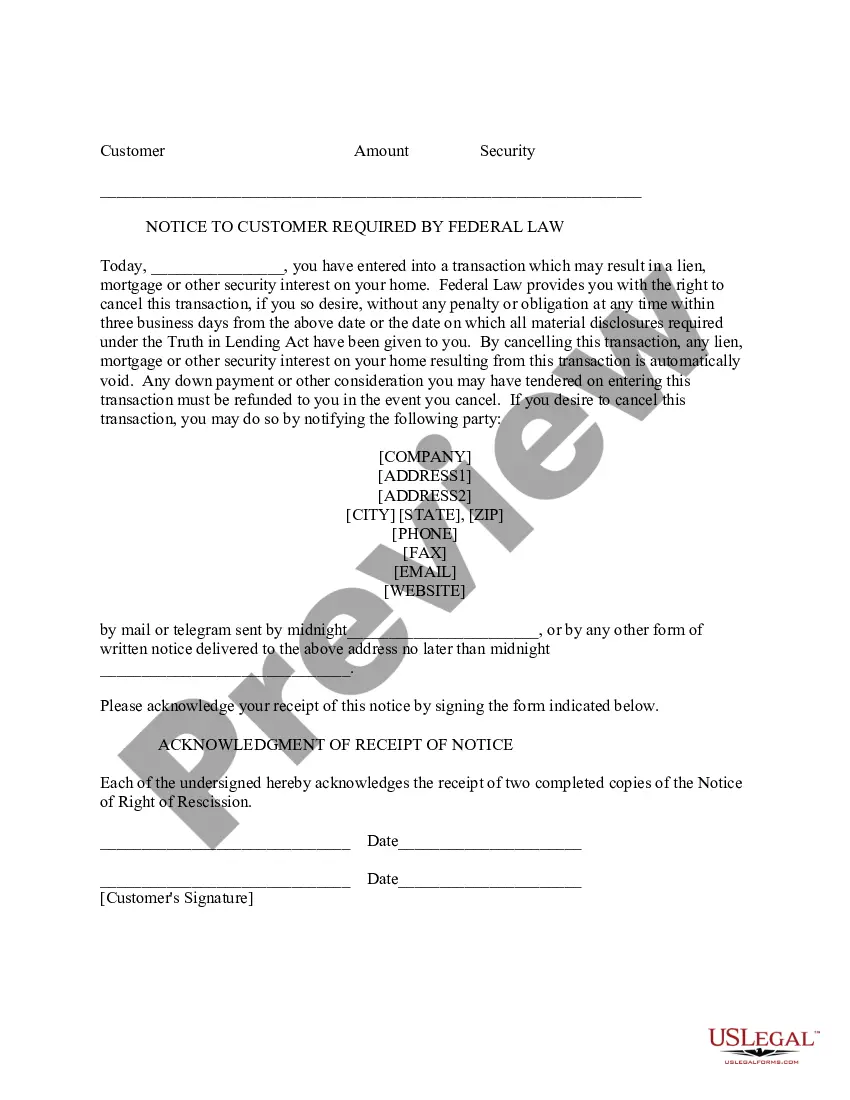

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice

required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

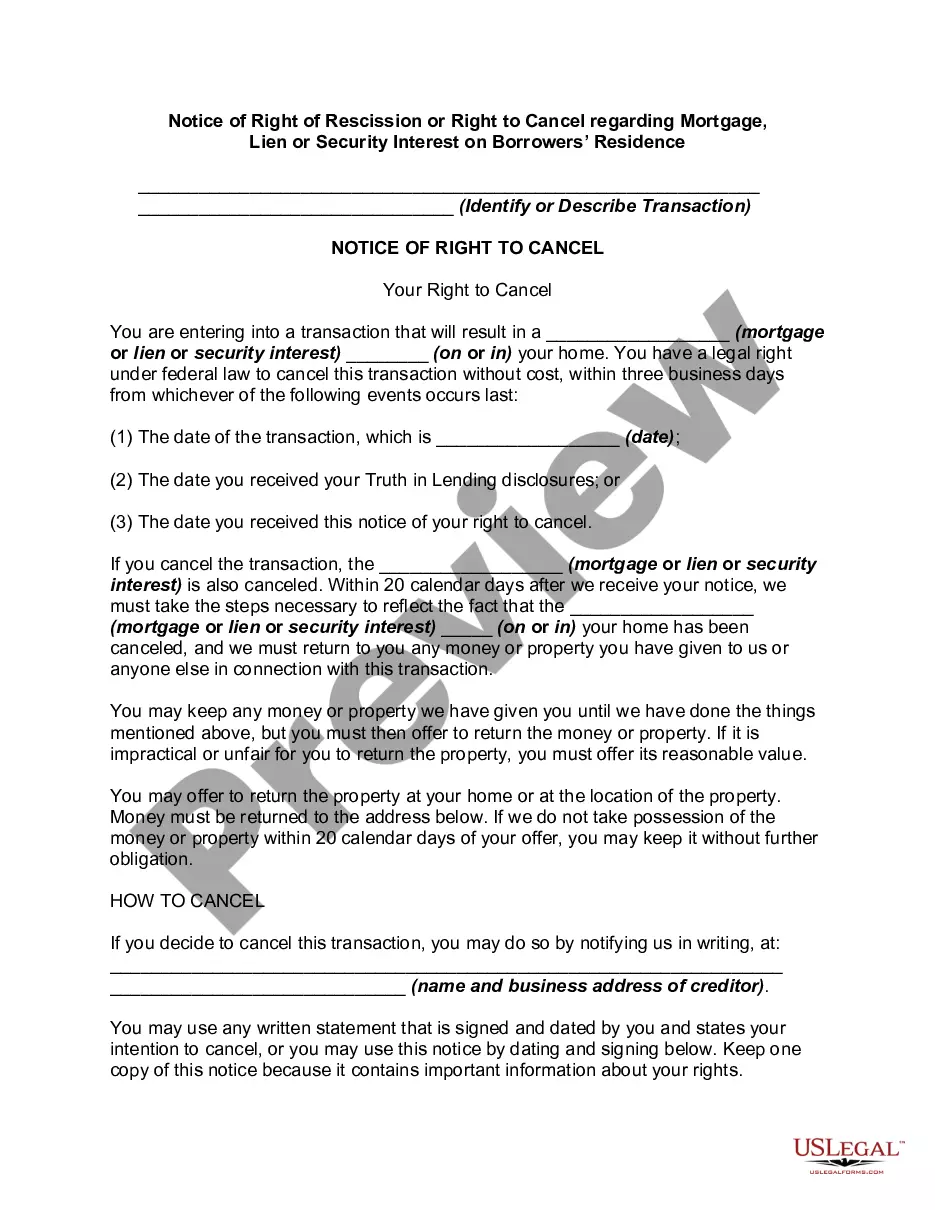

North Dakota Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence

Description

Form popularity

FAQ

Rescission period. The period within which the consumer may exercise the right to rescind runs for 3 business days from the last of 3 events: A. Consummation of the transaction.

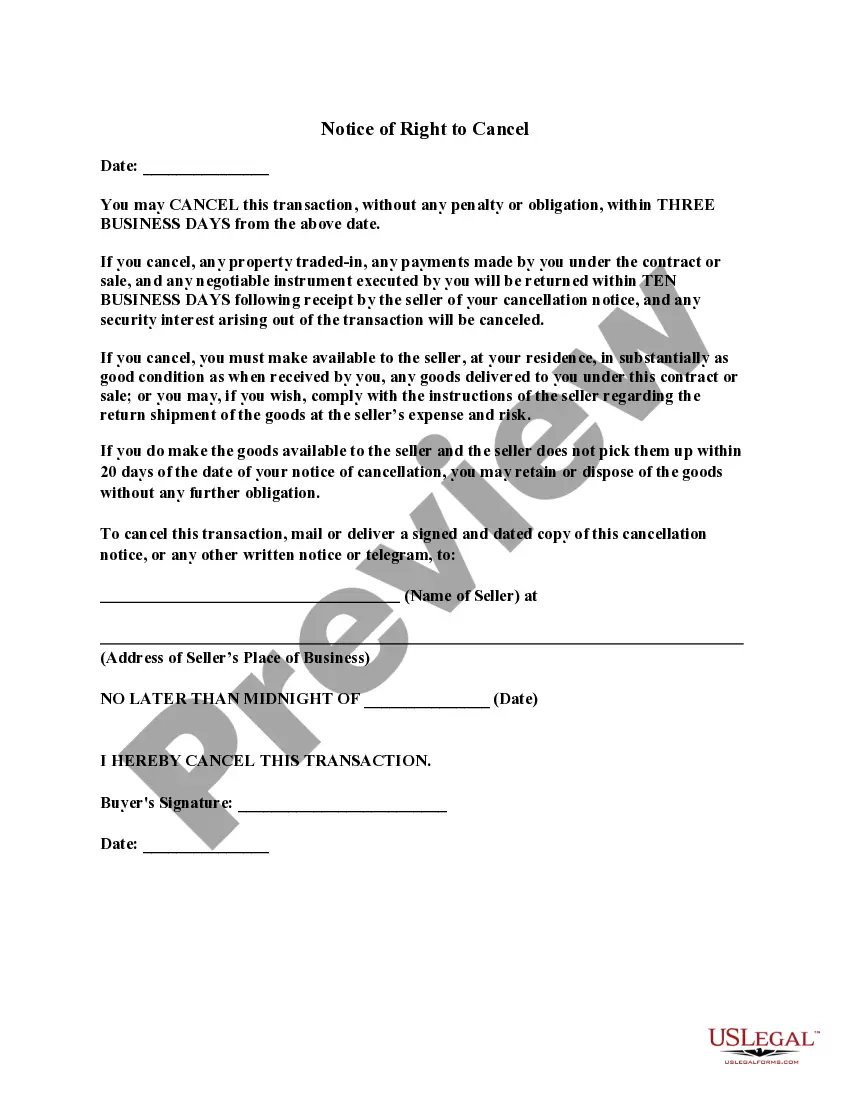

The three-day cancellation rule permits borrowers to renege on certain mortgage agreements within three days without financial penalty. The Truth in Lending Act (TILA) is a federal law enacted in 1968 to help protect consumers in their dealings with lenders and creditors.

The right of rescission is a legal protection under the Truth in Lending Act (TILA) that allows you to cancel certain home financing agreements without any financial penalties.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.

The rescission date is three business days after the signing date, the date the borrower receives the Truth in Lending Disclosure, or the date the borrower receives the "Notice of Right to Cancel", whichever occurs last. In some cases Saturday may not be considered a business day.

The right of rescission doesn't apply when you're buying a home, and it only applies to a loan against your primary residence. So, for instance, you won't be able to rescind your mortgage if you're buying or refinancing a second home, vacation home, or investment property.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.

What is the purpose of a Notice of Right to Cancel form? Under federal law, some ? but not all ? mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.