A software license is a license that grants permission to do things with computer software. The usual goal is to authorize activities which are prohibited by default by copyright law, patent law, trademark law and any other intellectual property right. The reason for the license, essentially, is that virtually all intellectual property laws were enacted to encourage disclosure of the intellectual property. Typically, then, the software license is a complex document, identifying the specific usage rights that are granted to the licensee, while also stating the license limitations.

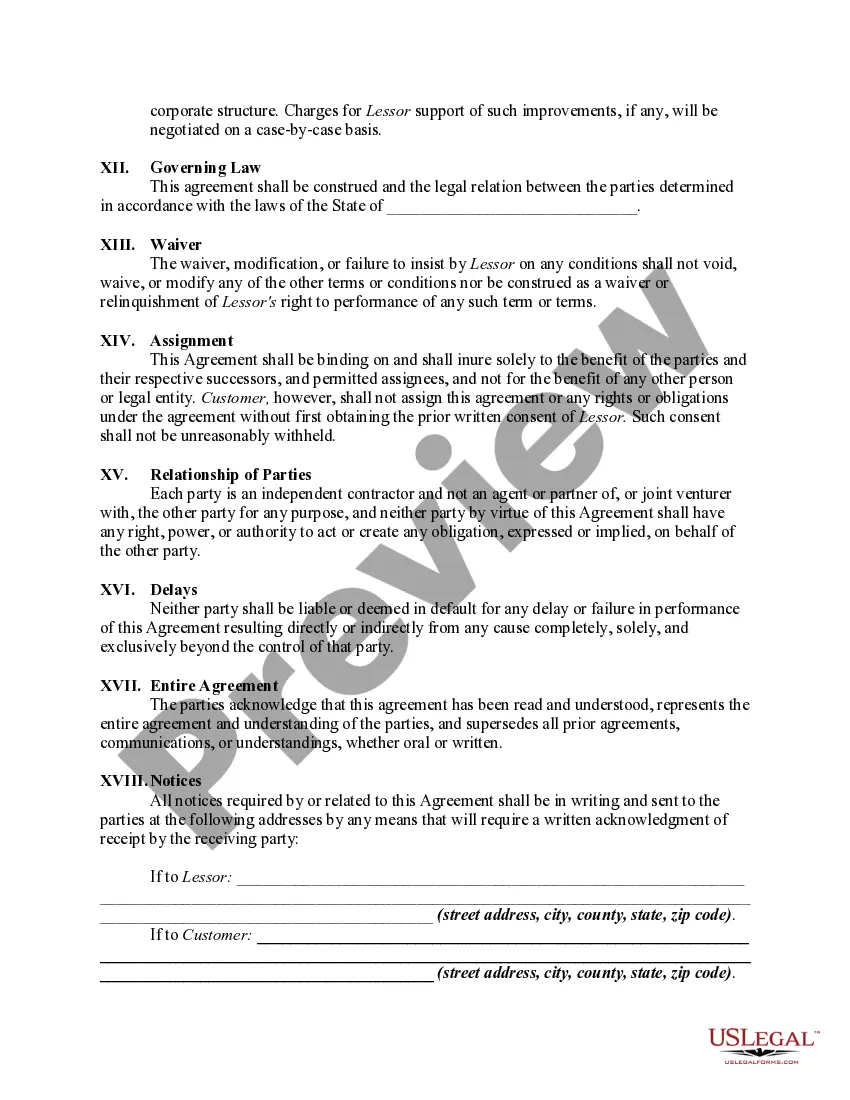

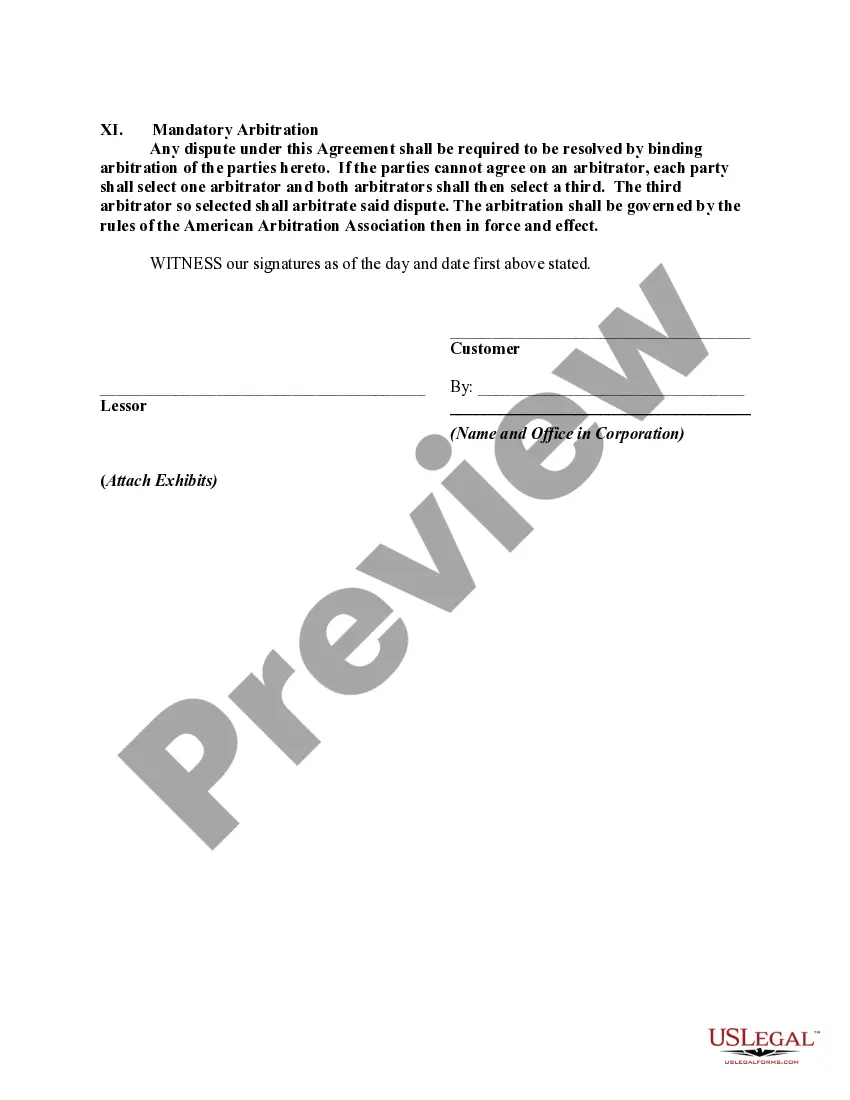

North Dakota Exclusive Computer Software Lease with License Agreement

Description

How to fill out Exclusive Computer Software Lease With License Agreement?

Have you ever found yourself in a situation where you require documents for potential business or personal reasons almost on a daily basis.

There are numerous legal document templates accessible online, but obtaining versions you can trust is not easy.

US Legal Forms provides a vast array of form templates, including the North Dakota Exclusive Software Lease with License Agreement, designed to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

Choose a suitable document format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain another copy of the North Dakota Exclusive Software Lease with License Agreement at any time if necessary. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the North Dakota Exclusive Software Lease with License Agreement template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Find the form you require and confirm it is for the correct city/state.

- Utilize the Review button to examine the form.

- Read the description to ensure you have chosen the right form.

- If the form isn’t what you need, use the Search field to locate the form that fits your needs and specifications.

- Once you identify the correct form, click on Get now.

Form popularity

FAQ

As of now, North Dakota does impose sales tax on SaaS products, which can impact businesses operating within the state. This means that when using or leasing software as a service, you must account for sales tax within your financial plans. Knowing how this affects your North Dakota Exclusive Computer Software Lease with License Agreement will ensure clarity and compliance with state regulations.

In North Dakota, various items are exempt from sales tax, including groceries, prescription drugs, and certain nonprofit sales. Understanding what is not taxed can help your business plan more effectively, particularly when engaging with software rental agreements like the North Dakota Exclusive Computer Software Lease with License Agreement. This knowledge can enhance your financial strategy and compliance efforts.

The sales tax rate in North Dakota is currently set at 5%. However, certain local jurisdictions may impose additional taxes, affecting the total sales tax rate. When entering into a North Dakota Exclusive Computer Software Lease with License Agreement, understanding the sales tax implications is essential for accurate budgeting and legal compliance.

The Nexus threshold in North Dakota refers to the level of business activity sufficient to establish a tax obligation in the state. Generally, if your business has physical presence or significant economic activity in North Dakota, you may meet the Nexus requirement. This can impact your legal agreements, including a North Dakota Exclusive Computer Software Lease with License Agreement, by defining your tax responsibilities.

Yes, the sale of software is often subject to sales tax, depending on the jurisdiction and software type. In North Dakota, for instance, purchases of certain types of software may incur sales tax, so it's essential to understand how these regulations apply when negotiating a North Dakota Exclusive Computer Software Lease with License Agreement. Being informed helps ensure compliance and budget accuracy.

A licensing agreement, particularly a North Dakota Exclusive Computer Software Lease with License Agreement, typically grants you permission to use the software, provides rights to updates and support, and establishes confidentiality regarding proprietary information. These provisions help protect both you and the software provider, fostering a transparent and productive working relationship.

Licensing agreements create legal permissions for you to use software or intellectual property under specific conditions. When considering a North Dakota Exclusive Computer Software Lease with License Agreement, it is important to understand the agreement’s terms, including payment, duration, and the rights granted. This ensures a clear understanding of what you can and cannot do with the software.

Software taxability varies across the United States, but it is often assessed based on delivery method and whether the software is customized. In North Dakota, for instance, purchases of prewritten software can be subject to sales tax. It is crucial to review the specific guidelines for each state to understand how a North Dakota Exclusive Computer Software Lease with License Agreement might be impacted by state tax laws.

Resale certificates generally apply only within the state that issued them. If you have a North Dakota Exclusive Computer Software Lease with License Agreement, your resale certificate may not be valid in other states. Each state has its own regulations regarding the acceptance of resale certificates. Therefore, it's important to verify the rules in the states where you plan to do business.

In North Dakota, Software as a Service (SaaS) is typically considered taxable. If your services fall under a North Dakota Exclusive Computer Software Lease with License Agreement, you should collect and remit sales tax on these transactions. The taxability of SaaS can depend on specific circumstances, so you may want to consult a tax professional. Understanding these nuances is vital for compliance.