North Dakota Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

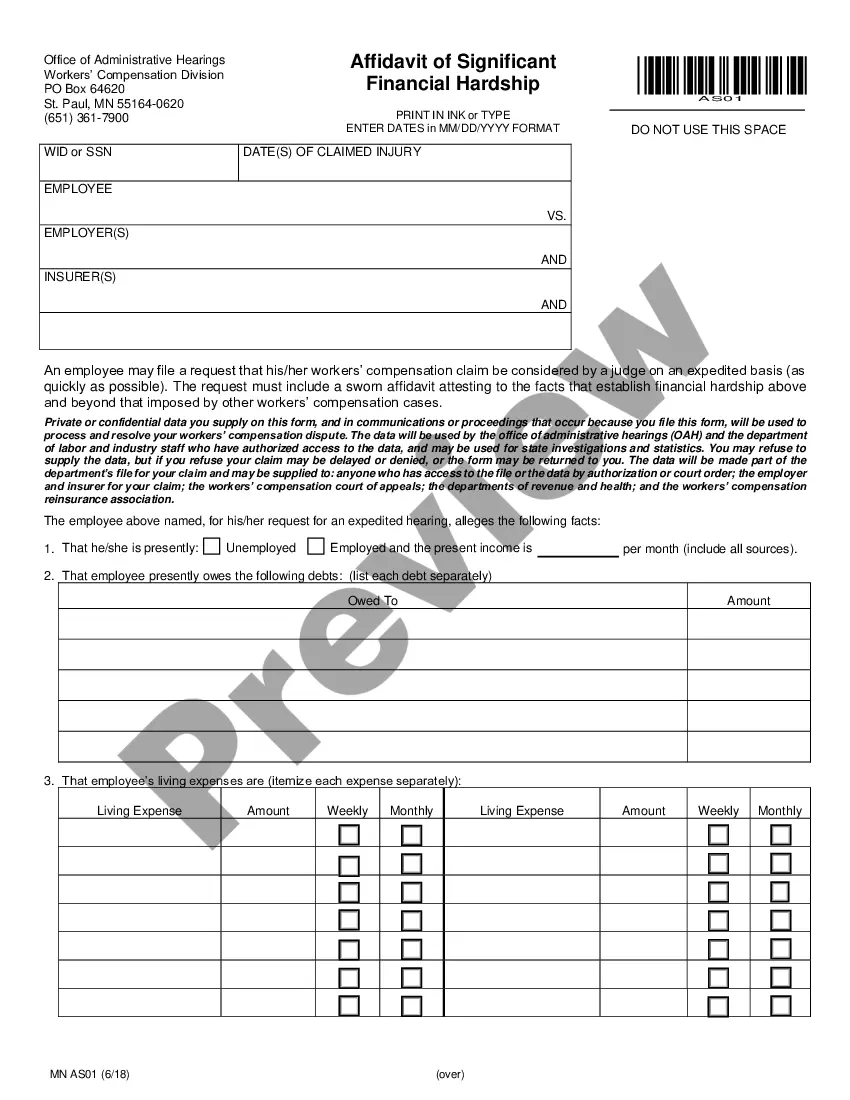

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

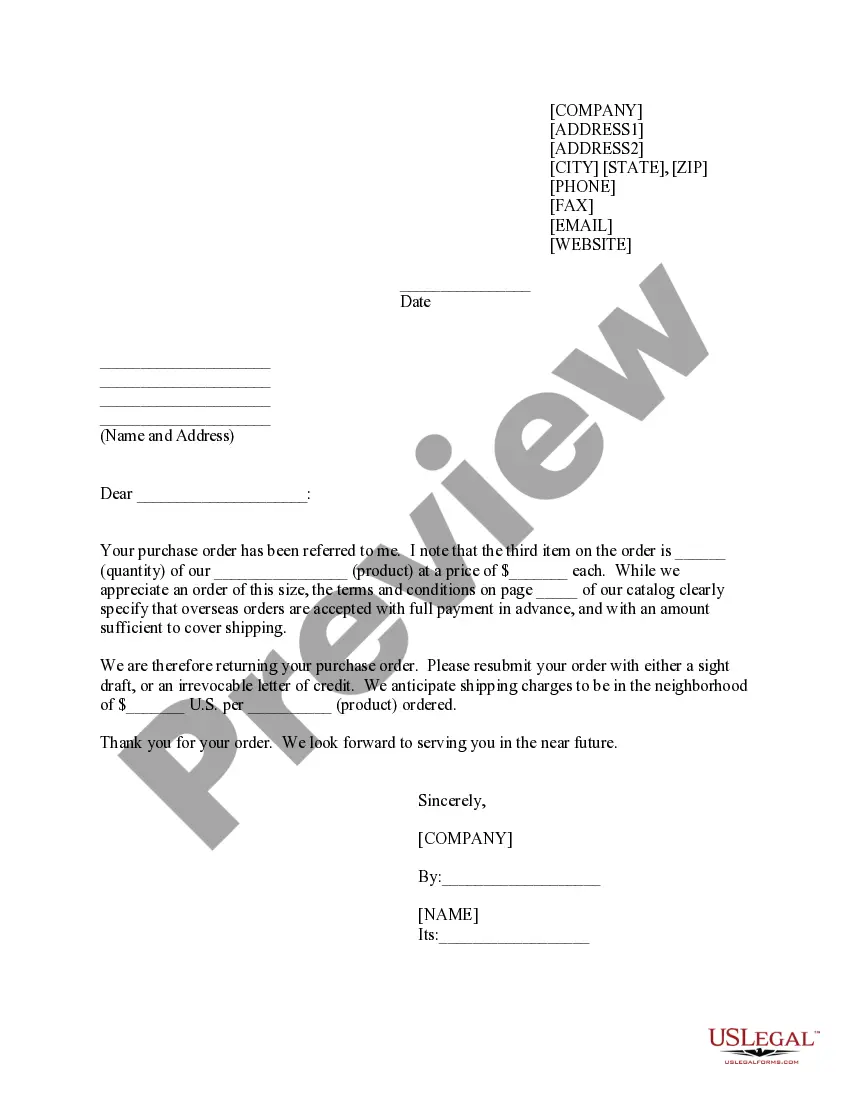

You can commit time on the web attempting to find the legitimate papers web template which fits the federal and state specifications you need. US Legal Forms offers thousands of legitimate kinds that happen to be reviewed by experts. You can actually obtain or produce the North Dakota Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) from our services.

If you currently have a US Legal Forms account, you may log in and click on the Download option. Afterward, you may comprehensive, revise, produce, or indication the North Dakota Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). Every single legitimate papers web template you acquire is yours forever. To acquire another copy of any obtained form, proceed to the My Forms tab and click on the related option.

If you work with the US Legal Forms website the first time, keep to the basic recommendations under:

- First, ensure that you have chosen the best papers web template for that area/metropolis that you pick. See the form information to ensure you have picked out the correct form. If accessible, utilize the Preview option to look from the papers web template as well.

- In order to locate another version from the form, utilize the Lookup field to find the web template that meets your needs and specifications.

- Upon having identified the web template you need, simply click Get now to proceed.

- Find the costs prepare you need, type in your references, and register for your account on US Legal Forms.

- Full the purchase. You can utilize your charge card or PayPal account to pay for the legitimate form.

- Find the formatting from the papers and obtain it for your device.

- Make adjustments for your papers if needed. You can comprehensive, revise and indication and produce North Dakota Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

Download and produce thousands of papers themes utilizing the US Legal Forms site, which offers the biggest selection of legitimate kinds. Use specialist and condition-certain themes to tackle your organization or individual requires.

Form popularity

FAQ

Yes, the bank can assess a fee if a check overdraws your account (known as a non-sufficient funds [NSF] fee), as long as this practice was previously disclosed.

A bounced check is slang for a check that cannot be processed because the account holder has non-sufficient funds (NSF) available for use. Banks return, or ?bounce,? these checks, also known as rubber checks, rather than honor them, and banks charge the check writers NSF fees.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

Understanding Bad Checks The bank will "bounce" the check if you write a bad one because there are insufficient funds in your account to cover it.

A checking account that does not have enough funds to cover all transactions is said to have non-sufficient funds (NSF), also known as insufficient funds. NSF also refers to the fee assessed when a check is presented but is not sufficient to cover the account's balance.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

When you write a check and there's not enough funds in your account when it's presented, this is considered non-sufficient funds (NSF). When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank.

When you cash or deposit a check and there's not enough funds to cover it in the account it's drawn on, this is also considered non-sufficient funds (NSF). When a check is returned for NSF in this manner, the check is generally returned back to you. This allows you to redeposit the check at a later time, if available.