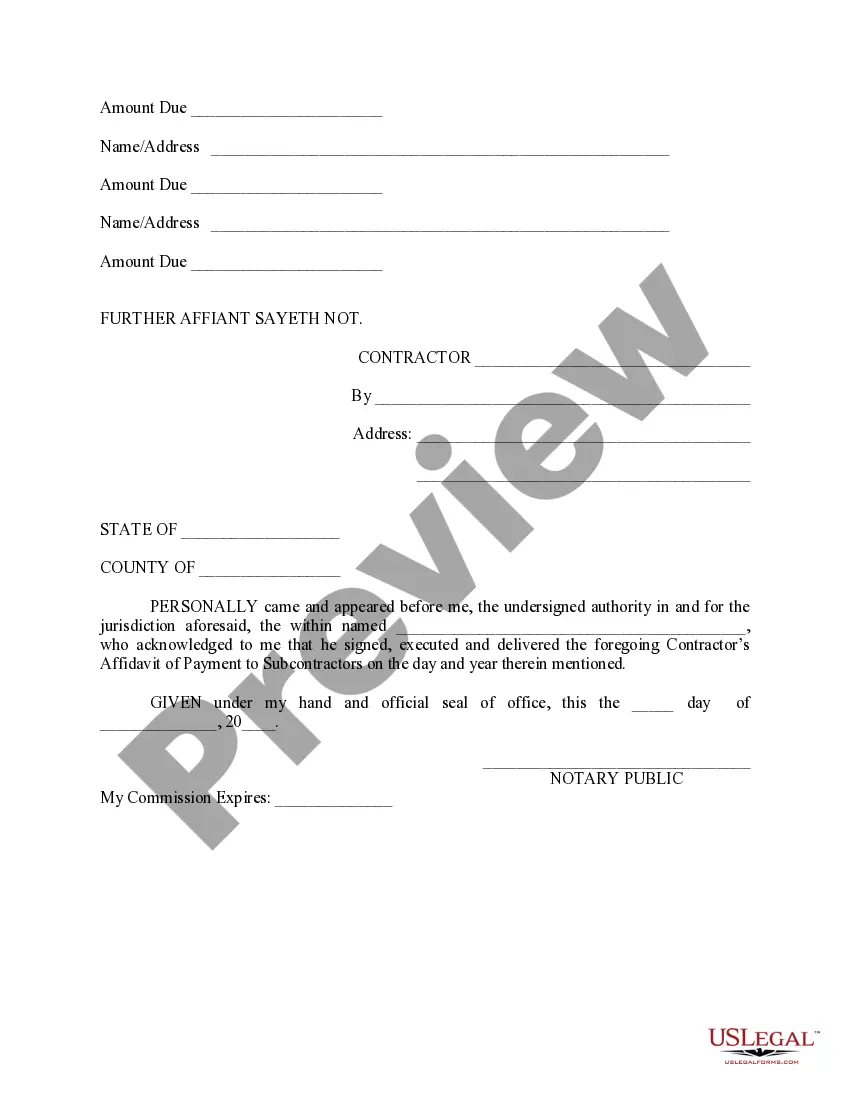

North Dakota Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the top assortment of legal forms available online.

Utilize the site's straightforward and convenient search feature to retrieve the documents you need.

Various templates for business and individual purposes are organized by categories and keywords. Use US Legal Forms to obtain the North Dakota Contractor's Affidavit of Payment to Subs in just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to each form you saved in your account. Visit the My documents section and select a form to print or download again.

Complete and acquire, and print the North Dakota Contractor's Affidavit of Payment to Subs using US Legal Forms. There are numerous professional and state-specific forms available for your business or individual needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to locate the North Dakota Contractor's Affidavit of Payment to Subs.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Always remember to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to carry out the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, review, and print or sign the North Dakota Contractor's Affidavit of Payment to Subs.

Form popularity

FAQ

Choosing to be a subcontractor can mean a reliable source of work without seeking new clients or being employed by a company. However, it can come with some significant drawbacks pay may be less reliable, taxes may be more complicated and you'll probably have less control over who you work with on a day-to-day basis.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

6 Tips for Dealing With Subcontractor DefaultPrequalify Your Subs. Before you take pricing or solicit bids from subcontractors you need to make sure they are capable of completing the work, both physically and financially.Know the Signs.Craft a Plan.Put It in a Contract.Protect Yourself.Termination of Contract.

Independent subcontractors regularly purchase materials and equipment related to their specific projects. Expenses for materials necessary for completion of a job may be directly deducted from taxable income on your tax return.

Subcontractors have to comply with the terms of the contract as well. They are held accountable for their work by the contractor and the customer. Punctuality and minimal time off is essential. Frequent communication between the subcontractor, general contractor and the customer helps to avoid problems down the road.

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

You can claim:Fuel costs.Repairs and servicing costs.Maintenance costs.Interest owed on the vehicle loan.Insurance premiums related to the vehicle.Payments on any lease agreements for the vehicle.Registration costs.Depreciation.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Subcontractor Costs means all costs incurred by subcontractors for the project, including labor and non-labor costs.

Subcontractors undertake work that a contractor cannot do but for which the contractor is responsible. Subcontractors can be anything from an individual self-employed person e.g. a plumber carrying out work for a building contractor to a large national organisation.