North Dakota Lease - Lot for Mobile Home

Description

How to fill out Lease - Lot For Mobile Home?

If you need to thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms accessible online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or by keywords. Utilize US Legal Forms to find the North Dakota Lease - Lot for Mobile Home with just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to each form you purchased within your account.

Stay competitive and acquire, and print the North Dakota Lease - Lot for Mobile Home with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to get the North Dakota Lease - Lot for Mobile Home.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

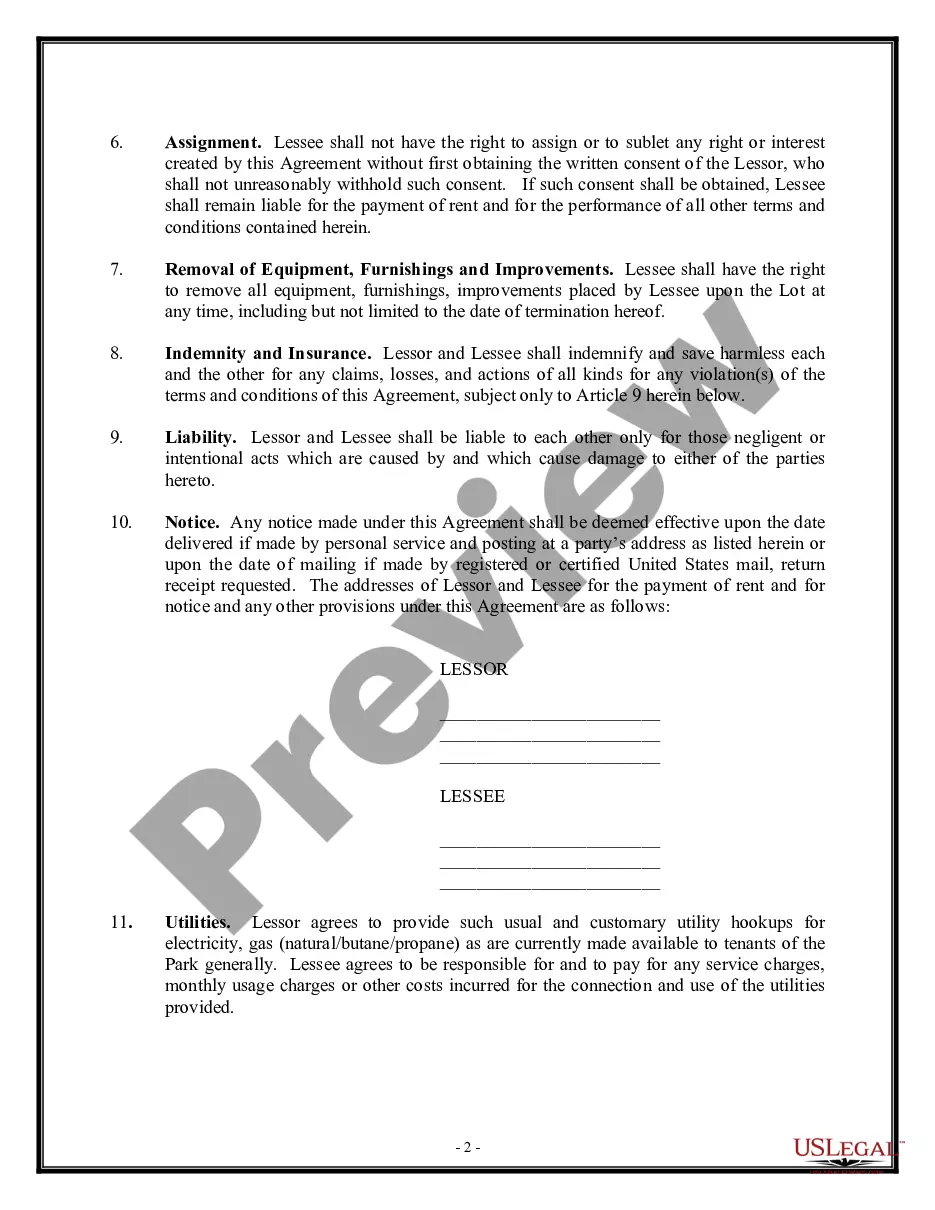

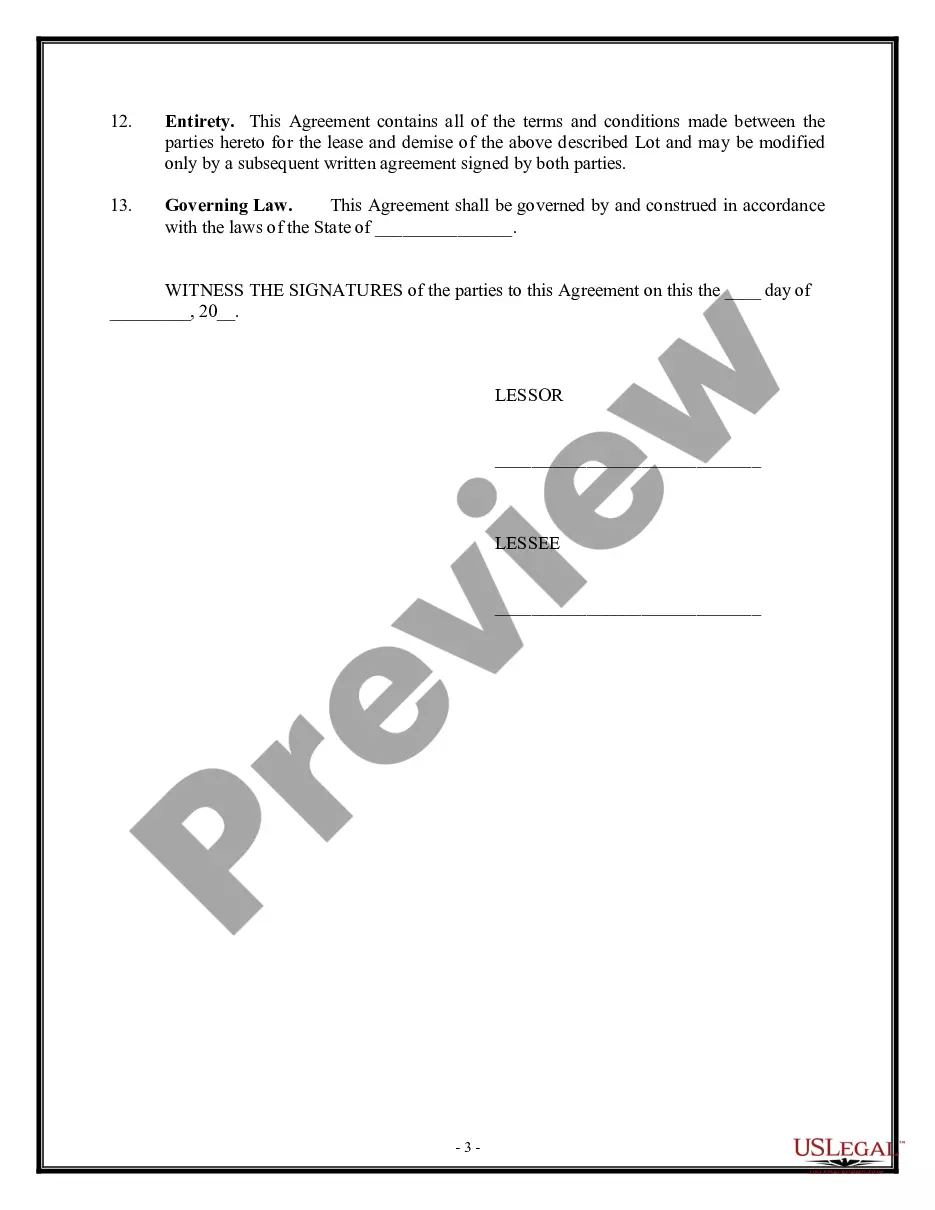

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, make use of the Search field at the top of the screen to find other versions of the legal template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the North Dakota Lease - Lot for Mobile Home.

Form popularity

FAQ

The tax credit for 2025 in North Dakota includes several initiatives aimed at easing the tax burden for residents. Specific details may still be subject to legislative changes, so it’s crucial to stay updated on any proposed adjustments. If you're interested in a North Dakota Lease - Lot for Mobile Home, knowing about the available credits can help you plan your finances better. Consulting official resources or local tax professionals is recommended for accurate information.

North Dakota property tax operates on a local level, with each county assessing property values for tax purposes. Homeowners typically receive tax bills based on the assessed value of their properties, including any exemptions or credits they may qualify for. When looking at a North Dakota Lease - Lot for Mobile Home, familiarity with the local tax rates can help you make informed financial decisions. Using platforms like uslegalforms can provide templates to assist you with related documentation.

The tax relief credit in North Dakota aims to provide financial assistance to low-income homeowners and renters. This credit can reduce the amount of taxes owed, making housing more affordable. If you're exploring a North Dakota Lease - Lot for Mobile Home, being aware of this credit can help you budget more effectively. It's advisable to check with state resources for detailed information on application procedures.

In North Dakota, property tax abatement refers to a reduction in property taxes for certain qualifying properties. This benefit applies particularly to new constructions or improvements made to existing structures. If you are considering a North Dakota Lease - Lot for Mobile Home, understanding these abatement opportunities can significantly lower your tax burden. Always consult with local officials for specific eligibility criteria.

Transferring a mobile home title in North Dakota involves filling out a title application and submitting it to the Department of Transportation. Both the seller and buyer must sign the application. If you are navigating a North Dakota Lease - Lot for Mobile Home, ensuring the title is correctly transferred is critical for safeguarding your investment.

In North Dakota, there is no specific age at which individuals stop paying property taxes. However, some exemptions and credits are available for seniors, which can reduce their tax burden. If you are considering a North Dakota Lease - Lot for Mobile Home, learning about these options can provide financial advantages.

The $500 property tax credit in North Dakota offers relief to qualifying homeowners, lowering their overall tax bill. To be eligible, homeowners need to meet certain income and residency requirements. If you are renting a North Dakota Lease - Lot for Mobile Home, understanding this credit may not apply directly to you, but can inform your future planning.

North Dakota's tax structure generally features lower taxes than many other states, particularly regarding personal income tax. However, property taxes can be significant depending on the area. When considering a North Dakota Lease - Lot for Mobile Home, weighing all tax implications will help inform your decision.

The property tax rate in North Dakota varies by county, typically ranging from 1.5% to 3%. Understanding these rates will give you a clearer picture of what to expect when investing in a property. When looking at a North Dakota Lease - Lot for Mobile Home, knowing the current property tax rate is essential for financial planning.

While there are states that do not levy property taxes, such as Wyoming and Alaska, it's essential to consider all tax factors when evaluating options. North Dakota imposes property taxes, so if your focus is on a North Dakota Lease - Lot for Mobile Home, it's important to budget accordingly. Researching different states can help you find the right fit for your needs.