North Dakota Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

How to fill out Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Have you been inside a place where you need to have documents for both company or person purposes virtually every time? There are a lot of legitimate papers layouts accessible on the Internet, but discovering kinds you can rely isn`t straightforward. US Legal Forms delivers a large number of form layouts, like the North Dakota Agreement of Shareholders of a Close Corporation with Management by Shareholders, which are composed in order to meet federal and state specifications.

If you are already familiar with US Legal Forms site and get a free account, just log in. Next, you are able to acquire the North Dakota Agreement of Shareholders of a Close Corporation with Management by Shareholders web template.

Unless you provide an profile and need to start using US Legal Forms, follow these steps:

- Discover the form you will need and make sure it is to the proper metropolis/area.

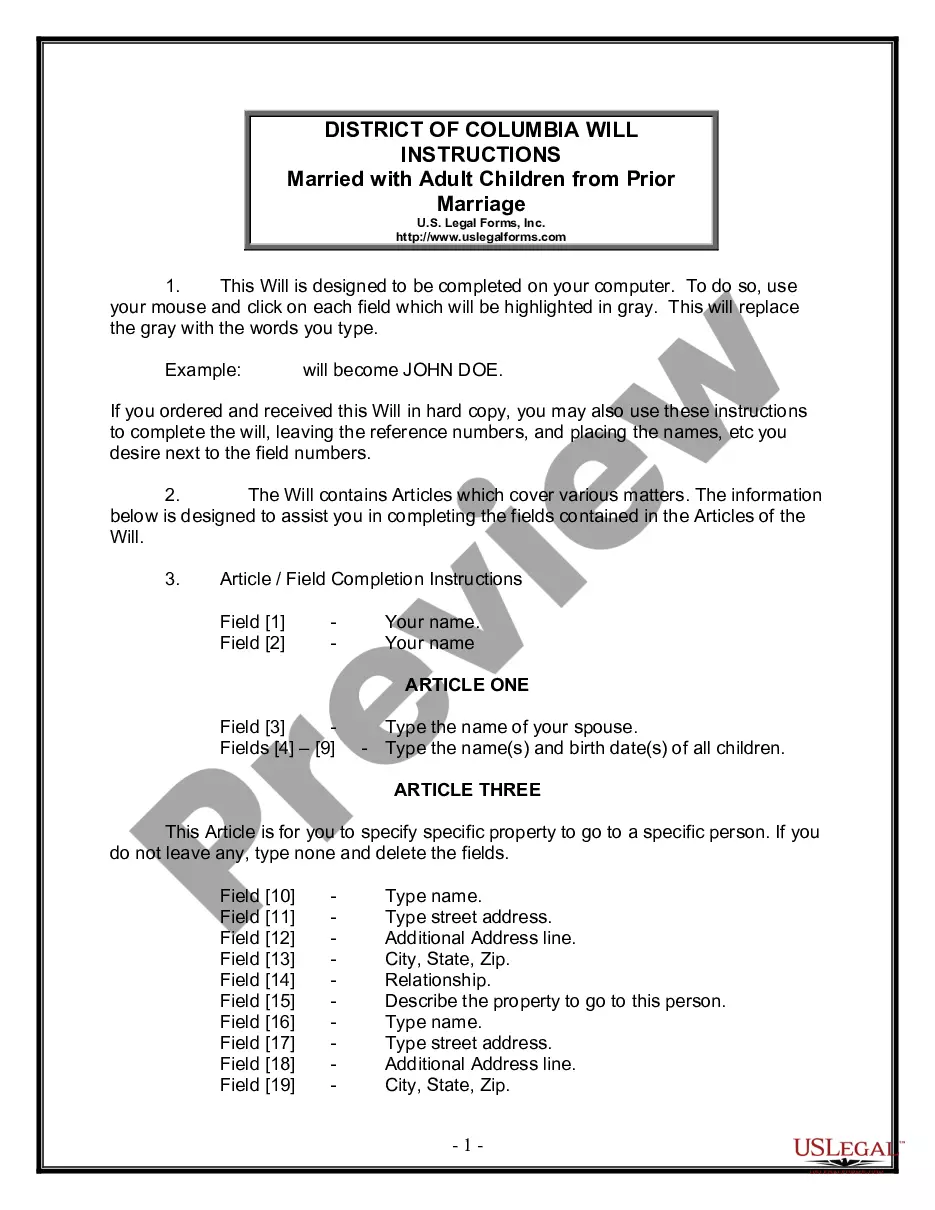

- Utilize the Review option to examine the shape.

- See the explanation to actually have selected the right form.

- In case the form isn`t what you are searching for, make use of the Research industry to get the form that suits you and specifications.

- Whenever you obtain the proper form, click Purchase now.

- Choose the prices strategy you need, fill in the necessary details to produce your bank account, and buy an order making use of your PayPal or bank card.

- Decide on a practical paper structure and acquire your duplicate.

Find all the papers layouts you might have bought in the My Forms menu. You can obtain a extra duplicate of North Dakota Agreement of Shareholders of a Close Corporation with Management by Shareholders whenever, if required. Just select the essential form to acquire or produce the papers web template.

Use US Legal Forms, by far the most extensive variety of legitimate kinds, to conserve time and stay away from mistakes. The assistance delivers expertly made legitimate papers layouts that you can use for an array of purposes. Generate a free account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

A shareholders' agreement is a legally binding contract entered between all or some of the shareholders in a company that regulates their rights and obligations and puts in place a framework of how the company should be managed.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Share restriction agreements typically contain restrictions on transfer, a right of first refusal in favour of the company, a drag-along and confidentiality provisions, and sometimes provide for a company repurchase right.

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

There are basic components that every shareholder's agreement contains. Examples include the number of shares issued, the issuance date, and the percentage of ownership of shareholders. Shareholders' agreements often determine the selling and transferring of shares to third parties.