The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

North Dakota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

Are you in a situation where you require documents for either organizational or personal reasons almost every day.

There are numerous legal document templates available online, but finding versions you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the North Dakota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Overdue Debt - Assets and Liabilities, which are crafted to meet federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- You can then obtain the North Dakota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Overdue Debt - Assets and Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the correct area/state.

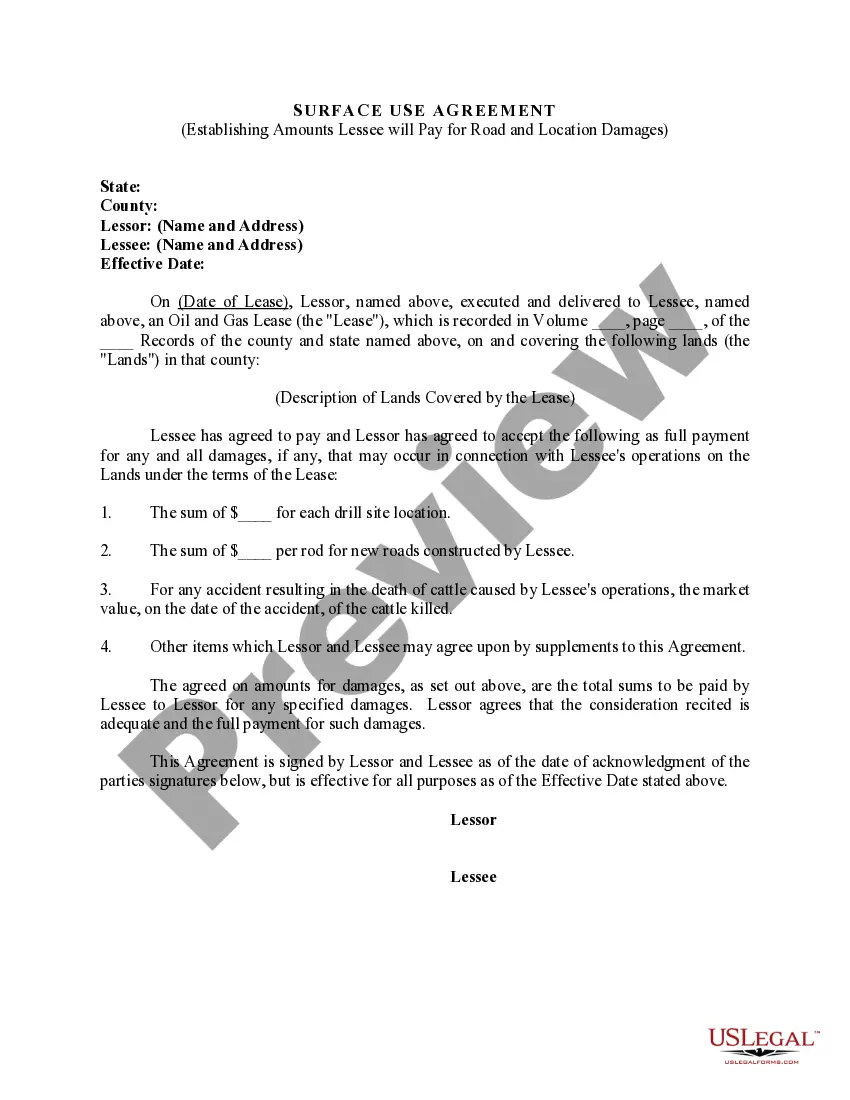

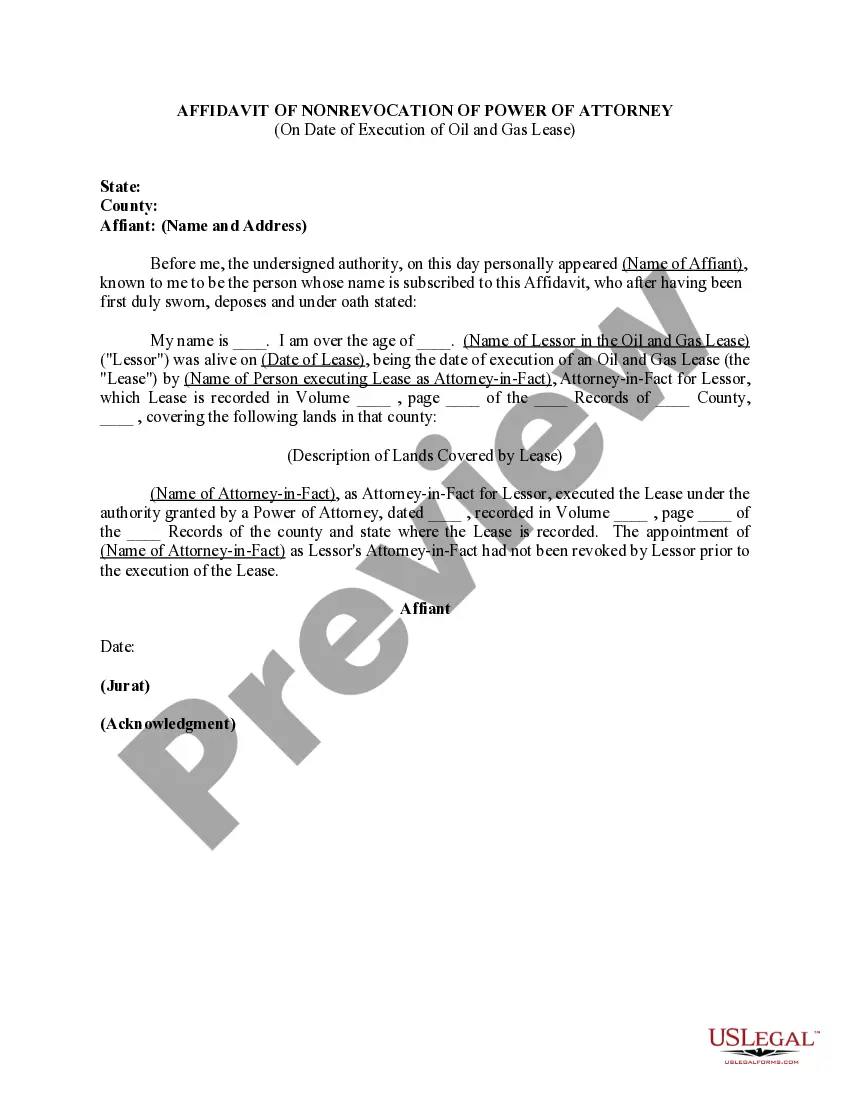

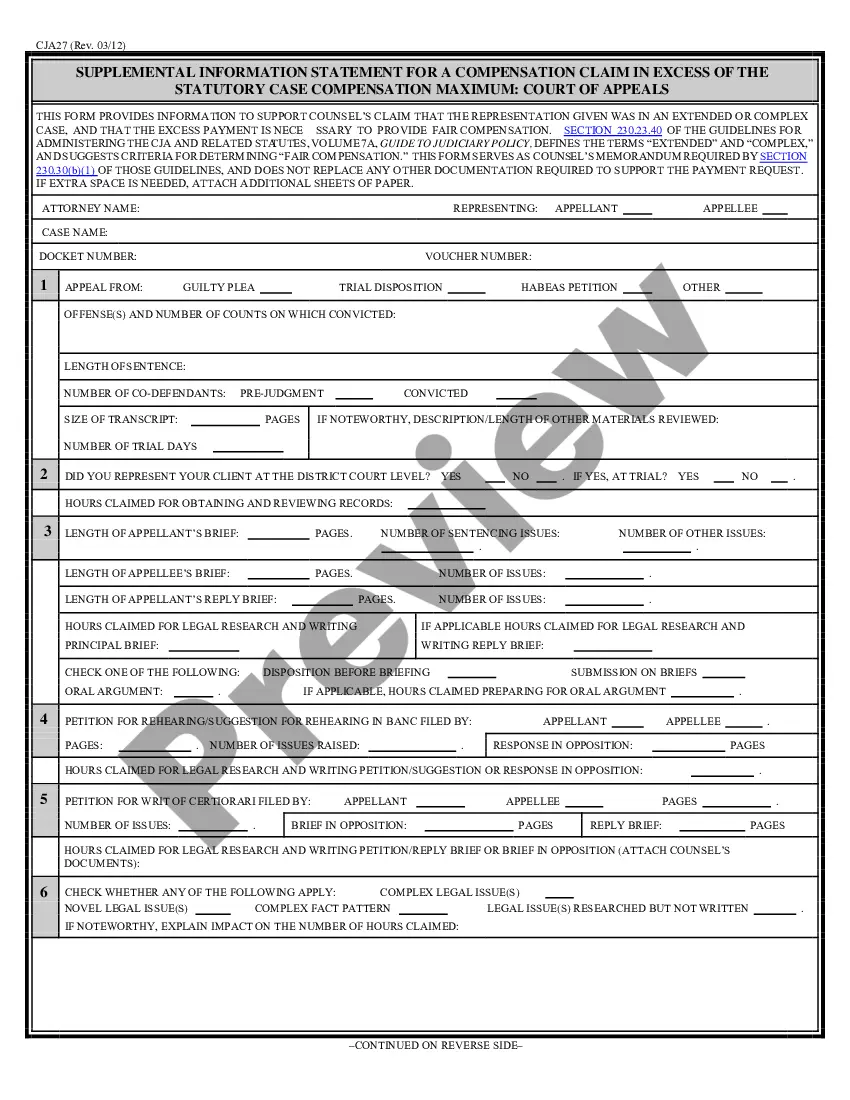

- Utilize the Review button to examine the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you need, use the Search field to find the template that fits your criteria.

- Once you find the correct form, click on Purchase now.

- Select the payment plan you prefer, complete the required details to create your account, and finalize your order using PayPal or Visa or Mastercard.

- Choose a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents list.

- You can download an additional copy of the North Dakota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Overdue Debt - Assets and Liabilities at any time, if necessary. Just select the desired form to download or print the document template.

Form popularity

FAQ

Assets that creditors can seizeBank accounts.Investment accounts.Inheritances.Assets owned by your spouse.Personal homes (different from state to state)Rental properties.Vehicles.Business equipment.More items...?

Time limits/Statute of LimitationsIf your creditor does not start the court action within 6 years of the debt being due, the action can be held to be statute-barred by the court.

You can be terminated from employment under North Dakota and federal law if you have more than one wage garnishment. This may leave you wondering how you can stop a garnishment. There are two main ways: You either pay off the debt or get it discharged in bankruptcy.

Federal benefits that are generally exempt from garnishment (except to pay delinquent taxes, alimony, child support or student loans) include: Social Security benefits. Supplemental Security Income benefits. Veterans benefits.

Options for asset protection include:Domestic asset protection trusts.Limited liability companies, or LLCs.Insurance, such as an umbrella policy or a malpractice policy.Alternate dispute resolution.Prenuptial agreements.Retirement plans such as a 401(k) or IRA.Homestead exemptions.Offshore trusts.

The answer is yes. If you owe creditors, collectors, or anyone else money, they can obtain a money judgment and have the funds in your bank account frozen, or they can seize them outright.

Overview: In general, a North Dakota small claims or state district court judgment expires ten years from the date the judgment was first docketed. However, the judgment may be renewed one time.

Only creditors with a valid court order can garnish wages in the state of North Dakota. This may be the original creditor you had the debt with or a debt buyer or debt collection agency. Creditors for certain debts can garnish your wages without a court order.

Debtor's Property That Can Be Seized They may consider such as the house where they live, or things they own, such as a car or a boat, or cold cash. But property, especially in court cases, can also mean a person's salary. It includes deposit accounts, stocks and bonds, IRA accounts and other similar types of assets.

How long is your judgment valid? In North Carolina, a judgment is valid for ten years from the date it was awarded by the Court. The judgment can be renewed for another ten years, giving a judgment creditor additional time to try to collect the money owed.