Are you presently in a place that you need paperwork for both enterprise or specific uses almost every day time? There are tons of authorized document web templates available on the Internet, but discovering kinds you can rely is not straightforward. US Legal Forms offers 1000s of type web templates, like the North Dakota Security Agreement in Accounts and Contract Rights, which are written to meet federal and state requirements.

When you are currently acquainted with US Legal Forms internet site and get a merchant account, merely log in. Following that, you can down load the North Dakota Security Agreement in Accounts and Contract Rights design.

Unless you offer an profile and would like to begin to use US Legal Forms, follow these steps:

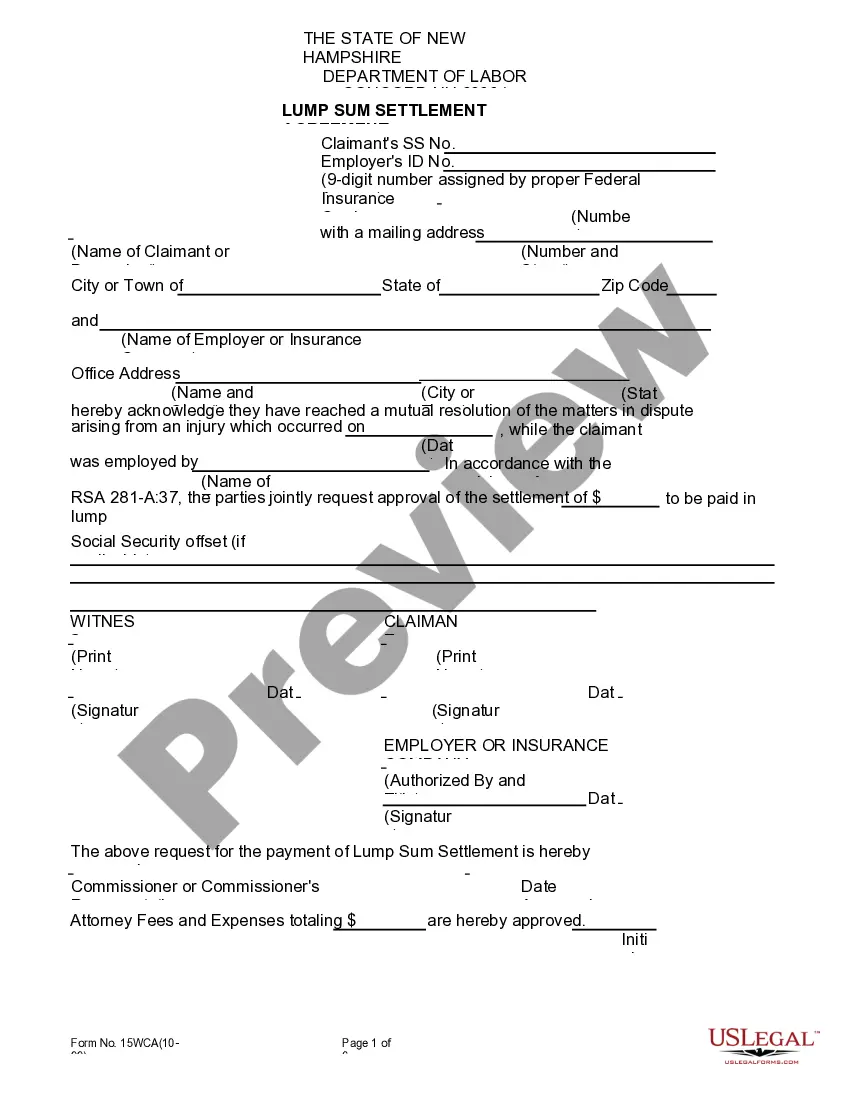

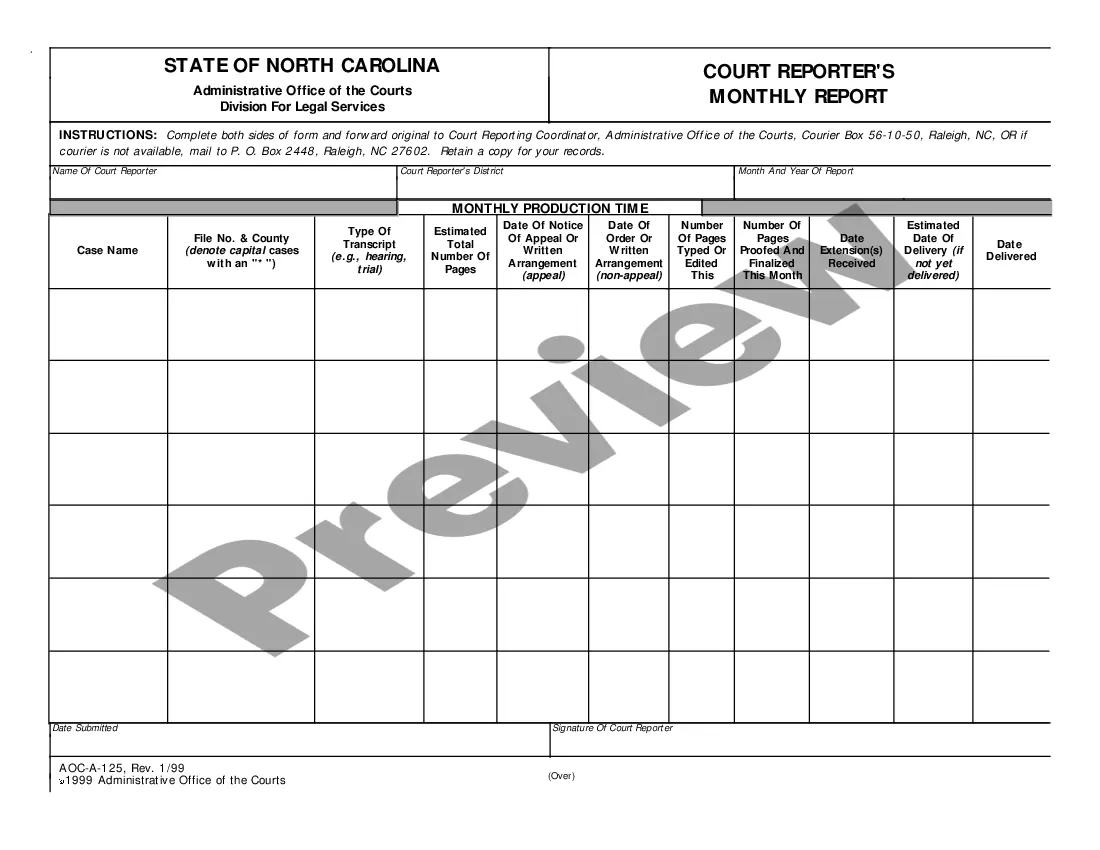

- Obtain the type you will need and make sure it is for that appropriate metropolis/region.

- Utilize the Preview button to check the shape.

- See the explanation to ensure that you have chosen the correct type.

- If the type is not what you`re trying to find, utilize the Look for industry to get the type that meets your requirements and requirements.

- Whenever you get the appropriate type, just click Get now.

- Select the rates plan you want, submit the specified information to generate your bank account, and purchase your order using your PayPal or bank card.

- Choose a practical document file format and down load your duplicate.

Get every one of the document web templates you might have bought in the My Forms food selection. You may get a more duplicate of North Dakota Security Agreement in Accounts and Contract Rights at any time, if needed. Just go through the necessary type to down load or print out the document design.

Use US Legal Forms, probably the most extensive collection of authorized types, in order to save efforts and steer clear of faults. The support offers professionally made authorized document web templates that you can use for a variety of uses. Make a merchant account on US Legal Forms and start making your lifestyle easier.