North Dakota Contract between General Agent of Insurance Company and Independent Agent

Description

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

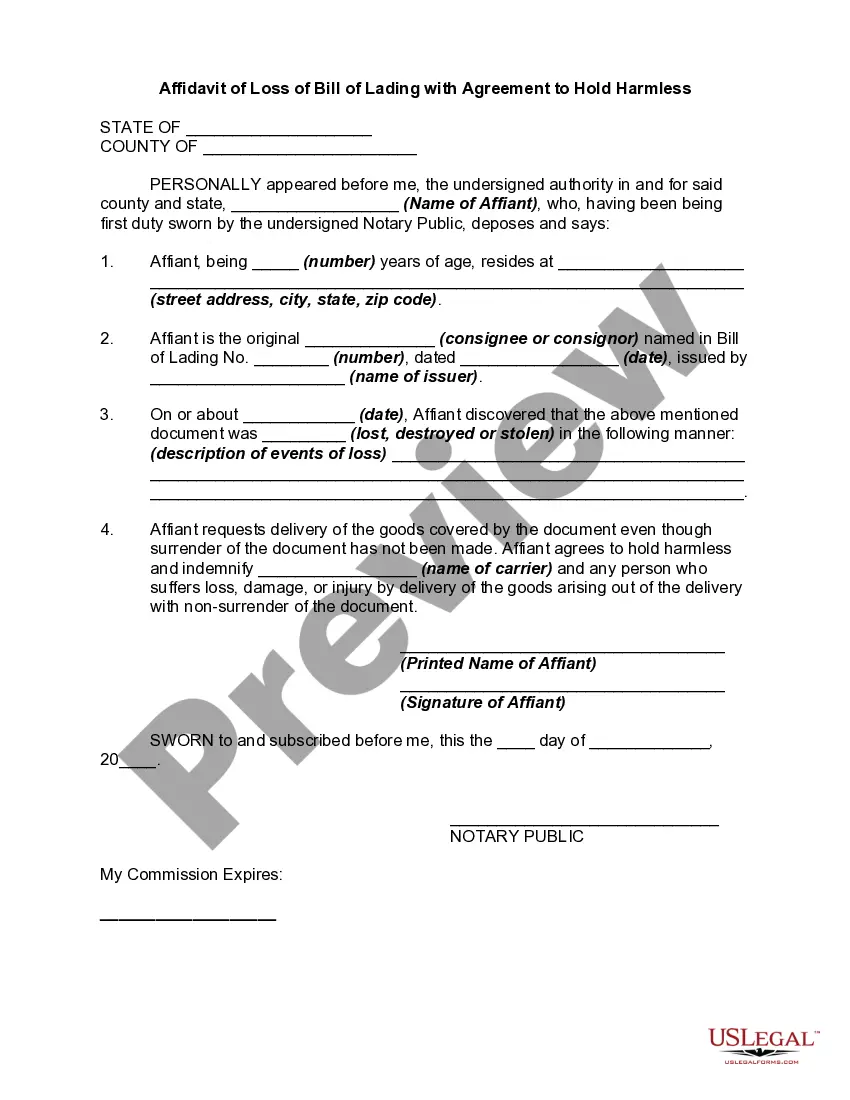

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

US Legal Forms - among the most extensive collections of legal documents in the United States - provides a range of legal form templates for you to download or print.

Through the website, you can obtain thousands of forms for business and personal purposes, classified by categories, states, or keywords. You can acquire the latest versions of forms like the North Dakota Contract between General Agent of Insurance Company and Independent Agent in a matter of minutes.

If you have a subscription, Log In and download the North Dakota Contract between General Agent of Insurance Company and Independent Agent from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Select the format and download the form onto your device.

Modify as needed. Fill out, edit, print, and sign the downloaded North Dakota Contract between General Agent of Insurance Company and Independent Agent.

- Ensure you have selected the appropriate form for your city/region. Click on the Preview button to review the form's content.

- Examine the form details to confirm you've chosen the right document.

- If the form doesn't meet your requirements, utilize the Search bar at the top of the page to find one that does.

- When satisfied with the form, validate your selection by clicking on the Buy now option.

- Then, choose the pricing plan you prefer and provide your information to create an account.

- Complete the payment. Use your credit card or PayPal account to finish the transaction.

Form popularity

FAQ

In North Dakota, the minimum liability limit is set at $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage. These limits ensure that drivers have a basic level of coverage in case of an accident. It is wise to consider higher limits based on your personal circumstances. Consulting a North Dakota Contract between General Agent of Insurance Company and Independent Agent can help you understand the implications of these limits.

North Dakota typically requires four types of insurance for drivers: liability insurance, comprehensive insurance, collision insurance, and uninsured/underinsured motorist insurance. Each of these policies serves a specific purpose and protects you from various risks on the road. Understanding these types can help you make informed decisions about your coverage. A North Dakota Contract between General Agent of Insurance Company and Independent Agent can help clarify the details.

Yes, it is illegal to drive without insurance in North Dakota. The state mandates that all drivers must carry liability insurance. The failure to comply with these insurance laws can lead to fines or other legal repercussions. To navigate these requirements effectively, consider reviewing a North Dakota Contract between General Agent of Insurance Company and Independent Agent for applicable insurance coverage.

Driving without insurance is not legal in most states, including North Dakota. Each state has specific laws regarding insurance requirements. However, the consequences for being uninsured can vary significantly from state to state, making it essential to be aware of local regulations. A North Dakota Contract between General Agent of Insurance Company and Independent Agent can guide you in understanding the insurance expectations in your state.

Yes, an independent contractor can serve as an agent of a company. This relationship is often formalized through a North Dakota Contract between General Agent of Insurance Company and Independent Agent. Such contracts outline the duties, rights, and compensation of the independent agent, providing clarity and structure to the partnership. Understanding the terms in these contracts is crucial for both parties.

North Dakota has specific insurance laws that govern various types of coverage and regulatory practices. These laws ensure compliance and protect both consumers and agencies. If you are an independent agent, understanding these regulations will aid in constructing effective terms in a North Dakota Contract between General Agent of Insurance Company and Independent Agent, ensuring both parties are on the same page.

North Dakota currently imposes a fuel tax of 23 cents per gallon for gasoline and 20 cents per gallon for diesel. This tax can influence transportation costs for businesses and consumers alike. For those involved in the insurance industry, being aware of such taxes is crucial when discussing benefits like transportation coverages in a North Dakota Contract between General Agent of Insurance Company and Independent Agent.

Yes, North Dakota typically operates with a budget surplus, which indicates strong fiscal health. This surplus can impact various sectors, including insurance. Agents entering into a North Dakota Contract between General Agent of Insurance Company and Independent Agent can benefit from a stable economic environment, fostering confidence in their operations and partnerships.

North Dakota has a progressive income tax system with rates ranging from 1.1% to 2.9% depending on the income bracket. Filing your taxes accurately is vital for financial planning, especially for independent agents. If you are considering agreements like a North Dakota Contract between General Agent of Insurance Company and Independent Agent, it’s essential to understand these implications on your overall earnings.