North Dakota Motor Vehicle Lease

Description

How to fill out Motor Vehicle Lease?

Are you presently in a situation where you require documentation for both business or personal purposes almost every day.

There are numerous genuine document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the North Dakota Motor Vehicle Lease, which are designed to conform to state and federal regulations.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, enter the required information to create your account, and complete your purchase using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the North Dakota Motor Vehicle Lease template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

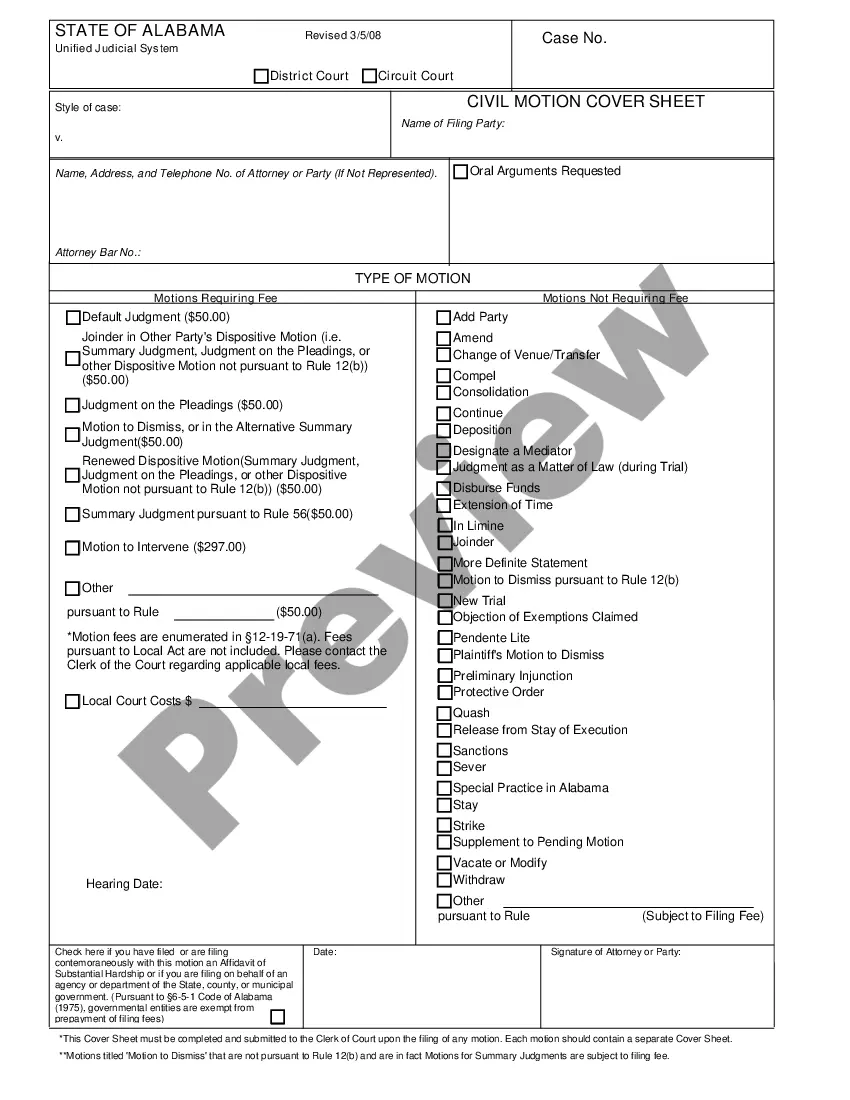

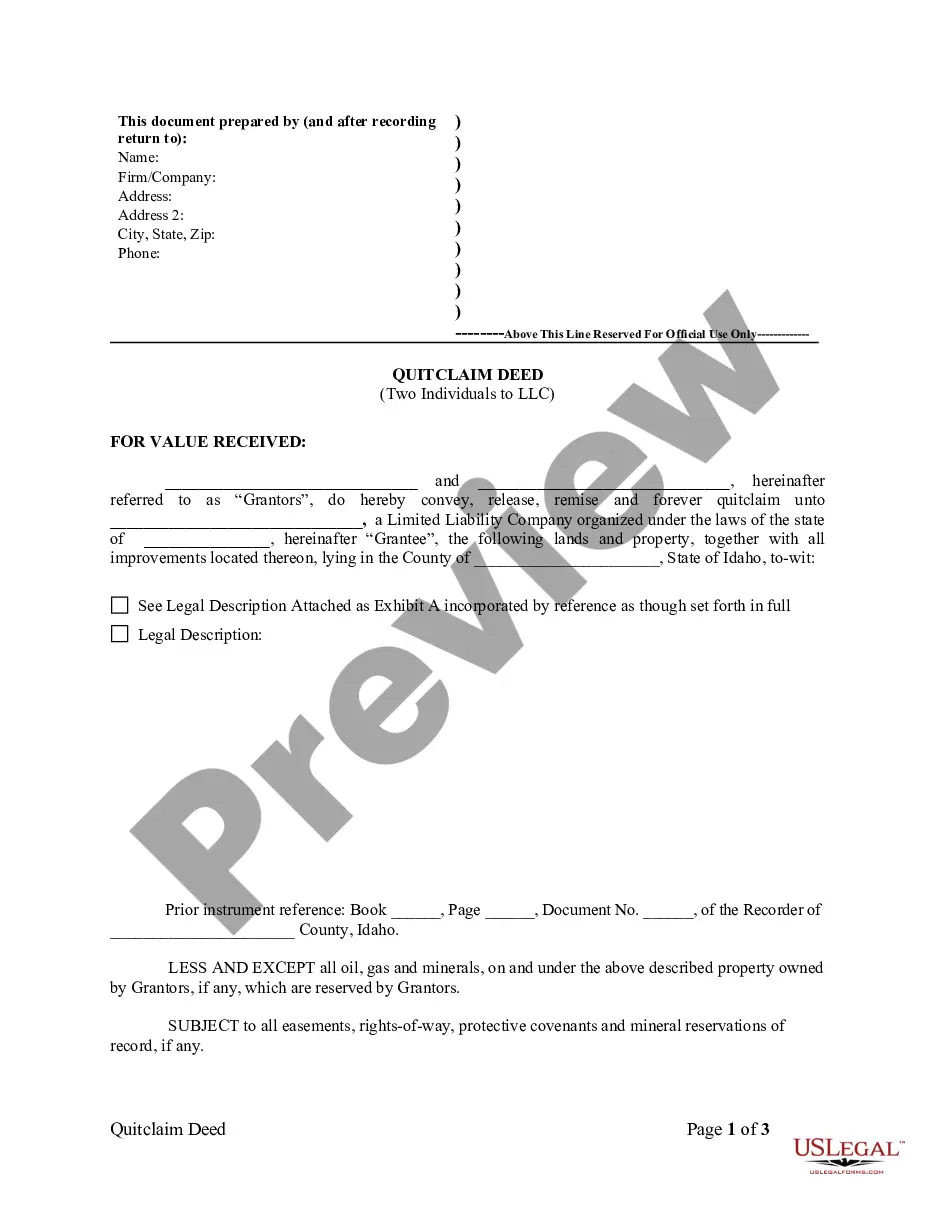

- Use the Preview button to view the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to locate the form that meets your needs and specifications.

Form popularity

FAQ

Yes, both parties typically need to be present when transferring a title in North Dakota. This is to ensure that all required signatures are obtained and the transaction is verified. It is advisable to bring proper identification and all necessary documents. Resources provided in the North Dakota Motor Vehicle Lease can guide you through this requirement effectively.

Transferring a car title to a family member in North Dakota involves a few straightforward steps. First, both the seller and the buyer need to complete the title transfer form found on the North Dakota Department of Transportation website. Then, submit the completed form along with the title to your local county treasurer’s office. Utilizing the North Dakota Motor Vehicle Lease will help ensure you navigate this process smoothly.

Leasing a vehicle from a dealership involves selecting a car, negotiating the lease terms, and signing a lease agreement. Be sure to understand the mileage limits, down payment, and monthly payments associated with the North Dakota Motor Vehicle Lease. The US Legal Forms platform provides essential templates and information to ensure you are well-prepared for the leasing process.

The minimum lease term for vehicles usually ranges from 24 to 36 months. However, specific terms may vary depending on the leasing company or the North Dakota Motor Vehicle Lease you choose. Flexible options do exist, so you can select a term that fits your personal needs. Be sure to review the lease agreement terms to confirm your commitments.

In North Dakota, the vehicle lease tax is generally imposed at a state sales tax rate of 5%. This rate applies to both leased and purchased vehicles, making the North Dakota Motor Vehicle Lease a straightforward arrangement for budgeting your expenses. Furthermore, any local taxes may also apply, so it is wise to check your area for additional fees. This clear tax structure helps you optimize your financial planning.

Leasing a vehicle can have tax benefits, such as potential deductions on your personal income tax. Specifically, with arrangements like the North Dakota Motor Vehicle Lease, you might find that certain lease payments qualify for tax deductions. It's crucial to consult with a tax professional to maximize the benefits of leasing. Understanding the specifics can significantly impact your financial returns.

Several states, such as Wyoming, Montana, and Delaware, do not impose property tax on vehicles. This is beneficial for car owners and can make leasing options like the North Dakota Motor Vehicle Lease more appealing. If minimizing taxes is a priority for you, consider evaluating state policies carefully. Always check the latest regulations to ensure you are informed.

In New Jersey, property tax on vehicles varies by municipality. Typically, it is based on the assessed value of the car. While leasing a vehicle can influence your overall financial situation, it is essential to consider how the North Dakota Motor Vehicle Lease compares in terms of tax implications. If you are considering leasing in North Dakota, keep in mind that the tax structure might differ significantly from New Jersey.

To write off a car lease, first determine if the lease qualifies as a business expense. Keep records of the lease payments and related costs. If you use the vehicle primarily for business, you can typically deduct a portion of the lease payments on your taxes. Understanding how to write off your North Dakota Motor Vehicle Lease can lead to significant savings.

To transfer a title in North Dakota, both the buyer and seller must complete the title transfer section on the document. This includes signing and dating the title to acknowledge the change in ownership. Once completed, submit the title to the DMV, along with any required fees. Ensuring a correct title transfer is vital when you are engaging in a North Dakota Motor Vehicle Lease.