North Dakota Lease of Machinery for use in Manufacturing

Description

How to fill out Lease Of Machinery For Use In Manufacturing?

If you require to sum up, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's user-friendly and convenient search feature to find the documents you need.

Various templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. After finding the form you require, click on the Acquire now button. Choose the pricing plan you prefer and input your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the North Dakota Lease of Machinery for use in Manufacturing in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to get the North Dakota Lease of Machinery for use in Manufacturing.

- You can also access forms you have previously saved from the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

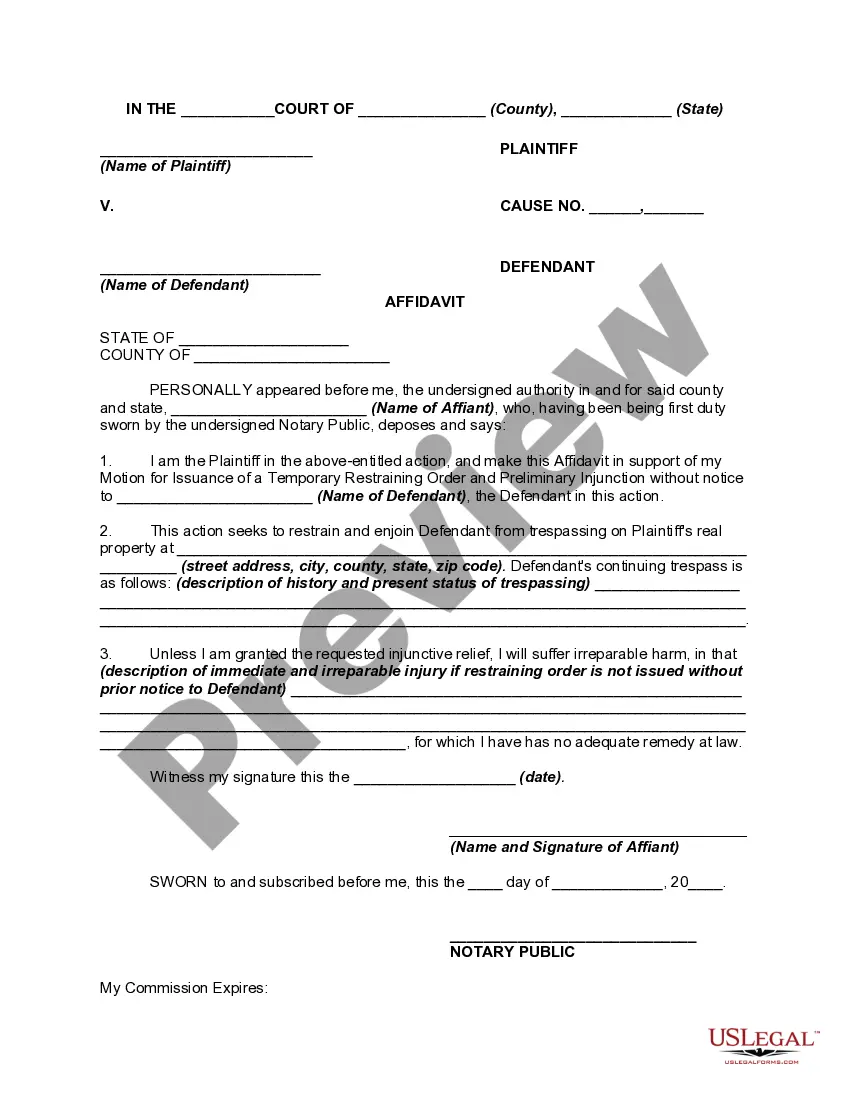

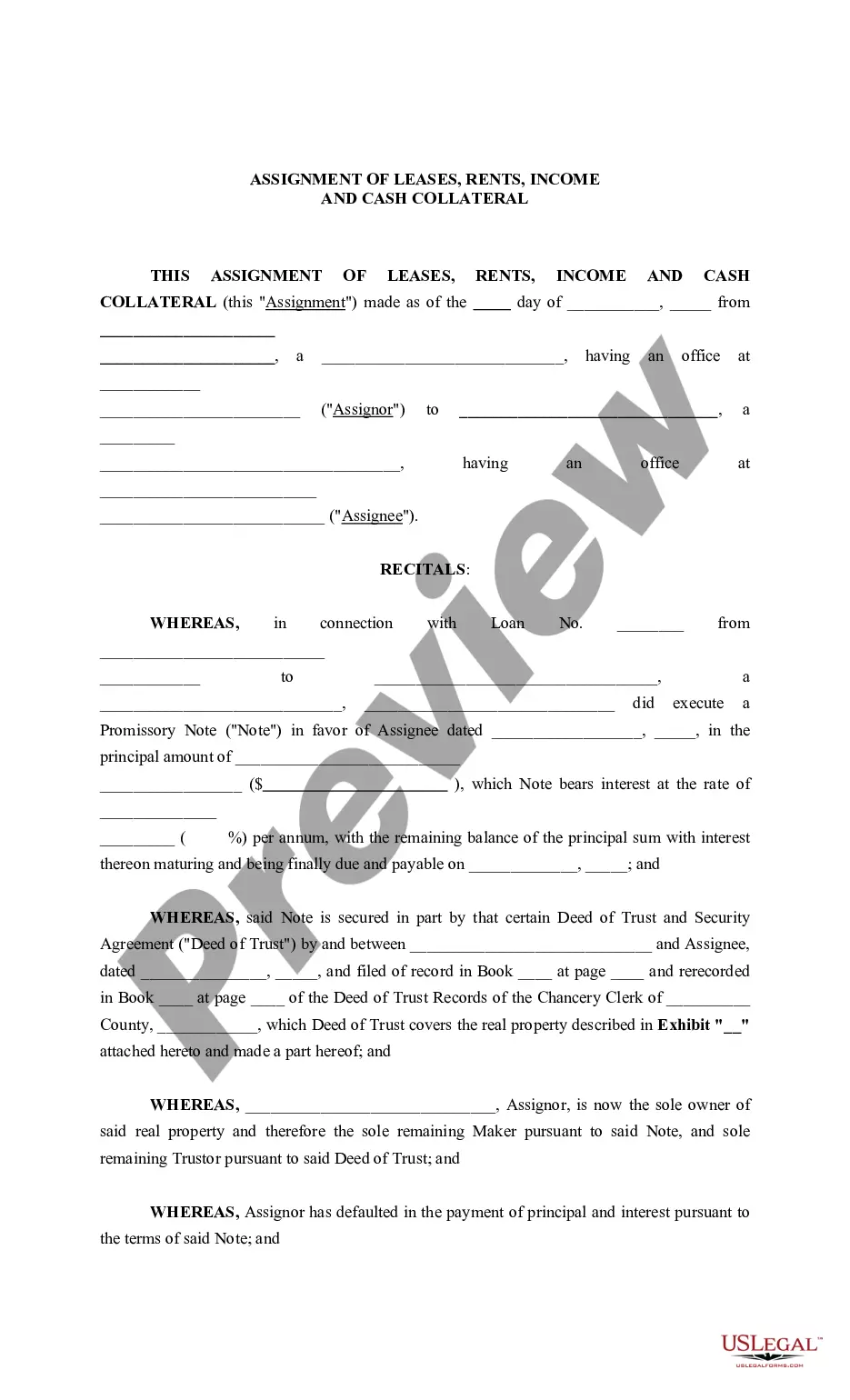

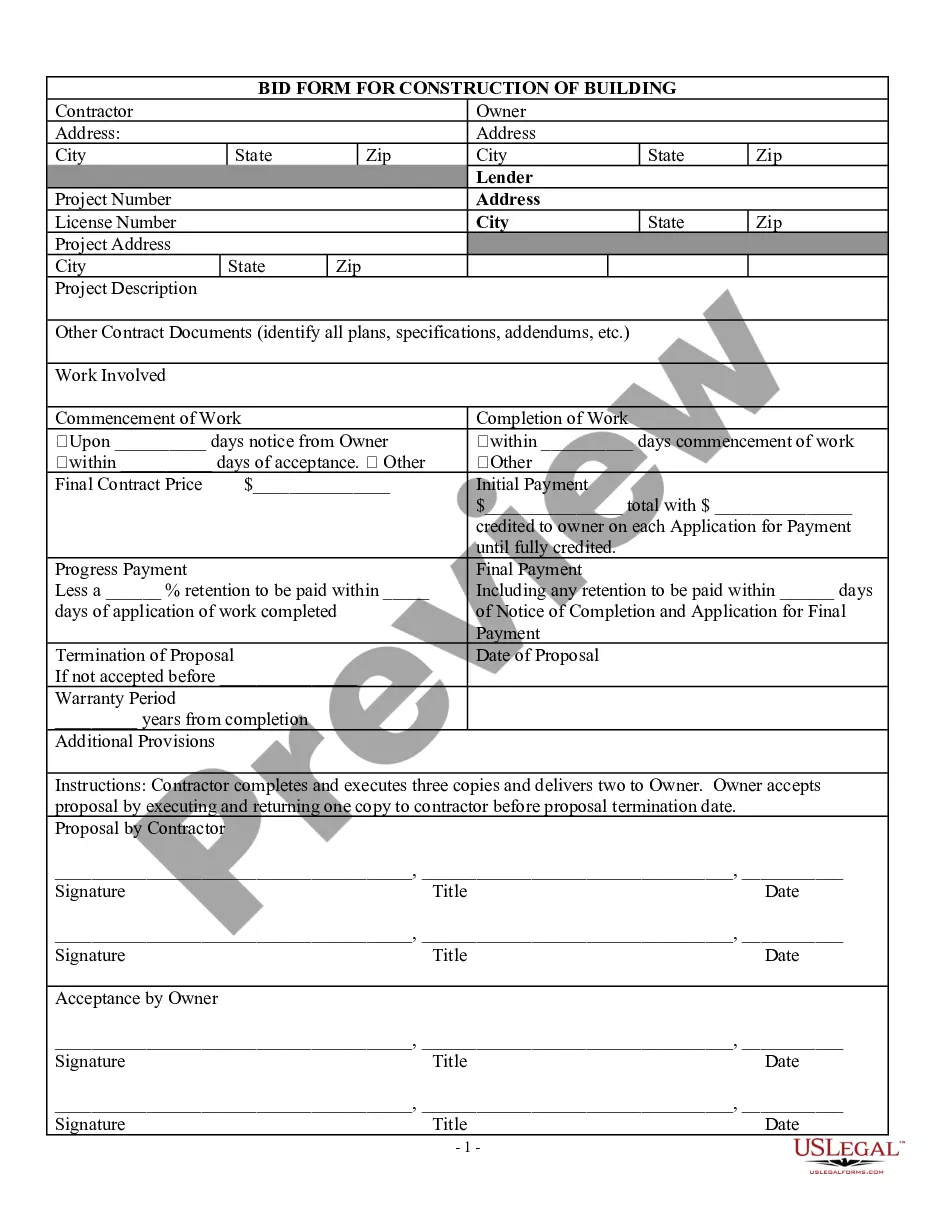

- Step 2. Utilize the Review option to inspect the form’s details. Don’t forget to view the information.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to locate different versions of the legal form template.

Form popularity

FAQ

The sales tax on used farm equipment in North Dakota generally mirrors the state's sales tax rate of 5%, along with any applicable local taxes. Important to note, specific exemptions may apply to used machinery, especially if it directly supports farming operations. Consider leaning on platforms like US Legal Forms when managing a North Dakota Lease of Machinery for use in Manufacturing to understand these nuances.

The automation tax credit in North Dakota provides tax incentives for businesses that invest in automation technology and equipment. This credit encourages manufacturers to upgrade their machinery, thus improving efficiency. A North Dakota Lease of Machinery for use in Manufacturing could help you acquire these automated tools while enjoying tax benefits.

Yes, there is sales tax on farm equipment in North Dakota, although certain exemptions may apply. Typically, equipment used directly in agricultural production may have tax benefits or reduced rates. It's advisable to consult the guidelines or utilize resources like US Legal Forms when navigating a North Dakota Lease of Machinery for use in Manufacturing.

The sales tax on a camper in North Dakota typically follows the state rate of 5%, plus any local taxes that may apply. If you are leasing a camper instead of purchasing it, the sales tax will still apply during the lease period. Make sure to factor in these costs, especially if you are exploring options like a North Dakota Lease of Machinery for use in Manufacturing.

In North Dakota, certain items are exempt from sales tax, including prescription drugs, some food items, and specific machinery used in manufacturing. If you lease equipment necessary for production, you may qualify for exemptions. Understanding these exemptions can benefit those considering a North Dakota Lease of Machinery for use in Manufacturing.

Machinery leasing is a process where businesses obtain machinery through a lease agreement rather than buying it outright. This arrangement allows companies to use essential equipment while preserving capital. For instance, many manufacturers find a North Dakota Lease of Machinery for use in Manufacturing beneficial, offering flexibility and reduced financial strain.