North Dakota Complaint Property Damage

Description

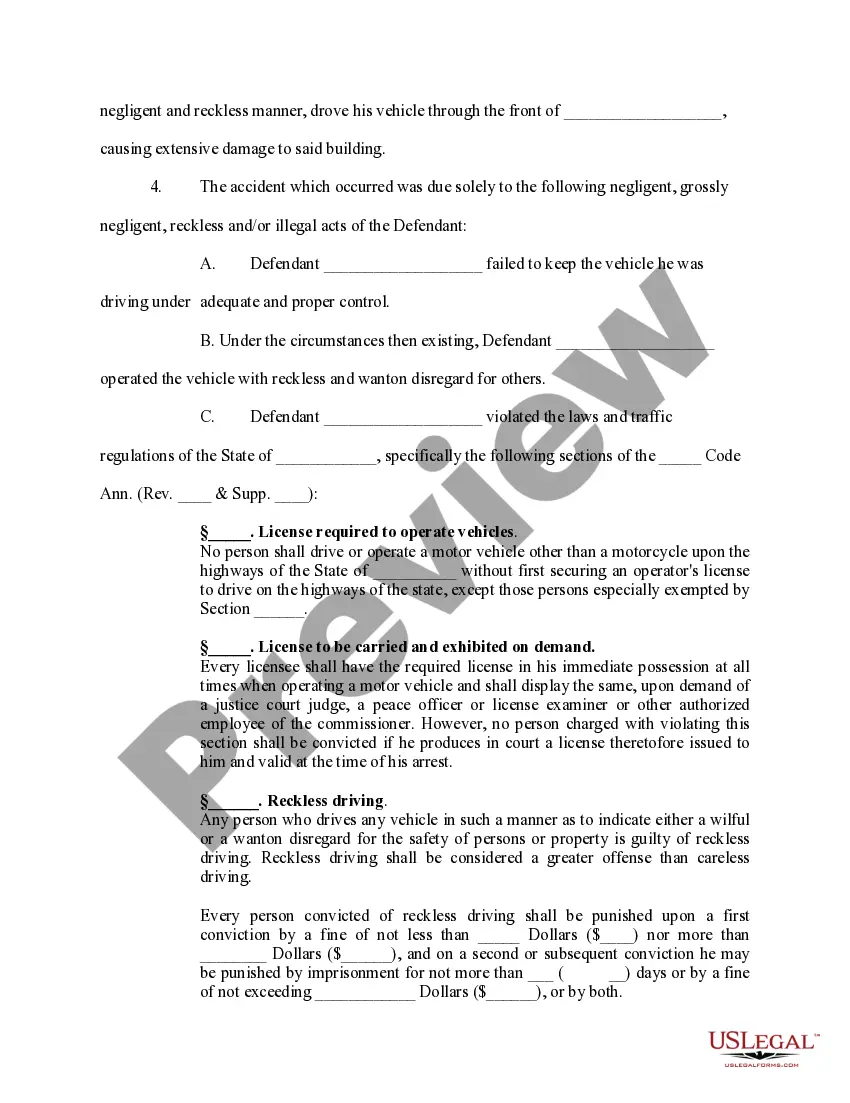

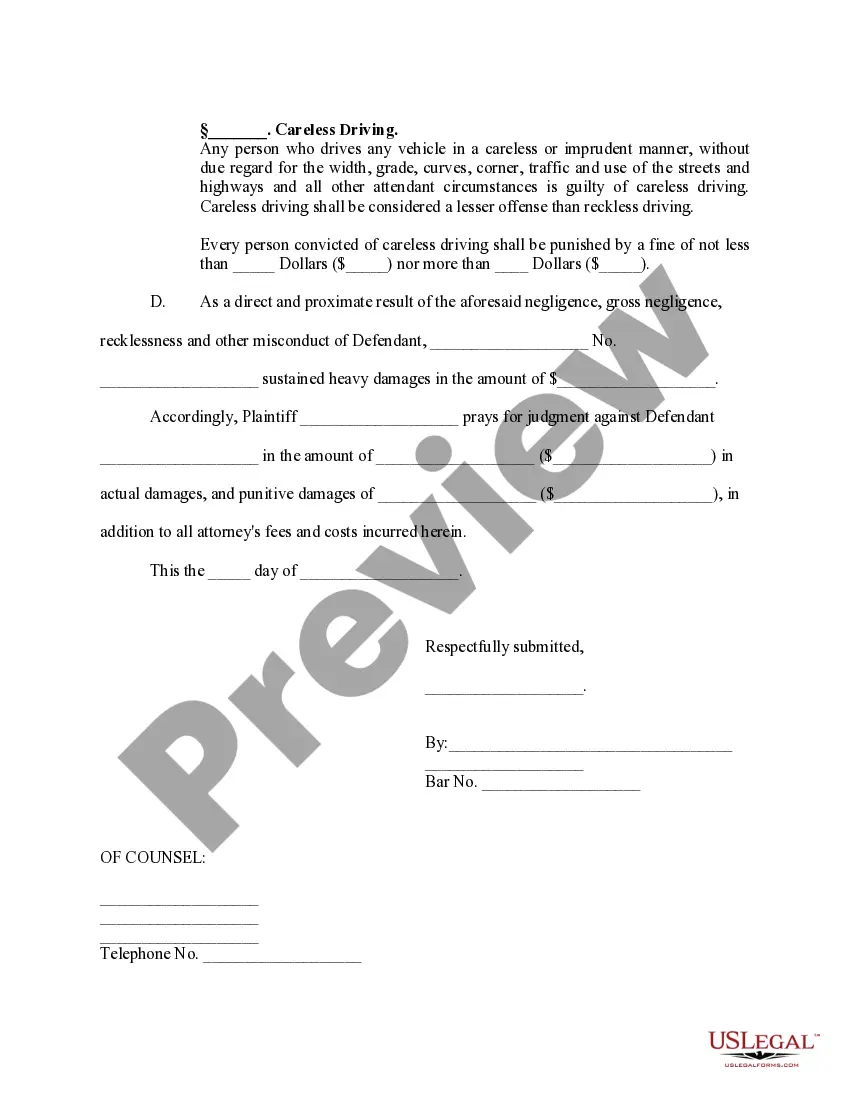

How to fill out Complaint Property Damage?

Are you in a circumstance where you require documents for either business or specific tasks almost every day.

There are numerous legitimate document templates available online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, such as the North Dakota Complaint Property Damage, that are designed to comply with state and federal regulations.

You can find all the document templates you have purchased in the My documents list. You can obtain an additional copy of the North Dakota Complaint Property Damage at any time, if needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service offers properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Dakota Complaint Property Damage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct state/region.

- Utilize the Preview button to review the form.

- Examine the information to ensure you have selected the appropriate form.

- If the form isn’t what you're looking for, use the Search field to find the form that meets your needs and specifications.

- Once you find the correct form, click Buy now.

- Choose the pricing plan you want, fill out the required details to create your account, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

North Dakota requires that the owner of a motor vehicle carry liability, uninsured and underinsured motorist, and no-fault insurance coverages.

State Farm might be a good place to start. NerdWallet analyzed auto insurance rates from 154 car insurance companies around the country to find cheap car insurance across several categories. State Farm is the cheapest car insurance company overall, with an average rate of $37 a month for minimum coverage.

Average Cost of Car Insurance in North Dakota The average cost of full coverage car insurance in North Dakota is $1,366 per year or $114 per month. The national average is $1,730 per year, so North Dakota drivers pay 21% less for car insurance than the typical American.

How Much Does Car Insurance Cost in North Dakota? In North Dakota, the average annual cost of a car insurance policy in 2023 is $1,277, which is less than the national average of $1,442. Nearby states tend to have higher auto insurance costs, with the annual average in Montana being $1,557 and Minnesota being $1,373.

Uninsured motorist coverage - $25,000 per person/$50,000 per accident.

North Dakota Auto Insurance Requirements North Dakota state law requires that all vehicles carry the following minimum insurance coverages: Bodily injury: $25,000 per person and $50,000 per accident. Property damage: $25,000 per accident. Uninsured motorist: $25,000 per person and $50,000 per accident.

Just as in any state, North Dakota has several requirements for vehicle operators if they are to be on the roads. All motor vehicles that are registered in the state must carry these minimum insurance coverages per person: Basic No-Fault, or Personal Injury Protection (PIP): $30,000 per person.

Cheapest Minimum Liability Car Insurance in North Dakota (October 2023) CompanyAnnual PremiumMonthly PremiumAuto-Owners Insurance Co$327$27State Farm$338$28Grinnell Mutual$353$29Progressive$372$316 more rows ?