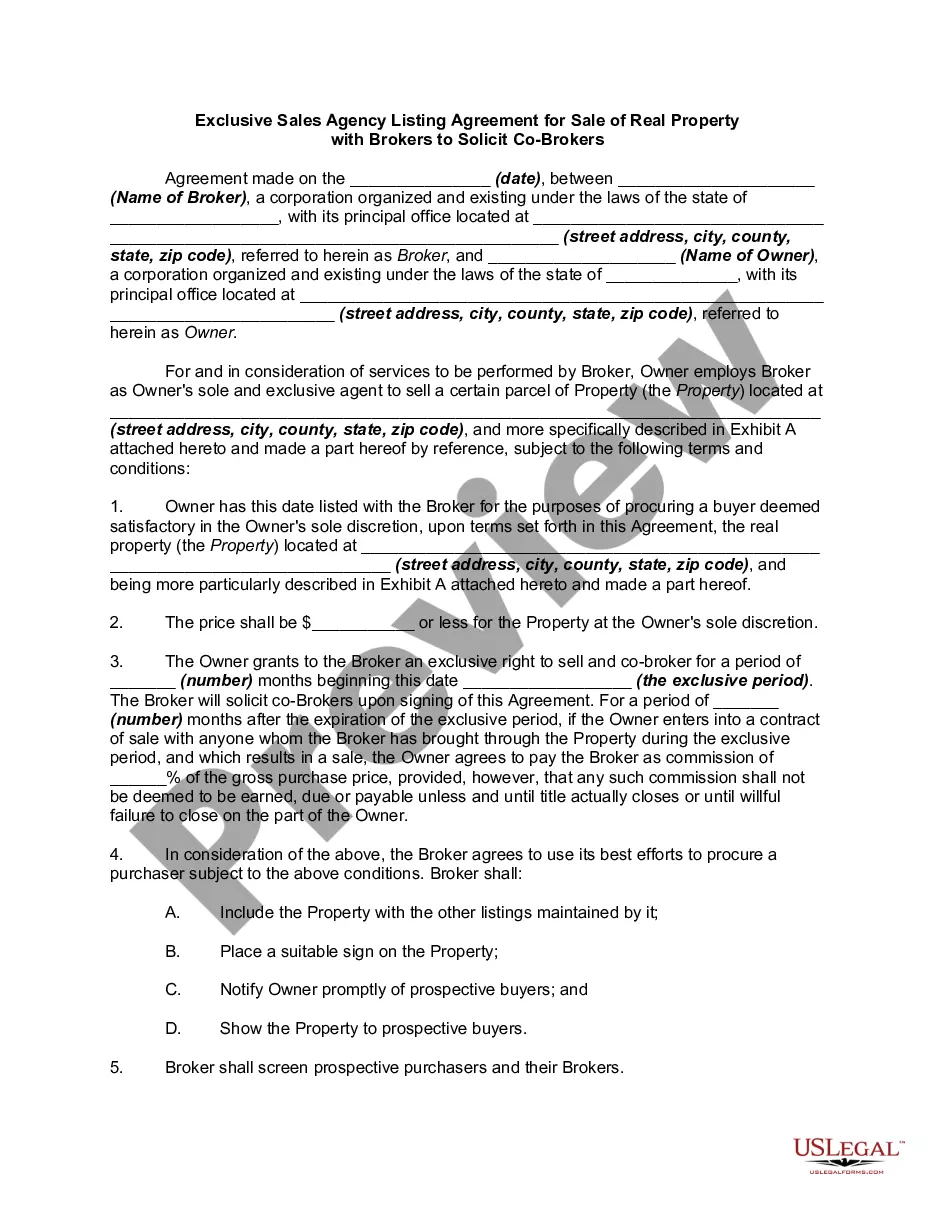

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

North Dakota Receipt for Payment Made on Real Estate Promissory Note

Description

How to fill out Receipt For Payment Made On Real Estate Promissory Note?

Are you currently in a location that you need documents for potential business or specific purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the North Dakota Receipt for Payment Made on Real Estate Promissory Note, which can be completed to comply with state and federal regulations.

Utilize US Legal Forms, a comprehensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally designed legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Dakota Receipt for Payment Made on Real Estate Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for your correct area/county.

- Utilize the Preview button to review the form.

- Read the information to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, just click Get now.

- Choose the pricing plan you desire, complete the necessary details to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You can obtain another copy of the North Dakota Receipt for Payment Made on Real Estate Promissory Note at any time.

- Simply select the desired form to download or print the document template.

Form popularity

FAQ

To record promissory notes payable, start by entering the note amount under liabilities in your accounting records. Next, document the repayment terms, including interest rates and payment schedules. This will help you maintain accurate records for the North Dakota Receipt for Payment Made on Real Estate Promissory Note.

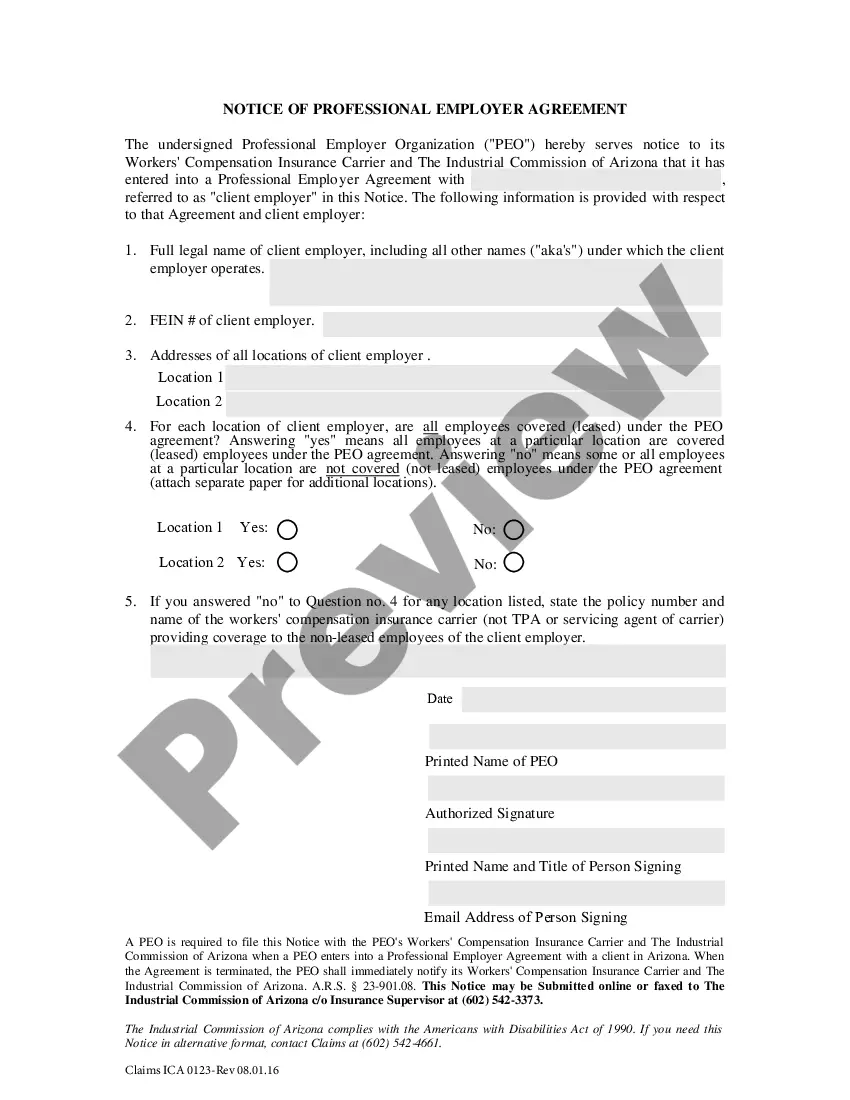

In North Dakota, bank deposit slips for trust funds must include the name of the payee, the account number, and a description of the transaction. Furthermore, ensure that the date is clearly noted. Proper documentation supports the clarity and validity of the North Dakota Receipt for Payment Made on Real Estate Promissory Note.

A deposit trust account is a bank account used to hold funds on behalf of another party, typically in real estate transactions. This account ensures that the buyer's deposits are secured until the transaction is finalized. If you are working with a North Dakota Receipt for Payment Made on Real Estate Promissory Note, utilizing a deposit trust account can provide peace of mind during the buying process, as it protects your investment securely until the sale is complete.

Transferring property in North Dakota involves preparing a deed, which is a document that legally conveys ownership from one party to another. You need to complete the deed and file it with the county recorder's office to finalize the transaction. Additionally, if you have a North Dakota Receipt for Payment Made on Real Estate Promissory Note, ensure that all financial obligations are settled before proceeding with the transfer. This process helps avoid any future disputes regarding property ownership.

In North Dakota, the redemption period refers to the time frame a property owner has to reclaim their property after a foreclosure. Generally, this period lasts for six months, but it can vary in some instances. Understanding this period is essential, especially when dealing with a North Dakota Receipt for Payment Made on Real Estate Promissory Note. It helps property owners take necessary actions to protect their interests.

A disadvantage of a promissory note is that it may not always provide the same level of security as a traditional mortgage. If the borrower defaults, the lender may face challenges in recouping their investment without additional collateral. Additionally, having a North Dakota Receipt for Payment Made on Real Estate Promissory Note does not eliminate potential disputes, making it essential to document every transaction thoroughly.

To create a promissory note for payment, gather essential details such as the amount borrowed, interest rate, repayment schedule, and the identities of both parties. You can utilize templates from platforms like uslegalforms to ensure all legal requirements are met. Once drafted, both parties must sign the note to make it enforceable, providing a clear record of the agreement, which is crucial if issues arise.

To write a promissory note for payment, start by clearly stating the amount owed, the names of both the borrower and the lender, and the date the payment is due. Next, include any relevant details about interest rates and payment terms. It is also essential to sign the document for it to be legally binding. By utilizing a North Dakota Receipt for Payment Made on Real Estate Promissory Note template, you can simplify the process and ensure that your document meets all legal requirements.