota. However, North Dakota has an official bill of sale form (form SFN 2888) and it's a good idea to complete this form to provide legal protection to both the buyer and the seller.

Goods that are subject to sales tax in North Dakota include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

If you wish to use a North Dakota resale certificateNorth Dakota provides resellers with certificates of resale. If you wish to buy items for resale, fill out the entire certificate and present it to your vendor. You can find a blank form here.

Exempt sales are based on the business or entity making the purchase. This means that the business or entity making the purchase is exempt from paying sales tax.

Purchases subject to sales tax in North Dakota generally include those of tangible personal property, magazines and other periodicals, and admission for recreational activities. Rentals and leases of tangible personal property, as well as that of hotel and similar accommodations, are also taxable.