North Dakota Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal document templates that you can download or print. By utilizing the website, you can find thousands of forms intended for both commercial and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of forms like the North Dakota Consulting Agreement - with Former Shareholder in just a few minutes. If you already have a membership, Log In to download the North Dakota Consulting Agreement - with Former Shareholder from the US Legal Forms collection. The Download button will be visible on every document you examine. You can access all previously acquired forms from the My documents section of your account.

If you are looking to use US Legal Forms for the first time, here are simple guidelines to help you get started.

Select the format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the downloaded North Dakota Consulting Agreement - with Former Shareholder. Each template you added to your account does not have an expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the document you desire. Gain access to the North Dakota Consulting Agreement - with Former Shareholder from US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

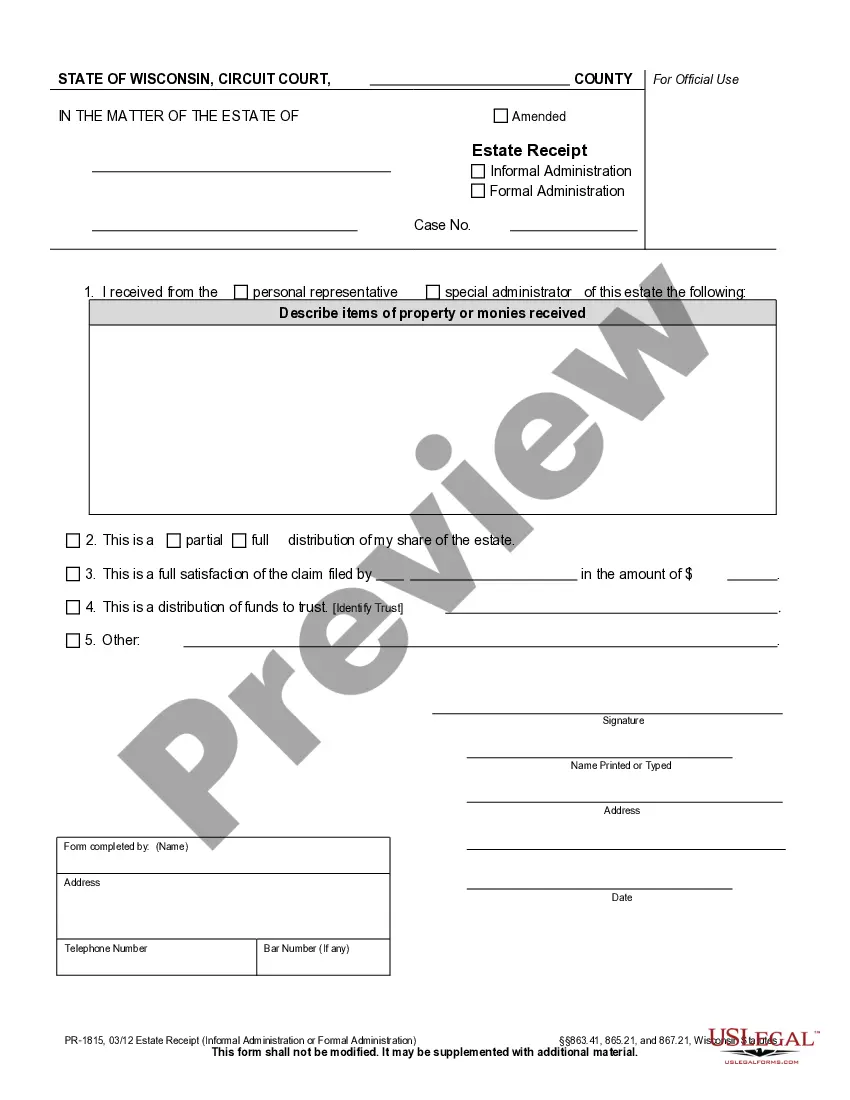

- Ensure you have chosen the right document for your city/state. Click the Preview button to review the form’s details.

- Examine the document summary to confirm that you have selected the appropriate document.

- If the document does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Dissolving a shareholder agreement typically involves a formal process that includes reviewing the agreement for termination clauses. Notify all parties involved in writing, and ensure compliance with any legal requirements. For a thorough process, looking into services that assist with North Dakota Consulting Agreements - with Former Shareholder can provide valuable support.

To terminate a shareholders agreement, it’s vital to closely follow the terms specified in that agreement. Usually, written notice is required, and certain conditions need to be met. If you want to navigate this smoothly, consider the North Dakota Consulting Agreement - with Former Shareholder as a framework.

In most cases, a shareholder agreement does not need to be notarized to be legally effective; however, notarization can add an extra layer of validity. It's wise to check local laws and consider getting your document notarized for added legal security. Always strive for clarity and compliance when drafting agreements.

Terminating a shareholder involves following the specific process laid out in your shareholder agreement. Generally, this includes issuing a formal notice and potentially buying out the shareholder's stake. Engaging with an expert familiar with the North Dakota Consulting Agreement - with Former Shareholder can facilitate a straightforward termination.

When writing a shareholder agreement, include essential elements such as ownership percentages, roles, and responsibilities. It’s important to outline terms for profits, voting rights, and dispute resolution. Utilizing templates from trusted sources can simplify the process and ensure all critical components are addressed.

Exiting a shareholder agreement usually involves a formal process defined by the agreement. You may need to provide a written notice and sometimes find a buyer for your shares. Consider consulting legal services that specialize in the North Dakota Consulting Agreement - with Former Shareholder to guide you through a smooth transition.

Terminating a shareholders agreement typically requires a written notice that complies with the terms set forth in the agreement itself. Make sure to review the requirements carefully, as they often specify the notice period and the necessary conditions for termination. Consulting with a legal professional can help ensure that you follow the correct process according to the North Dakota Consulting Agreement - with Former Shareholder.

To write a consulting contract agreement in North Dakota, begin by defining the scope of work and the services you will provide. Clearly outline the terms, including compensation, duration of the agreement, and confidentiality clauses. Use a simple format, avoid legal jargon, and ensure both parties understand and agree to the content.

To change a shareholders agreement, you typically need to follow the amendment process outlined in the existing agreement. This often involves obtaining agreement from all shareholders and documenting the changes formally. If you need to modify a North Dakota Consulting Agreement - with Former Shareholder, it’s advisable to consult with a legal professional or utilize resources from uslegalforms to ensure compliance with local laws.

A consulting agreement is a legal document that outlines the arrangement between a consultant and a client. In the context of a North Dakota Consulting Agreement - with Former Shareholder, it details the services provided, payment terms, and confidentiality obligations. This agreement serves to protect both parties by clarifying expectations and legal responsibilities, which is essential for a successful partnership.