North Dakota Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

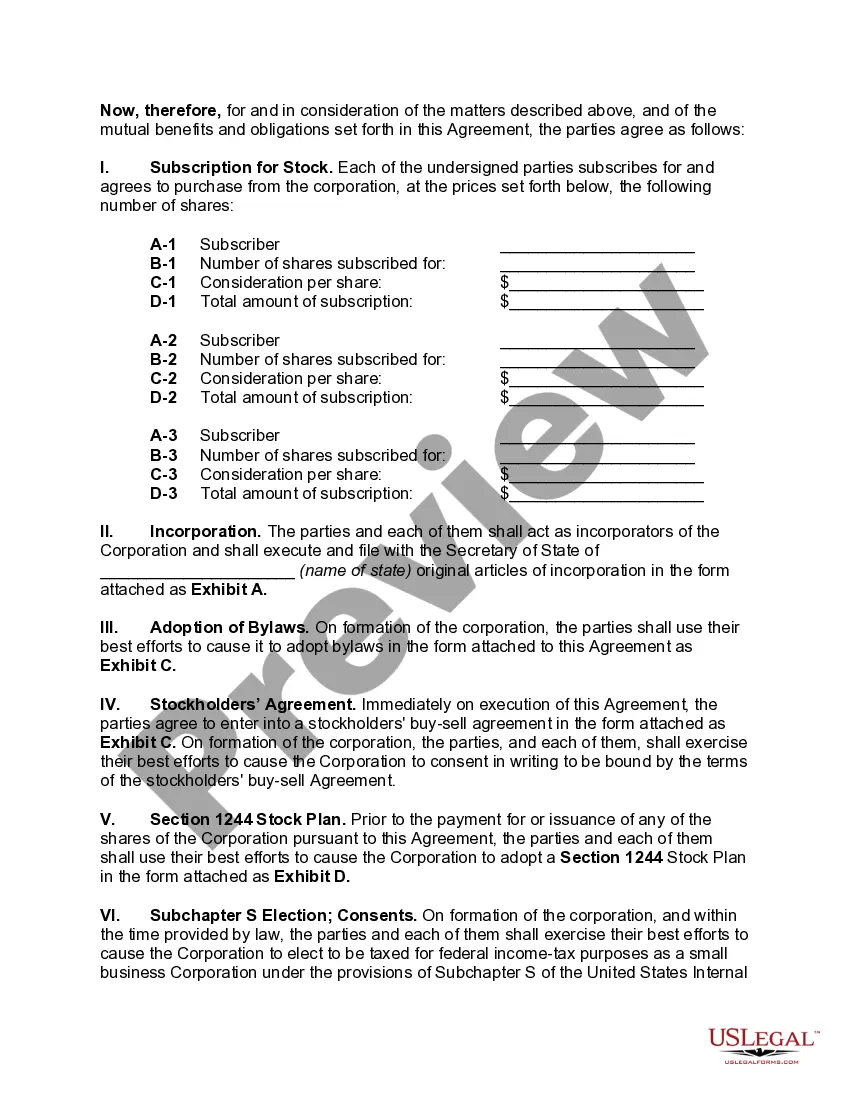

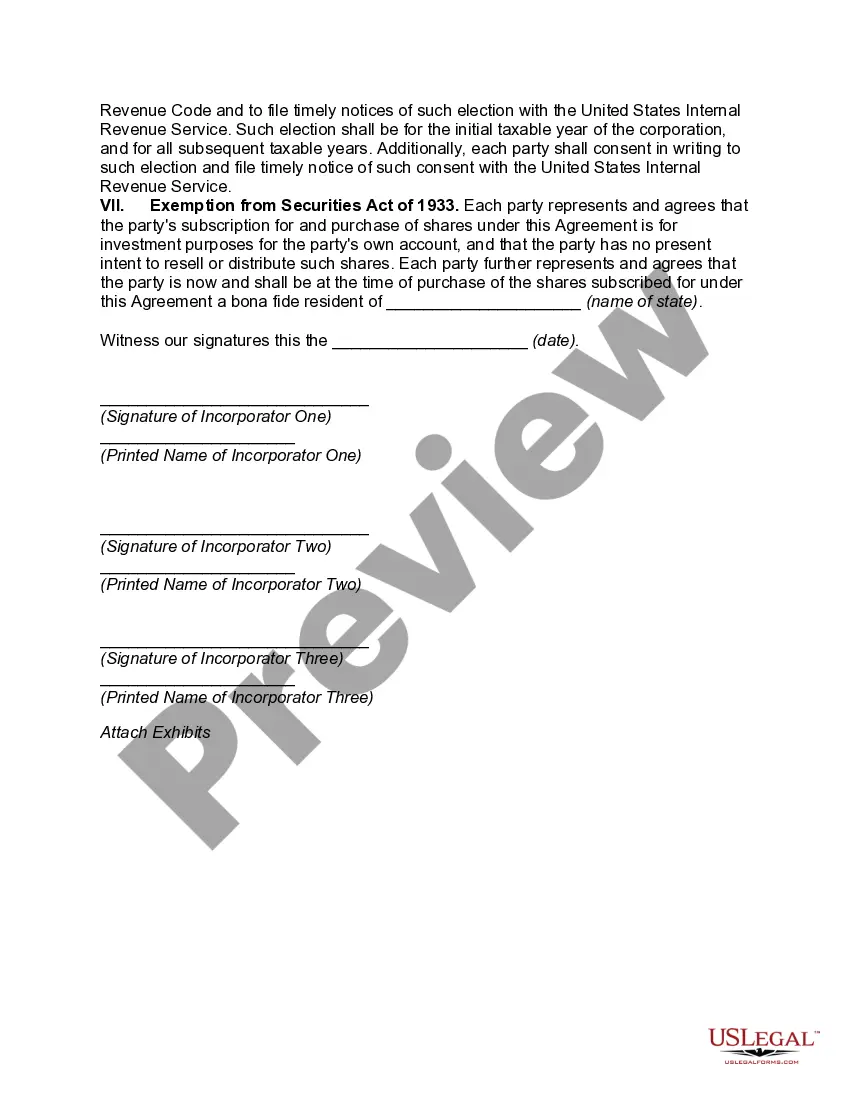

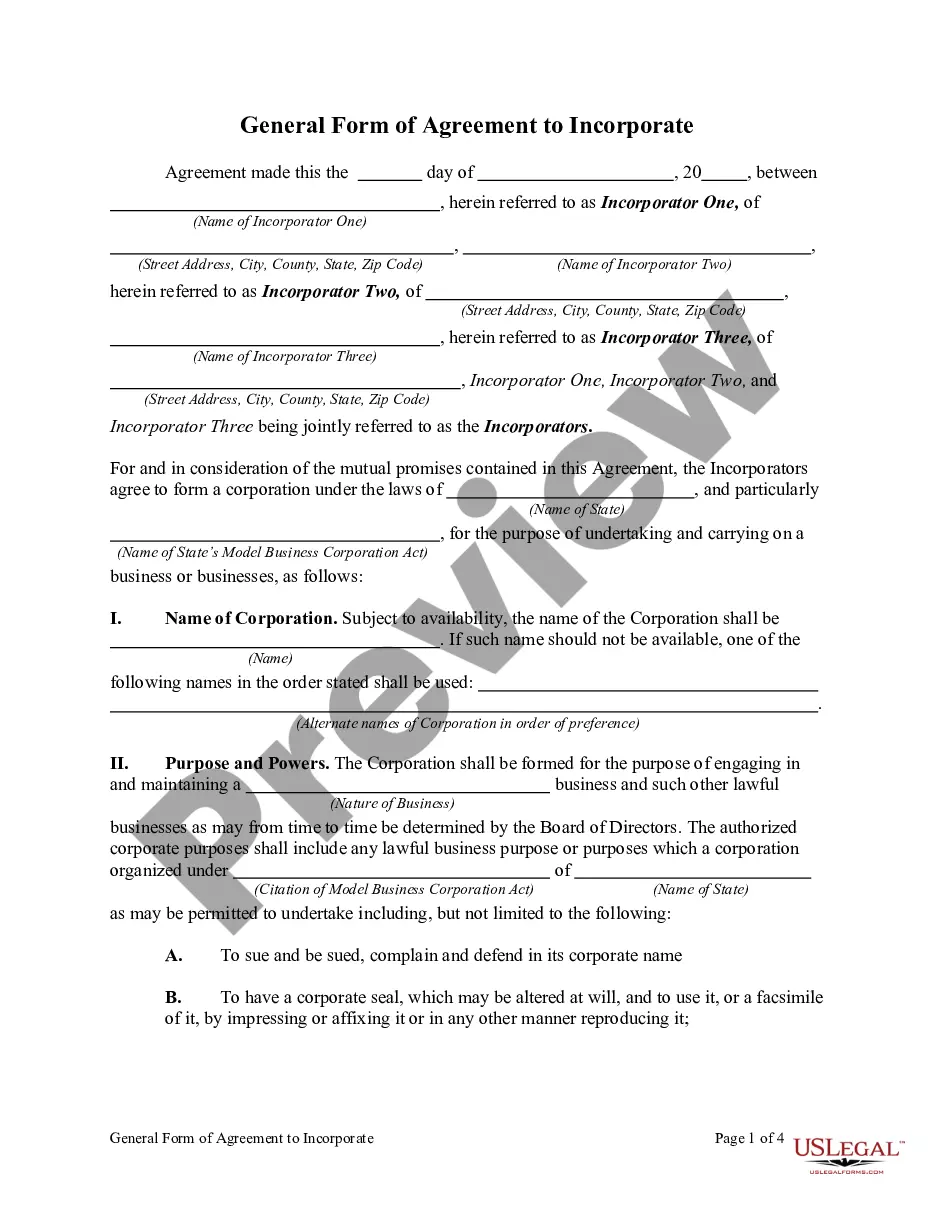

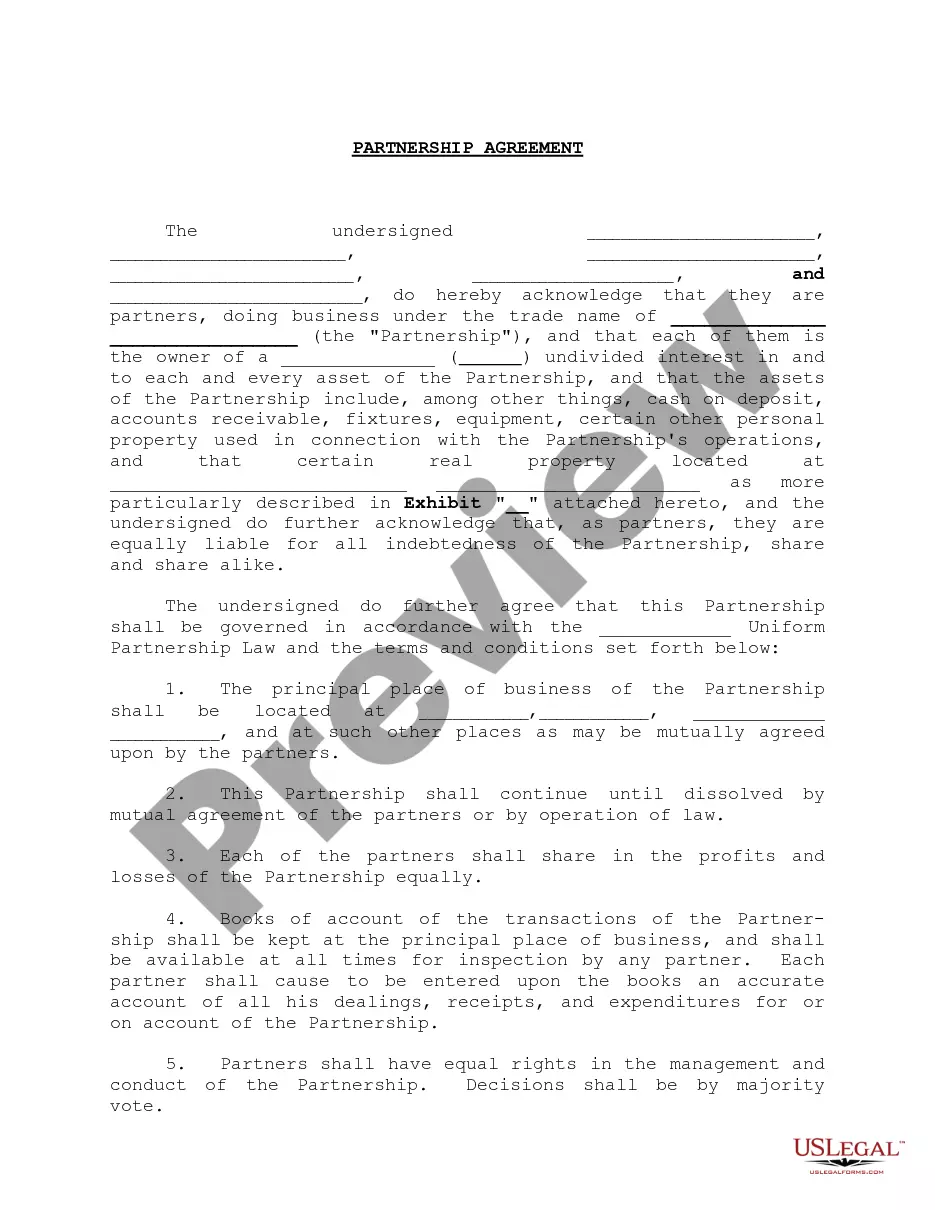

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Are you in a situation where you require documents for either professional or personal purposes almost daily.

There are numerous credible document templates accessible online, but acquiring ones you can trust is not easy.

US Legal Forms provides thousands of form templates, such as the North Dakota Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, that are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain an extra copy of the North Dakota Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock anytime, if needed. Just click the necessary form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Dakota Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

- Utilize the Review option to inspect the form.

- Read the description to ensure you have chosen the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs and specifications.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you want, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

To qualify for S corporation status, the corporation must meet the following requirements:Be a domestic corporation.Have only allowable shareholders.Have no more than 100 shareholders.Have only one class of stock.More items...?

To qualify for S corporation status, the corporation must meet the following requirements:Be a domestic corporation.Have only allowable shareholders.Have no more than 100 shareholders.Have only one class of stock.More items...?

Section 1244 stock refers to the tax treatment of qualified restricted shares. Section 1244 stock allows firms to report certain capital losses as ordinary losses for tax purposes. This lets new or smaller companies take advantage of lower effective tax rates and increased deductions.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

Qualifications to Elect S Corporation Status It must be a domestic (U.S.) corporation, with no foreign investors; It must have no more than 100 shareholders; It has only one class of stock; It must use a December 31 year-end.

The S corporation requirements are divided into two categories: shareholder-related and corporation-related requirements. 25b6 The corporation must not have more than 100 shareholders. 25b6 All shareholders must be individuals, estates, certain tax-exempt organizations, or certain kinds of trusts.

HW: How are gains from the sale of § 1244 stock treated? losses? The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

Starting a North Dakota LLC and electing S corp tax status is easy....Step 1: Name Your LLC.Step 2: Choose Your North Dakota Registered Agent.Step 3: File the North Dakota LLC Articles of Organization.Step 4: Create an LLC Operating Agreement.Step 5: Get an EIN and Complete Form 2553 on the IRS Website.