North Dakota Computer Software Lease with License Agreement

Description

How to fill out Computer Software Lease With License Agreement?

You might spend time online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a wide array of legal forms that have been assessed by experts.

It is easy to download or print the North Dakota Computer Software Lease with License Agreement from our platform.

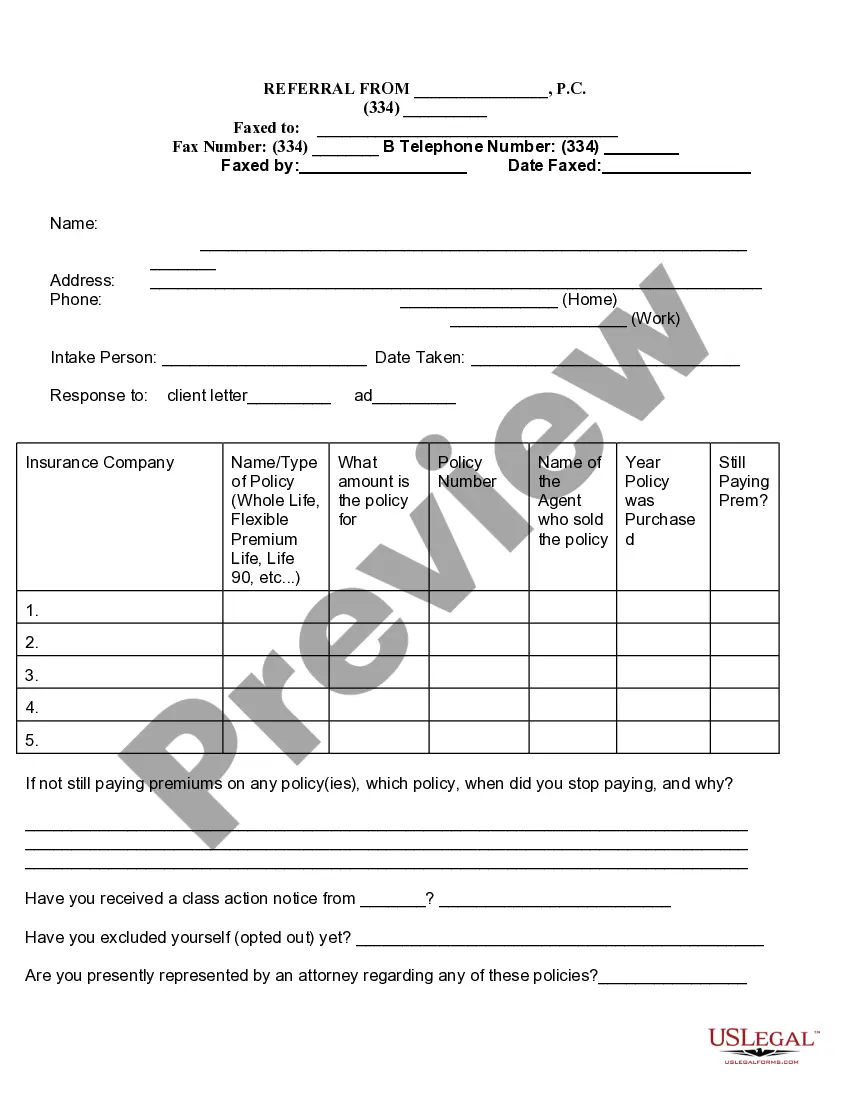

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the North Dakota Computer Software Lease with License Agreement.

- Every legal document template you acquire is your personal asset indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward steps outlined below.

- First, make sure you have selected the correct document template for your desired state/region.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

North Dakota does impose taxes on Software as a Service (SaaS), treating it similarly to other forms of software. This tax further emphasizes the importance of compliance for businesses operating under a North Dakota Computer Software Lease with License Agreement. To navigate these tax implications effectively, consider using platforms like USLegalForms, which can help you manage legal agreements and ensure compliance.

Yes, rentals are typically taxable in North Dakota, including leases and rental agreements for various types of property. This does encompass leases related to computer software and technology. If you are entering into a North Dakota Computer Software Lease with License Agreement, be prepared to account for these taxes in your financial planning.

Economic nexus in North Dakota establishes the level of sales or transactions a business must have to be required to collect sales tax. This threshold aims to capture out-of-state businesses engaging with North Dakota residents. Understanding economic nexus is crucial for anyone involved in a North Dakota Computer Software Lease with License Agreement, as it affects your sales tax obligations.

North Dakota is often viewed as tax-friendly, particularly for small businesses. The state has a relatively lower tax burden compared to many others, which can foster a positive environment for startups and new ventures. If you are considering a North Dakota Computer Software Lease with License Agreement, you may find that the state's tax policies can benefit your business in the long run.

Vehicle tax in North Dakota applies to various types of vehicles, including personal and commercial. This tax is calculated based on the value of the vehicle and is important for residents and businesses alike. When leasing computer software or technology that uses vehicles, be aware of how these taxes might influence your overall budget, especially under a North Dakota Computer Software Lease with License Agreement.

In North Dakota, the total loss threshold defines the amount of loss a business can claim before it is considered taxable. This threshold helps to provide businesses with clarity regarding losses on their financial statements. If you're entering into a North Dakota Computer Software Lease with License Agreement, knowing this threshold can help you manage your financial expectations and liabilities.

The Nexus threshold in North Dakota refers to the minimum level of business activity required for a company to be subject to the state's tax obligations. For many businesses, this includes having a physical presence or significant economic activity in the state. If you are involved in a North Dakota Computer Software Lease with License Agreement, it is essential to understand how these thresholds might impact your taxable status.

Software in Illinois is generally taxable, particularly if it is prewritten and delivered electronically. However, nuances in the law apply based on how and where the software is utilized. When considering a North Dakota Computer Software Lease with License Agreement, be sure to understand the implications of software taxation in Illinois.

SaaS in North Dakota is generally considered taxable, which aligns with how the state treats digital products. It’s essential to stay informed about any changes in tax regulations that may affect your SaaS solution. For a North Dakota Computer Software Lease with License Agreement, confirm how these tax rules might impact your costs.

Florida generally taxes software licenses, particularly for prewritten software. However, exceptions might apply based on licensing structure and delivery method. When assessing a North Dakota Computer Software Lease with License Agreement, be mindful of how license agreements may influence tax liabilities in Florida.