North Dakota Accounts Receivable Monthly Customer Statement

Description

How to fill out Accounts Receivable Monthly Customer Statement?

You might spend time online trying to discover the appropriate legal document template that satisfies the federal and state requirements you need. US Legal Forms offers a vast array of legal forms that have been evaluated by experts.

It is easy to obtain or print the North Dakota Accounts Receivable Monthly Customer Statement from the service. If you already possess a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the North Dakota Accounts Receivable Monthly Customer Statement.

Every legal document template you purchase is yours indefinitely. To access another copy of a purchased form, go to the My documents section and click the corresponding button.

Complete the transaction. You can utilize your credit card or PayPal account to pay for the legal form. Choose the format of your document and save it to your device. Make adjustments to the document if necessary. You can complete, modify, sign, and print the North Dakota Accounts Receivable Monthly Customer Statement. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Review the form description to make sure you have chosen the right form.

- If available, use the Preview button to view the document template as well.

- To find another version of your form, use the Search field to locate the template that meets your criteria.

- Once you have located the template you want, click Get now to proceed.

- Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms.

Form popularity

FAQ

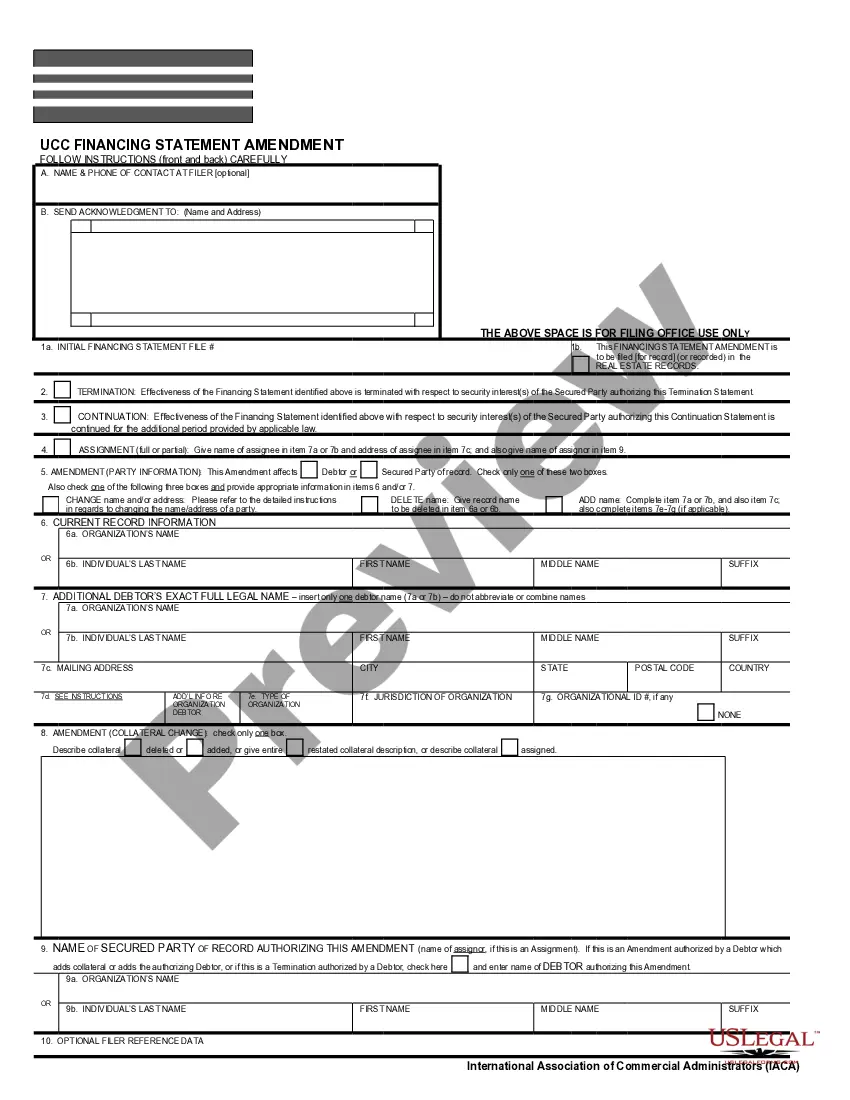

A North Dakota Accounts Receivable Monthly Customer Statement typically features a clear layout that presents account information in an organized manner. It includes sections for recent transactions, outstanding balances, and payment history. By using a well-structured format, customers can easily navigate their statements, making it simpler for them to address any concerns or questions they may have.

When creating a North Dakota Accounts Receivable Monthly Customer Statement, ensure it includes essential elements such as the customer's name, account number, transaction details, and the total amount due. Additionally, include the due date and payment instructions to provide clarity. This comprehensive information helps customers understand their account status and facilitates timely payments.

The balance sheet is the main statement that shows accounts receivable, detailing the amounts owed to your business. Additionally, you can find accounts receivable in a detailed accounts receivable report. The North Dakota Accounts Receivable Monthly Customer Statement is a valuable resource for summarizing these figures and improving your financial management.

Accounts receivable is primarily reflected on the balance sheet as an asset. It represents the total amount owed to your business by customers. The North Dakota Accounts Receivable Monthly Customer Statement is an essential tool for keeping track of these assets and ensuring your financial statements are accurate.

The statute of limitations for most debts in North Dakota is six years. This period starts from the date of the last payment or acknowledgment of the debt. Using the North Dakota Accounts Receivable Monthly Customer Statement can help you track these timelines and manage your collections efficiently.

To show accounts receivable on your financial documents, list the total amount owed by customers, along with individual balances if necessary. Make sure to include any adjustments for doubtful accounts. Utilizing a North Dakota Accounts Receivable Monthly Customer Statement can simplify this process and enhance clarity in your financial reporting.

You can find accounts receivable listed under current assets on a balance sheet. This section highlights amounts owed by customers that are expected to be collected within a year. The North Dakota Accounts Receivable Monthly Customer Statement serves as a practical tool to monitor these amounts and ensure accurate financial reporting.

In North Dakota, the general statute of limitations for collecting debts is six years. This means that if a debt remains unpaid for this period, it is considered uncollectible. To manage your accounts effectively, your North Dakota Accounts Receivable Monthly Customer Statement can help you track overdue accounts and take timely action.