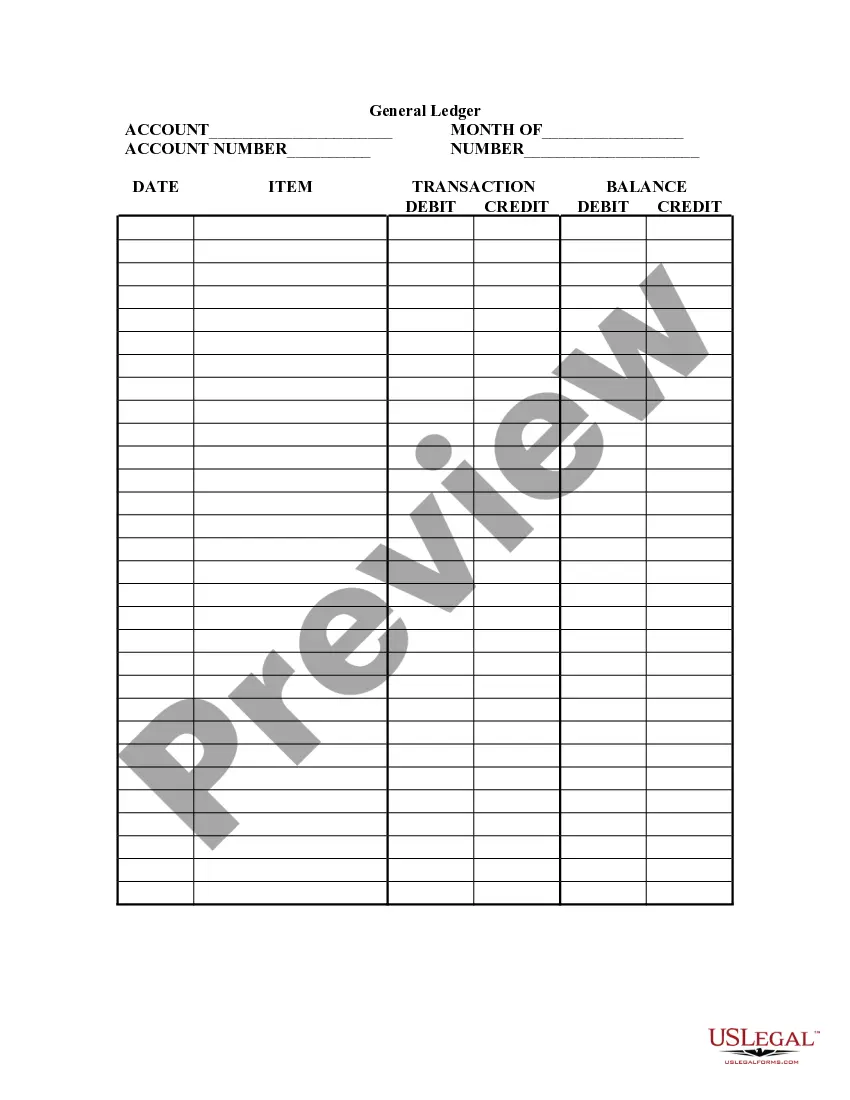

North Dakota General Journal

Description

How to fill out General Journal?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a wide variety of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the North Dakota General Journal in just minutes.

If you already have a subscription, Log In and retrieve the North Dakota General Journal from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously saved forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, alter, print, and sign the saved North Dakota General Journal. Each template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the North Dakota General Journal with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your city/region.

- Click on the Preview button to review the form's details.

- Check the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

The economic nexus threshold in North Dakota indicates the sales amount or the number of transactions that create a tax obligation for out-of-state sellers. As of recent updates, the threshold is set at $100,000 in sales or 200 transactions annually. Familiarizing yourself with these criteria is vital for accurate reporting in your North Dakota General Journal.

The total loss threshold in North Dakota is the amount at which a loss incurred can be claimed on your tax returns. This concept helps taxpayers understand when they can benefit from reporting losses. Reviewing transactions and claims in the North Dakota General Journal can clarify your options.

Nexus threshold denotes the level of activity that establishes a business's tax obligations in a jurisdiction. It ensures that businesses cannot avoid taxes simply by operating online or remotely. To ensure compliance with the North Dakota General Journal guidelines, it is essential to be informed about Nexus thresholds.

The Nexus threshold in North Dakota typically refers to the minimum level of business activity that must be met for a business to be considered as having a tax obligation in the state. As per current standards, businesses must meet physical presence or economic activity criteria. Understanding this threshold is crucial for accurate reporting in the North Dakota General Journal.

To claim residency in North Dakota, you must establish a physical presence in the state, such as obtaining a driver's license or registering to vote. Additionally, showing intent to make North Dakota your permanent home is important. Make sure to document your residency status properly, as this will be useful when discussing matters related to the North Dakota General Journal.

Yes, you can file your North Dakota taxes online using the state's secure tax portal. This method allows for quicker processing and easier access to your tax forms. By using trusted platforms like uslegalforms, you can ensure that your filings are accurate and timely, which is crucial for compliance with North Dakota General Journal regulations.

In North Dakota, you can stop paying property taxes when you reach the age of 65 and meet certain income requirements. This exemption is aimed at seniors who are on a fixed income, helping them manage their financial resources better. For specific eligibility criteria, it’s wise to consult the North Dakota General Journal or local tax authorities.

People are moving to North Dakota for its strong job market, affordable living, and high quality of life. Many are attracted to the state's opportunities in energy and agriculture. The North Dakota General Journal frequently covers stories about new residents and business developments, illustrating the reasons behind the state's growing appeal.

Failure to appear in North Dakota refers to a situation where an individual does not show up for a scheduled court date. This can lead to additional legal consequences, including fines or bench warrants. The North Dakota General Journal often features articles that explain legal concepts, helping individuals understand their rights and obligations within the state.

North Dakota's economy relies heavily on agriculture, energy, and technology sectors. The diversity of industries provides robust job opportunities and stimulates growth. Reports in the North Dakota General Journal provide detailed accounts of economic trends and developments, offering valuable insights for investors and residents interested in the state’s financial landscape.