North Dakota Rental Application for Married Couple

Description

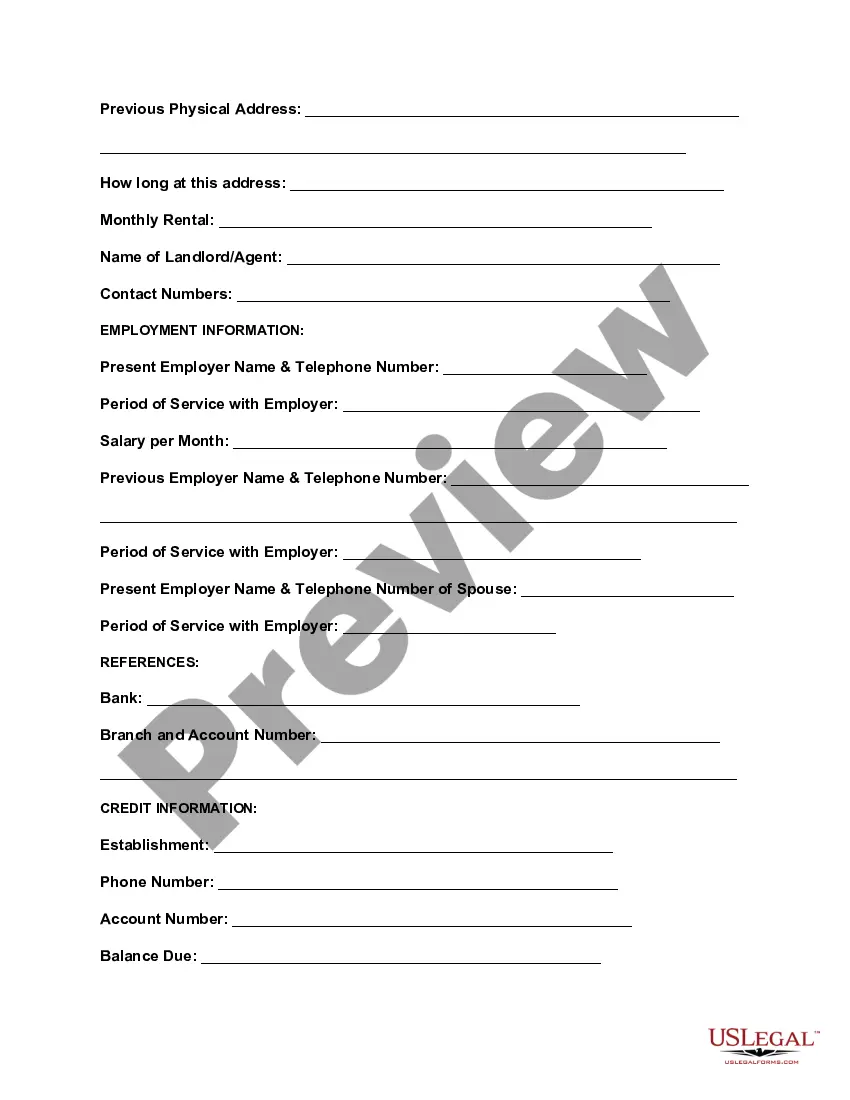

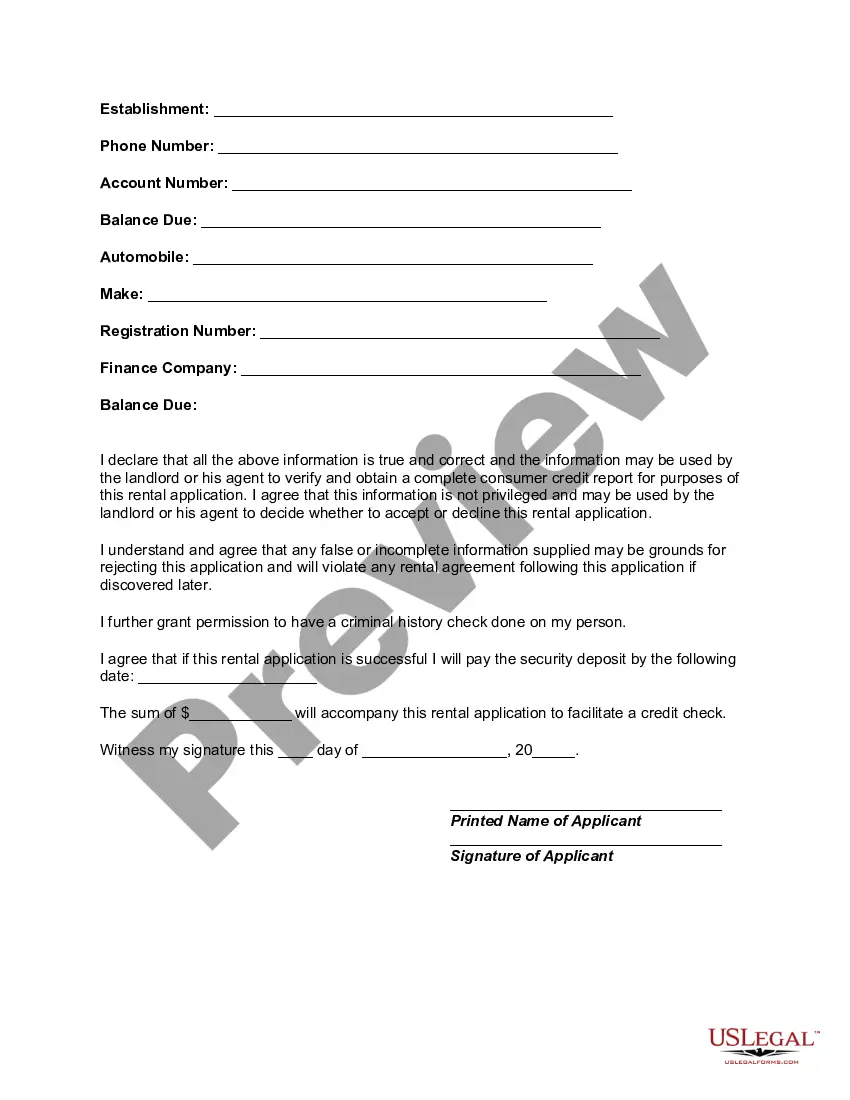

How to fill out Rental Application For Married Couple?

Are you currently in a circumstance where you need documents for either business or personal reasons almost daily.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the North Dakota Rental Application for Married Couple, which are designed to meet state and federal standards.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the North Dakota Rental Application for Married Couple template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review option to check the document.

- Read the description to make sure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

- If you obtain the correct form, click Buy now.

Form popularity

FAQ

To make your North Dakota Rental Application for Married Couple stand out, you should provide complete and accurate information. Include strong references that can attest to your reliability as tenants. Additionally, consider including a cover letter that expresses your enthusiasm about the rental property and your plans as a married couple. Using platforms like US Legal Forms can help streamline this process, ensuring your application appears professional and thorough.

Generally, there is no specific age at which you stop paying taxes entirely. Various factors, such as income and state laws, determine your tax obligations. For marriage couples, knowing tax regulations can assist in strategic planning for financial stability. Using resources like the North Dakota Rental Application for Married Couple can also guide you in making informed choices about housing and taxes.

Many states offer property tax breaks specifically for seniors, including exemptions and credits. Although this varies widely, it’s important to be aware that understanding your local laws can optimize your benefits. If you're a married couple using the North Dakota Rental Application for Married Couple, make sure to inquire about state-specific offers that may assist in housing affordability.

The $500 property tax credit in North Dakota is aimed at helping homeowners lower their property tax liability, benefiting especially those on fixed incomes. If you are a married couple, exploring the North Dakota Rental Application for Married Couple may lead you to additional resources or support in navigating tax benefits. This credit can be a great relief, so be sure to leverage it if you're eligible.

Qualifying for the homestead credit typically involves demonstrating ownership of your primary residence and occupying it as your main home. While this is crucial for various states, if you’re a married couple looking to rent, utilizing the North Dakota Rental Application for Married Couple can ease your search for a suitable place. Each state has specific criteria, so always check local guidelines.

To apply for the Maryland homestead tax credit, you need to fill out an application form available from your local tax office. This process doesn’t intersect with the North Dakota Rental Application for Married Couple but emphasizes the importance of understanding tax credits that can benefit homeowners. Make sure you meet the eligibility criteria and submit your application by the required deadline.

In North Dakota, residents may qualify for property tax exemptions at age 65 or older, but this does not mean you stop paying entirely. Married couples should consider the North Dakota Rental Application for Married Couple, as it can provide insights into potential exemptions. It’s always wise to check local regulations, as they can vary by county.

Landlords in North Dakota are generally not responsible for damages caused by tenants or for normal wear and tear. They also do not have to provide maintenance for tenant-owned appliances. Knowing what landlords are and aren't responsible for can provide clarity when you are filling out a North Dakota Rental Application for Married Couple, helping set proper expectations.

Evicting a tenant in North Dakota typically involves a process that can take several weeks to complete. After serving an eviction notice, landlords must wait a specified period before filing a court case. Understanding this timeline can be helpful when engaging with a North Dakota Rental Application for Married Couple, as it underscores the significance of stable relationships in rental agreements.

Landlords may ask for information to verify a couple's marital status during the rental application process. This verification helps landlords understand the tenants' dynamic and potential lease responsibilities. If you are completing a North Dakota Rental Application for Married Couple, providing accurate details can help streamline the process.