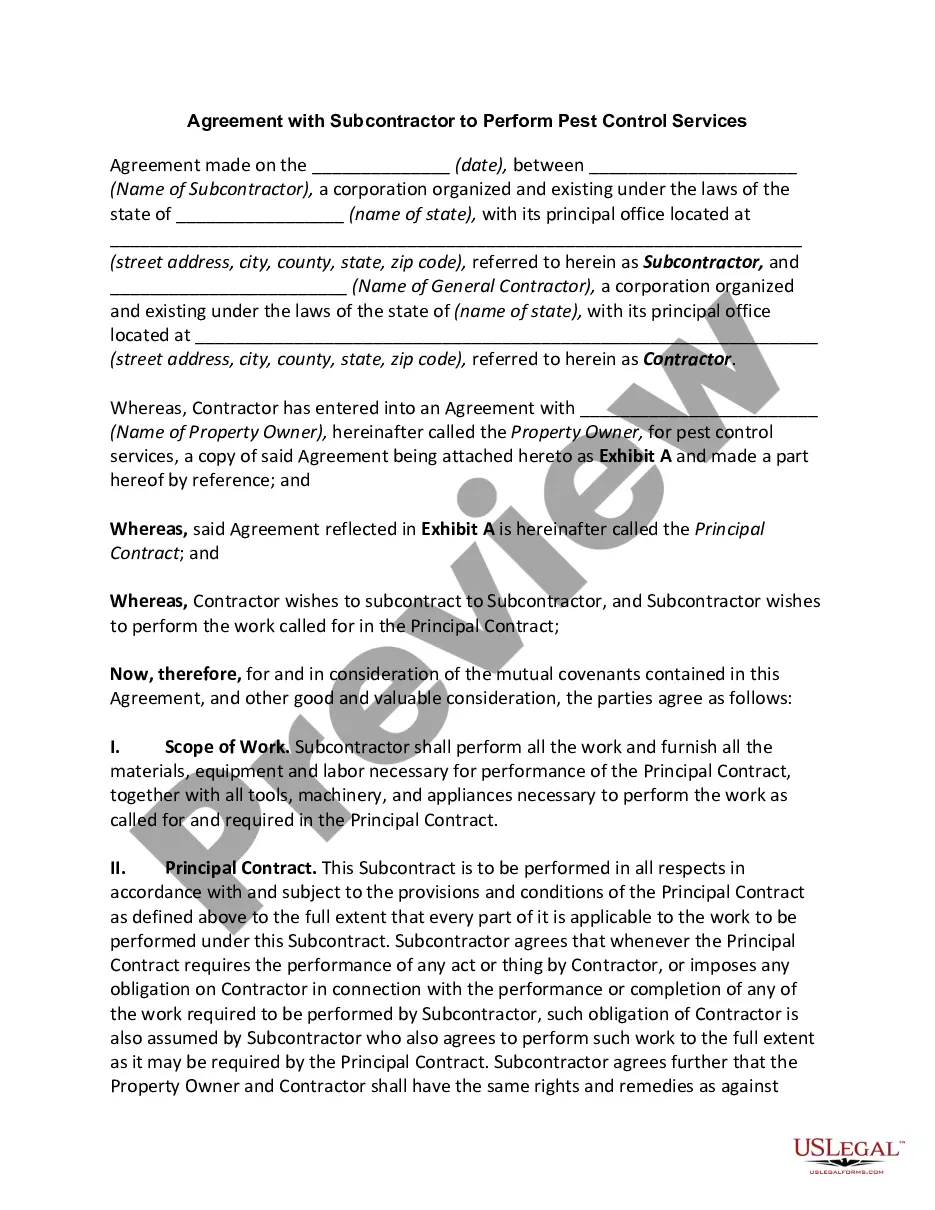

North Dakota Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

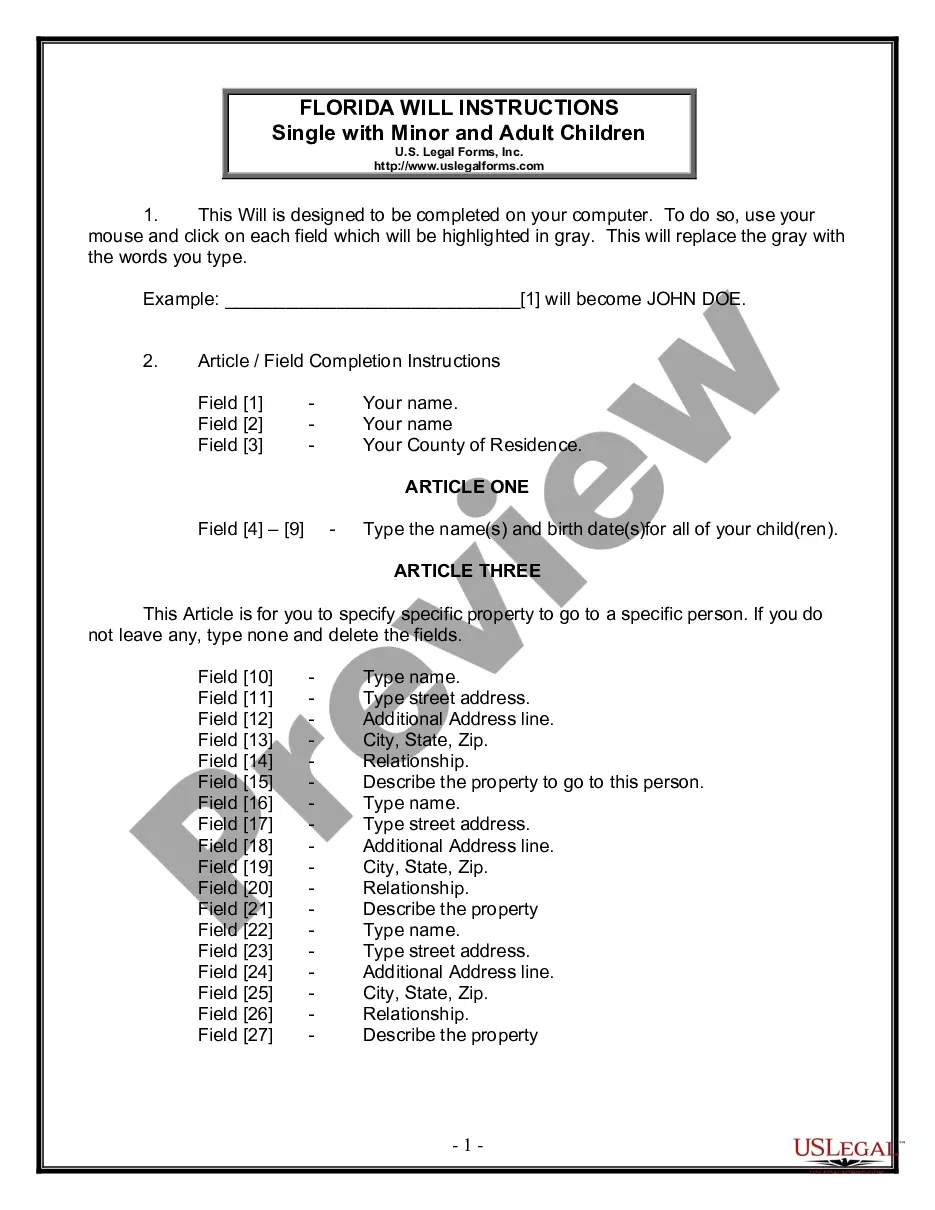

How to fill out Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the site, you can find thousands of forms for business and personal use, categorized by types, states, or keywords.

You can access the latest versions of forms such as the North Dakota Agreement for Sale of Business - Sole Proprietorship - Asset Purchase in moments.

Read the form summary to confirm that you have chosen the appropriate form.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you have an account, Log In and download the North Dakota Agreement for Sale of Business - Sole Proprietorship - Asset Purchase from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously downloaded forms in the My documents section of your profile.

- If you are new to US Legal Forms, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to check the form's content.

Form popularity

FAQ

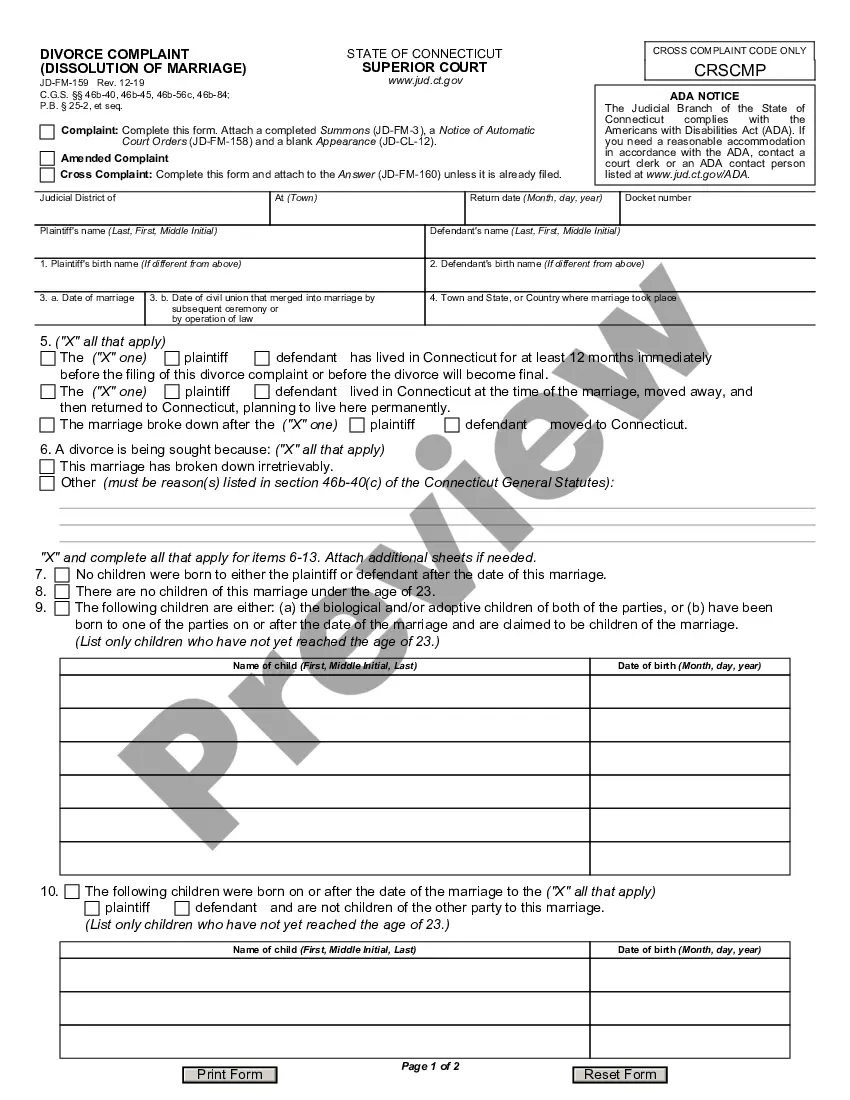

Sole proprietorships typically do not require an operating agreement, as this is more relevant for partnerships and LLCs. However, having a clear agreement can help define business operations and decision-making processes. While it's not mandatory, consider drafting an agreement to streamline operations and clarify expectations.

Sole proprietors must conduct business under their legal name or a registered trade name. If you operate under a trade name, you should file the necessary paperwork with the state of North Dakota. Doing so provides a sense of legitimacy and helps in the marketing of your business.

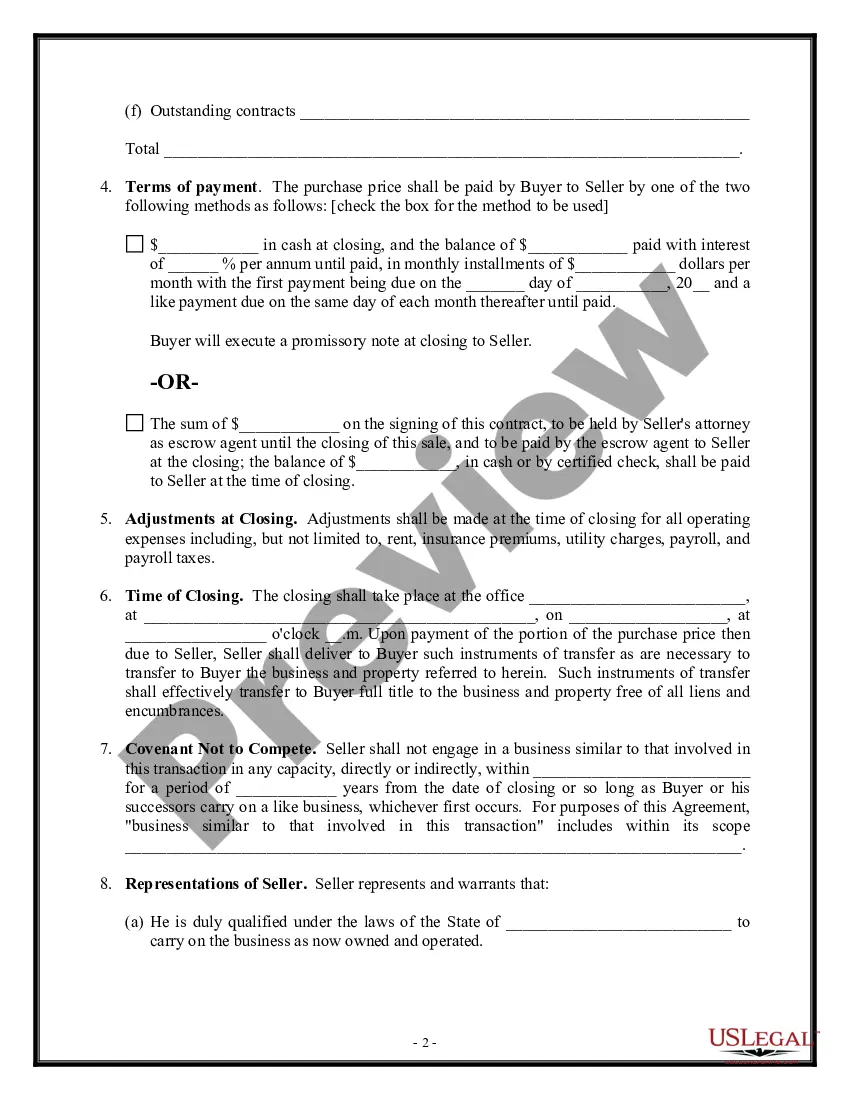

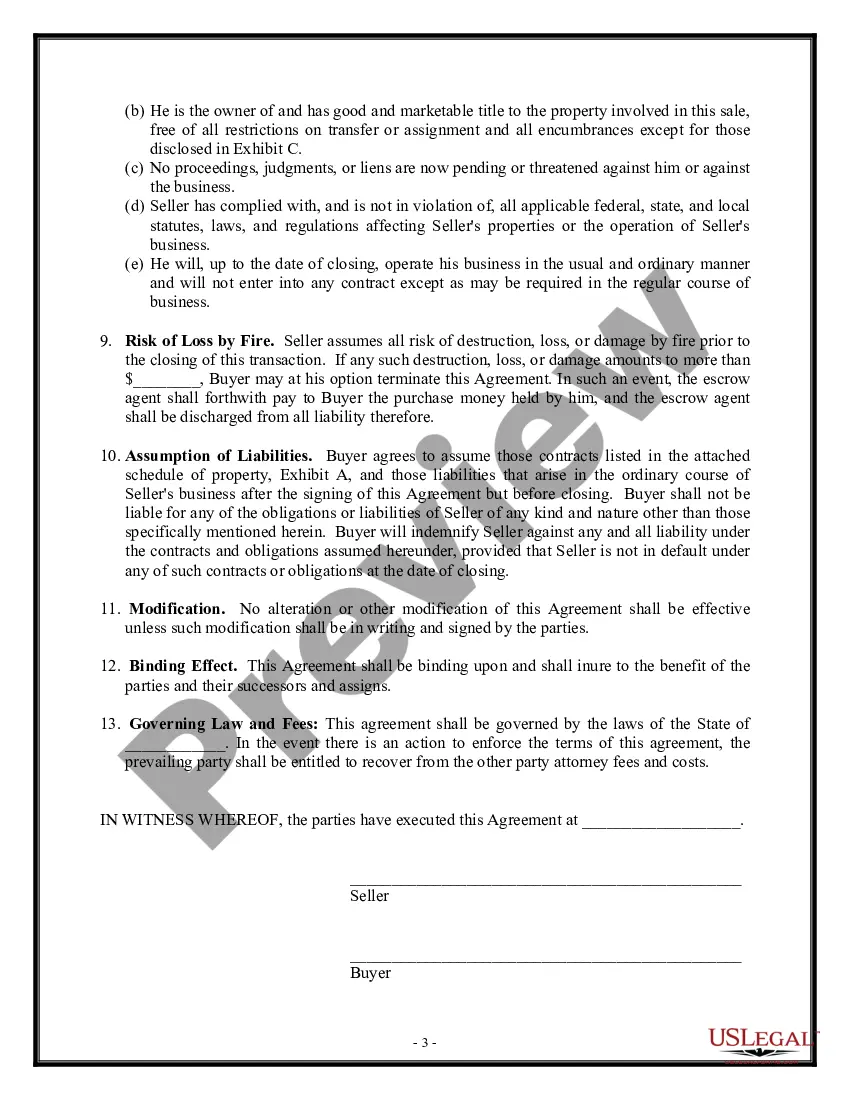

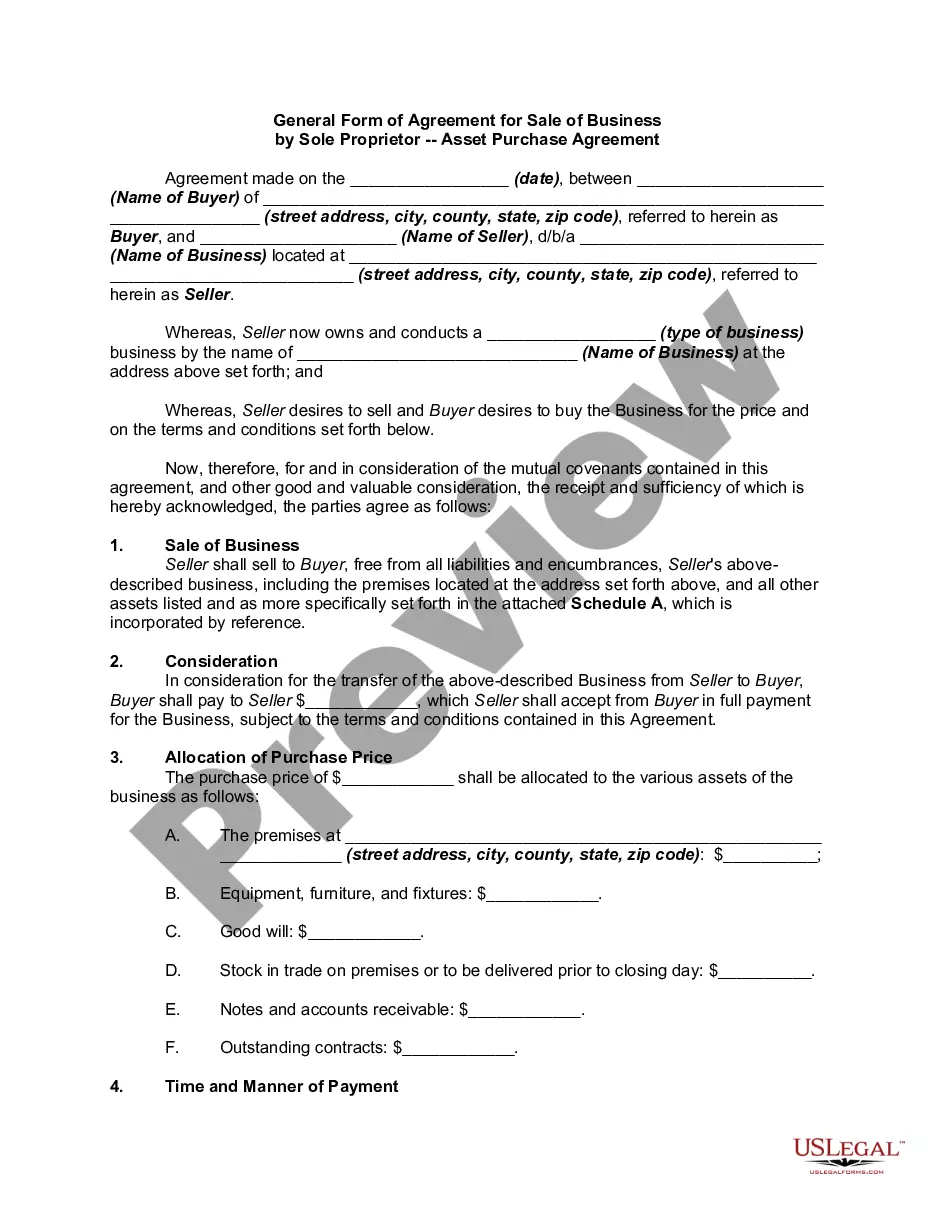

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

In an asset sale the target's contracts are transferred to the buyer by means of assigning the contracts to the buyer. The default rule is generally that a party to a contract has the right to assign the agreement to a third party (although the assigning party remains liable to the counter-party under the agreement).

While you definitely need a lawyer to complete the settlement of your sale, you technically don't need a lawyer to sign a 'Sale and Purchase Agreement'. However, it's wise to speak to your lawyer as soon as you have decided to put your property on the market.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

For a contract to be legally binding it must contain four essential elements:an offer.an acceptance.an intention to create a legal relationship.a consideration (usually money).