North Dakota Auto Expense Travel Report

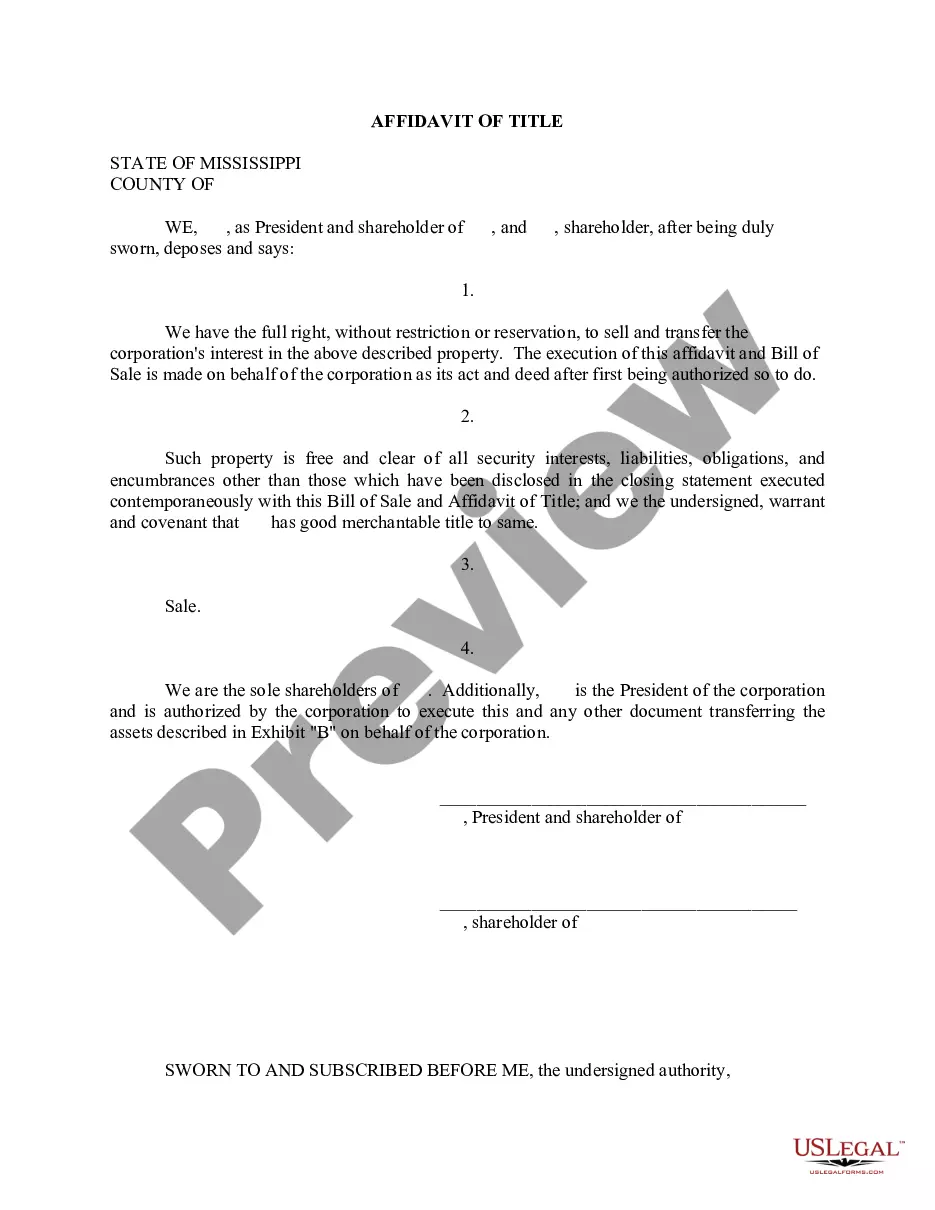

Description

How to fill out Auto Expense Travel Report?

If you desire a thorough, acquire, or create legitimate document templates, utilize US Legal Forms, the largest compilation of legal forms accessible online.

Make the most of the site’s straightforward and user-friendly search to find the documents you require. Various templates for business and individual purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to locate the North Dakota Auto Expense Travel Report in just a few clicks.

Every legal document template you obtain is yours indefinitely. You can access each form you downloaded in your account. Click on the My documents area and select a form to print or download again.

Stay competitive and acquire, and print the North Dakota Auto Expense Travel Report with US Legal Forms. There are millions of professional and state-specific forms you may utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to acquire the North Dakota Auto Expense Travel Report.

- You can also access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to review the form’s content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types of the legal form template.

- Step 4. Once you have found the form you need, select the Get now option. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the North Dakota Auto Expense Travel Report.

Form popularity

FAQ

NDSU, or North Dakota State University, follows specific guidelines for mileage reimbursement. The rate can differ from the state's standard rate, typically outlined in their travel policies. Keeping these details in mind is essential when preparing your North Dakota Auto Expense Travel Report, as it ensures that all your claimed expenses align with university standards.

The General Services Administration (GSA) sets a per-mile reimbursement rate that affects travelers in North Dakota. This rate is periodically updated and can significantly impact your travel expenses. Utilizing up-to-date information will help you provide accurate entries in your North Dakota Auto Expense Travel Report, ensuring you receive the correct compensation for your travel.

For 2025, the mileage reimbursement rate in North Dakota will be released later this year, typically aligning with federal changes. It is essential to regularly check official announcements to ensure compliance with the latest rates. Accurate mileage tracking is vital when filling out your North Dakota Auto Expense Travel Report, as it directly affects your reimbursements.

The mileage reimbursement rate for Washington state is determined based on federal guidelines but may differ slightly each year. For anyone tracking their travel expenses, understanding the Washington mileage rate is crucial for accurate reporting. To maximize your returns on the North Dakota Auto Expense Travel Report, it is advised to stay updated on these reimbursement rates.

A travel expense report is a document that outlines all expenses incurred during business travel, including transportation, lodging, meals, and other incidentals. This report is crucial for reimbursement purposes and helps maintain accurate financial records for your organization. By using our North Dakota Auto Expense Travel Report, you can streamline this process and ensure all details are captured effectively for your reimbursement claims.

The IRS allows a set per diem rate for business travel that can include allowances for lodging, meals, and other travel-related expenses. Rates vary based on location and are updated periodically, so staying informed is essential. The North Dakota Auto Expense Travel Report provides valuable information that can assist you in adhering to IRS guidelines while claiming your travel expenses.

The GSA per diem for North Dakota provides specific monetary amounts that travelers can claim while conducting business within the state. This amount takes into account regional costs, including meals and lodging. To optimize your expense reporting, consider using the North Dakota Auto Expense Travel Report, which helps you keep track of these allowances accurately.

Federal per diem rates are established by the General Services Administration (GSA) and vary by location and time of year. These rates serve as a guideline for travelers, ensuring your daily travel expenses are covered, including meals and lodging. By utilizing the North Dakota Auto Expense Travel Report, you can stay informed about current rates and make better financial decisions during your travels.

Mileage reimbursement in North Dakota typically aligns with the current federal rate, which adjusts annually based on economic conditions. As part of the North Dakota Auto Expense Travel Report, ensuring you document your mileage accurately is vital to receiving your full reimbursement. Using our platform, you can easily track mileage and calculate reimbursements efficiently.

The travel rate in North Dakota varies based on several factors, including the type of travel and the length of time traveled. However, employees can often expect rates to follow the guidelines outlined in the North Dakota Auto Expense Travel Report. This report provides essential details on mileage and per diem allowances, helping you understand the appropriate compensation for your travel expenses.