North Dakota Credit Card Agreement and Disclosure Statement

Description

How to fill out Credit Card Agreement And Disclosure Statement?

Choosing the best legal record web template can be quite a have difficulties. Needless to say, there are a lot of themes available on the net, but how can you find the legal form you will need? Utilize the US Legal Forms site. The assistance gives thousands of themes, including the North Dakota Credit Card Agreement and Disclosure Statement, which can be used for company and private requirements. Each of the forms are checked out by pros and satisfy state and federal requirements.

If you are already authorized, log in in your accounts and then click the Down load switch to find the North Dakota Credit Card Agreement and Disclosure Statement. Utilize your accounts to search from the legal forms you may have ordered previously. Proceed to the My Forms tab of your respective accounts and have yet another duplicate of your record you will need.

If you are a new end user of US Legal Forms, listed here are straightforward directions that you should adhere to:

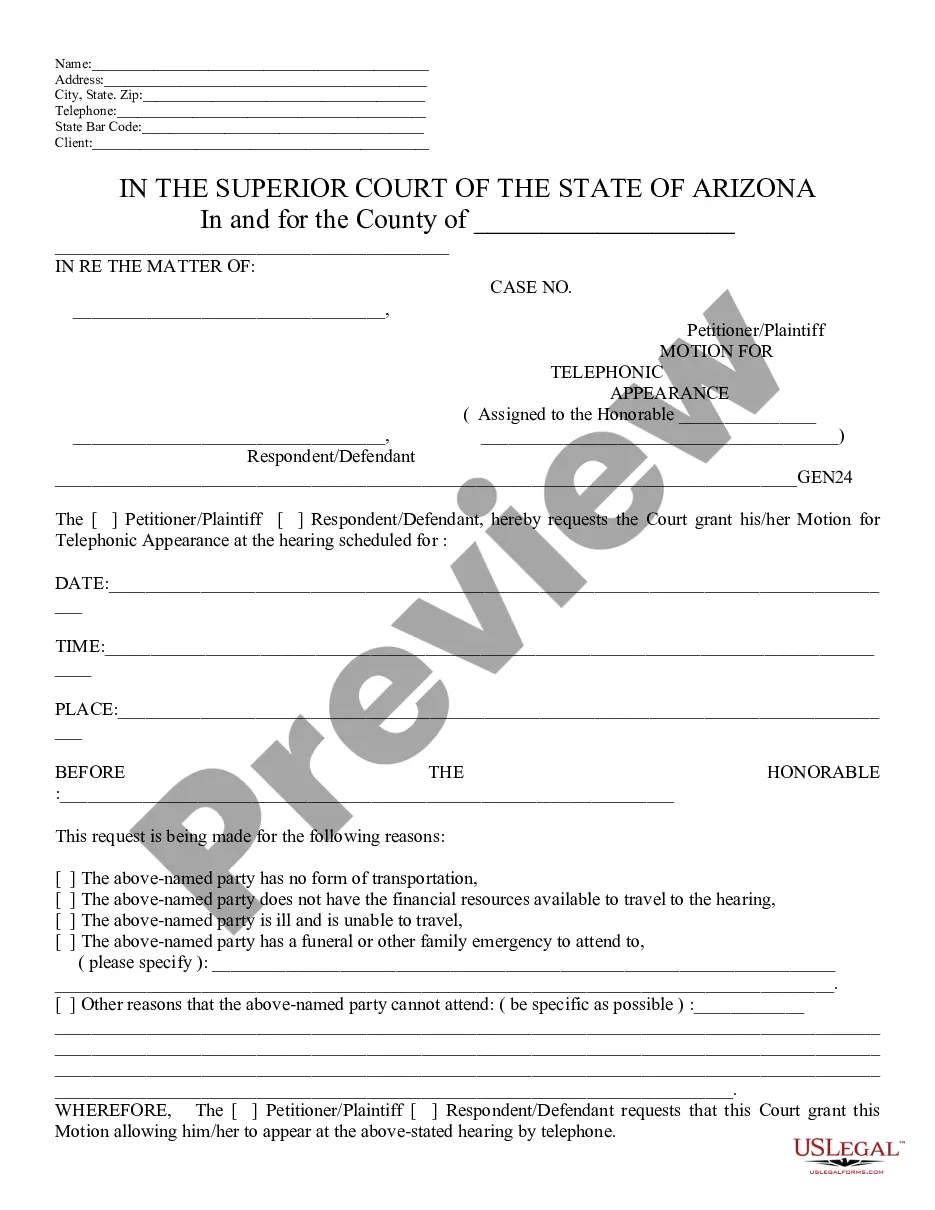

- Initially, make sure you have selected the proper form for your area/region. You are able to look through the shape while using Preview switch and study the shape explanation to guarantee it will be the best for you.

- If the form will not satisfy your requirements, make use of the Seach industry to find the correct form.

- Once you are positive that the shape would work, click the Get now switch to find the form.

- Pick the prices strategy you desire and enter the needed info. Build your accounts and purchase an order using your PayPal accounts or bank card.

- Choose the file formatting and download the legal record web template in your product.

- Comprehensive, edit and print and signal the received North Dakota Credit Card Agreement and Disclosure Statement.

US Legal Forms is definitely the largest collection of legal forms in which you can find numerous record themes. Utilize the company to download expertly-manufactured files that adhere to state requirements.

Form popularity

FAQ

DFPI Licenses and Regulates | The Department of Financial Protection and Innovation.

After acquiring the mortgage company, State Bank changed its name to the catchier Bell. Since 2012, Bell's profitability doubled to $10 billion in assets, surpassing the state-owned Bank of North Dakota as North Dakota's biggest banker.

The OCC is the primary regulator of banks chartered under the National Bank Act and federal savings associations chartered under the Home Owners' Loan Act. The OCC issues rules and regulations that govern the banks it supervises.

What Is a Merchant Agreement? A merchant agreement is a contract governing the relationship between a business and the merchant acquiring bank it partners with. This document details the full range of electronic payment services that the merchant acquiring bank agrees to provide.

The North Dakota Department of Financial Institutions is responsible for chartering, regulating, and examining North Dakota state-chartered banks, credit unions, and trust companies.

The Federal Reserve System is one of several banking regulatory authorities. The Federal Reserve regulates state-chartered member banks, bank holding companies, foreign branches of U.S. national and state member banks, Edge Act Corporations, and state-chartered U.S. branches and agencies of foreign banks.