North Dakota Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

US Legal Forms - among the most significant libraries of legal types in America - delivers a variety of legal papers templates you can down load or produce. While using website, you can get thousands of types for company and person functions, categorized by categories, claims, or search phrases.You can find the latest types of types such as the North Dakota Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders within minutes.

If you already possess a registration, log in and down load North Dakota Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders through the US Legal Forms catalogue. The Download switch can look on each form you look at. You get access to all previously acquired types inside the My Forms tab of your profile.

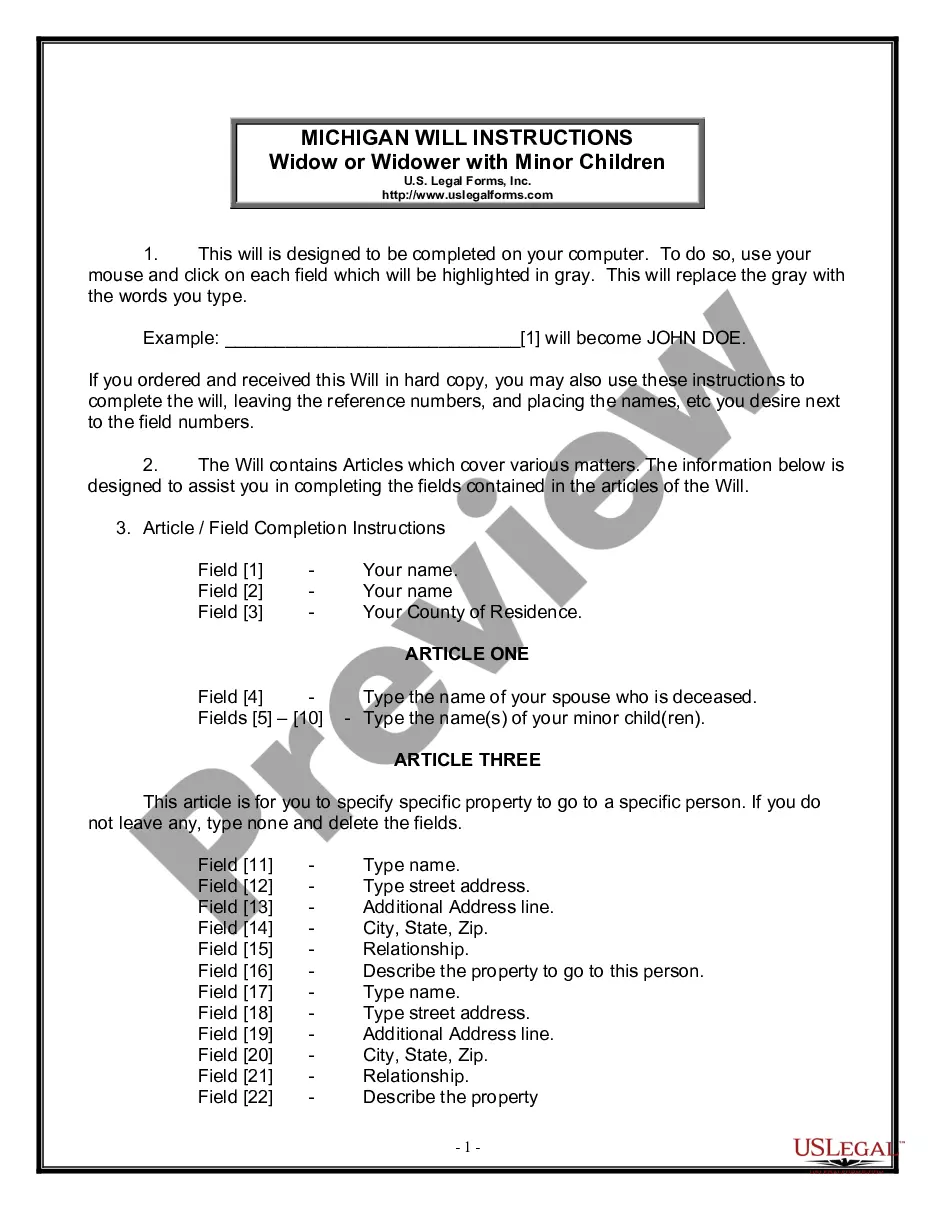

If you want to use US Legal Forms initially, listed below are basic instructions to obtain started:

- Be sure you have selected the proper form for the area/state. Click on the Preview switch to analyze the form`s content material. Browse the form description to ensure that you have selected the correct form.

- If the form does not fit your specifications, utilize the Research industry towards the top of the display to discover the one that does.

- If you are content with the form, validate your option by visiting the Get now switch. Then, choose the prices strategy you like and supply your qualifications to sign up to have an profile.

- Procedure the transaction. Make use of credit card or PayPal profile to accomplish the transaction.

- Select the format and down load the form on your own gadget.

- Make alterations. Load, change and produce and indication the acquired North Dakota Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Each web template you added to your money lacks an expiry day and is your own property for a long time. So, if you wish to down load or produce one more backup, just proceed to the My Forms section and click on in the form you need.

Gain access to the North Dakota Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders with US Legal Forms, the most substantial catalogue of legal papers templates. Use thousands of professional and express-certain templates that meet your small business or person requirements and specifications.

Form popularity

FAQ

Types of Buy-Sell Agreements In a cross-purchase agreement, the remaining owners or partners purchase the share of the business that is for sale. In an entity-purchase agreement (also known as a redemption agreement), the business entity itself buys the deceased's share of the business.

Share repurchases are a popular method for returning cash to shareholders and are strictly voluntary on the part of the shareholder. Redemptions are when a company requires shareholders to sell a portion of their shares back to the company.

?A share buyback happens when a company pays shareholders current market share value to reabsorb a portion of its ownership. Share redemptions occur when a company requires shareholders to sell a portion of their shares back to the company.

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.