North Dakota Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

How to fill out Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Locating the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service offers a vast collection of templates, such as the North Dakota Irrevocable Life Insurance Trust - Beneficiaries Hold Crummey Right of Withdrawal, which can be utilized for business and personal purposes. All documents are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Download button to obtain the North Dakota Irrevocable Life Insurance Trust - Beneficiaries Hold Crummey Right of Withdrawal. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the document you require.

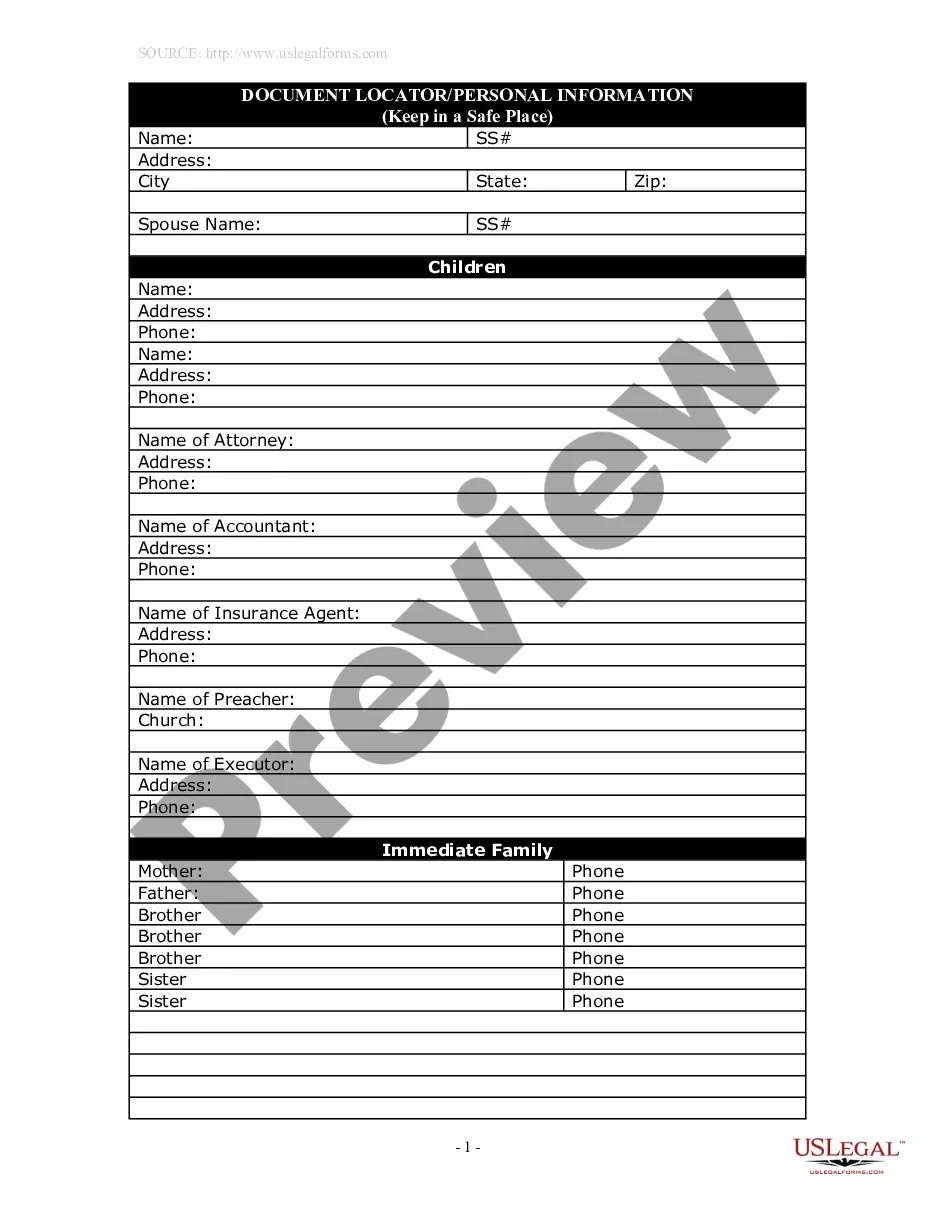

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Get Now button to acquire the form. Select the payment plan you need and enter the necessary details. Create your account and pay for your order using your PayPal account or Visa or Mastercard. Choose the document format and download the legal document template for your needs. Complete, edit, print, and sign the obtained North Dakota Irrevocable Life Insurance Trust - Beneficiaries Hold Crummey Right of Withdrawal.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Use this service to obtain professionally crafted paperwork that meets state requirements.

Form popularity

FAQ

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

When executing their trust, settlors generally name themselves as the sole trustee and beneficiary while they are living; this allows them to exercise full control over the trust and its assets during their lifetime, as well as to withdraw trust funds as they see fit.

Can Creditors Garnish a Trust? Yes, judgment creditors may be able to garnish assets in some situations. However, the amount they can collect in California is limited to the distributions the debtor/beneficiary is entitled to receive from the trust.

Distributing assets from an irrevocable trust requires that the assets first be part of the trust's corpus. Tax laws allow trusts to recover the after-tax money locked up in the corpus as tax-free return of principal. Trusts pass this benefit along to their beneficiaries in the form of tax-free distributions.

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year. The trustee must issue you a Schedule K-1 for the income distributed to you, which you must submit with your tax return.

The right of withdrawal is limited in duration and scope usually available for 30 days after you have made the annual payment to the trust. Even though this option is carefully crafted into an ILIT, the intention is that the beneficiaries of the ILIT will not actually exercise the power to make a withdrawal.

Withdrawals are performed through the myIIT portal in the same way as adding or dropping a course. Students may withdraw from one or more courses by the published withdrawal deadline, which is approximately the 60 percent point of the termsee the Academic Calendar.

Crummey powers give the beneficiary a limited time (often 30, 45 or 60 days) to withdraw contributions to a trust at will, converting the future interest gift to a present interest gift. This withdrawal right is generally limited to an amount equal to the current annual gift tax exclusion.

Yes, you could withdraw money from your own trust if you're the trustee. Since you have an interest in the trust and its assets, you could withdraw money as you see fit or as needed. You can also move assets in or out of the trust.