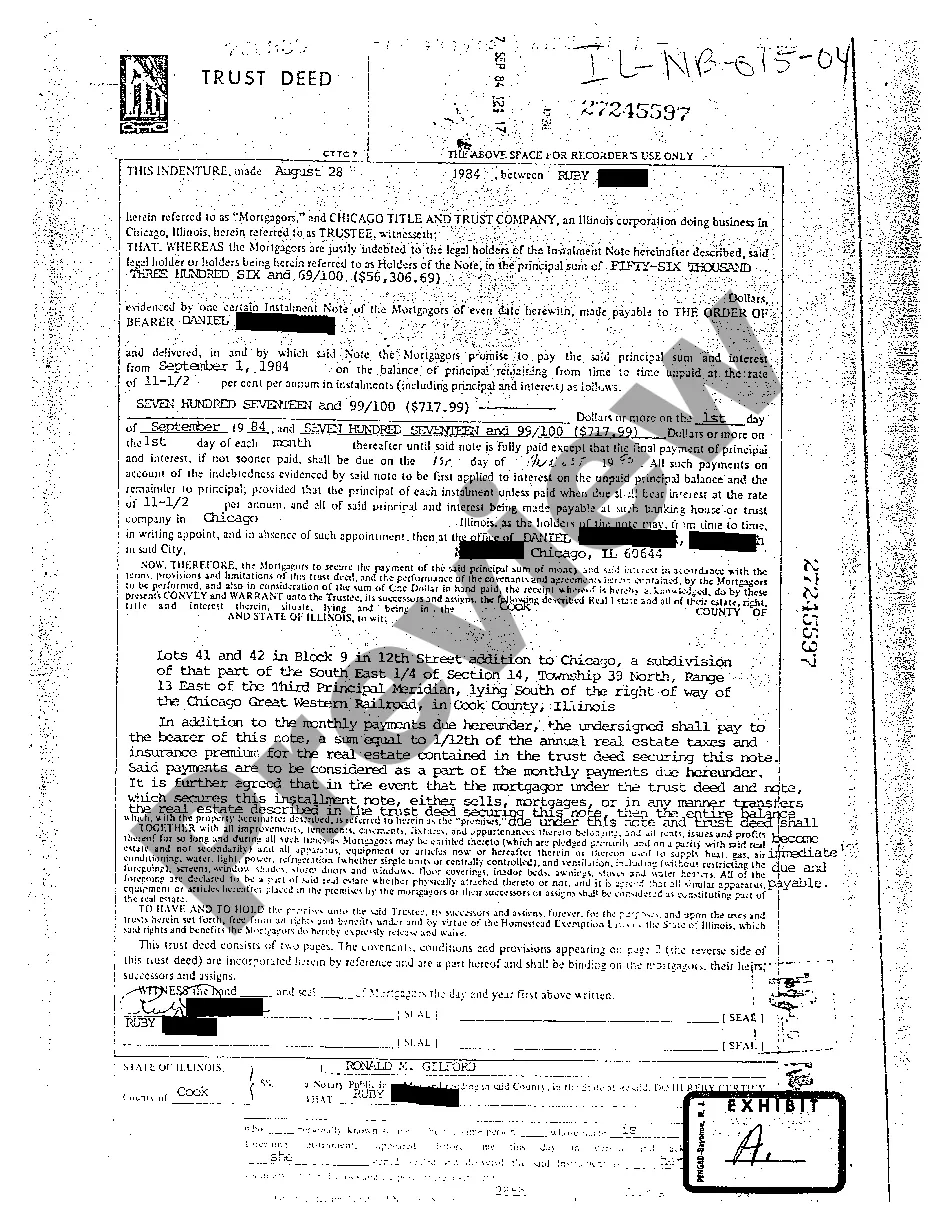

This form is an Authority to Release. The county clerk is authorized and requested to release from a deed of trust a parcel of land to the executor of the estate. The form must be signed in the presence of a notary public.

North Dakota Authority to Release of Deed of Trust

Description

How to fill out Authority To Release Of Deed Of Trust?

You can spend several hours online searching for the legal document template that meets the state and federal criteria you need. US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the North Dakota Authority to Release of Deed of Trust from my service. If you already have a US Legal Forms account, you can Log In and click on the Obtain option. After that, you can complete, edit, print, or sign the North Dakota Authority to Release of Deed of Trust.

Every legal document template you receive is yours forever. To get another copy of the purchased form, visit the My documents tab and click on the corresponding option.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the North Dakota Authority to Release of Deed of Trust. Access and print thousands of document templates using the US Legal Forms site, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the right form.

- If available, use the Review option to examine the document template as well.

- If you need to obtain another version of your form, use the Lookup field to find the template that meets your needs and specifications.

- Once you have found the template you require, click on Acquire now to proceed.

- Select the pricing plan you need, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

The three primary requirements of a trust include a competent settlor, a definitive trust property, and a designated beneficiary. Each element must be clearly defined to meet the legal standards set by the North Dakota Authority to Release of Deed of Trust. Understanding these requirements can help you create a valid trust. For assistance with the documentation, consider using US Legal Forms, which offers tailored solutions for your legal needs.

To establish a trust in North Dakota, you need a settlor, a trustee, and a beneficiary. The trust must have a clear purpose and be properly documented. It's essential to comply with the North Dakota Authority to Release of Deed of Trust to ensure that the trust functions as intended. Using US Legal Forms can simplify the process by providing you with the necessary legal documents.

To remove someone from a Deed of Trust in North Dakota, you must typically obtain their consent, as they are a party to the agreement. This often involves creating a deed of release or an amendment to the original Deed of Trust. It is advisable to consult a legal expert or use resources from uslegalforms to ensure the process aligns with state requirements. Understanding the North Dakota Authority to Release of Deed of Trust is vital for executing this correctly.

Several states, including North Dakota, require a Deed of Trust as a means of securing loans. The laws vary by state, and some states prefer using mortgages instead. Generally, states in the western United States are more likely to utilize Deeds of Trust. It’s crucial to understand your state’s requirements, especially regarding the North Dakota Authority to Release of Deed of Trust.

A living trust North Dakota keeps your family business private. Wills become public record through the probate process, but a trust is kept away from prying eyes and is not revealed. Your assets, beneficiaries and trust terms are not released to anyone not involved in the process.

A trust is created only if the settlor has capacity to create a trust, the settlor indicates an intention to create the trust, the trust has a definite beneficiary or is a charitable trust, a trust for the care of an animal, as provided in section 59-12-08, or a trust for a noncharitable purpose, as provided in section ...

That really depends on which benefits are most important to you. But, generally, the consensus among advisers and estate attorneys is that the trust laws of South Dakota and Nevada offer the best combination of tax benefits, asset protection, trust longevity and flexible decanting provisions. Why Do I Need a Trust?

A common law trust is a financial agreement by which a person or entity transfers ownership of assets to another person or entity through the creation of a trust deed. A common law trust is often simply referred to as trust and it is a private contract two parties to help grow the assets of the trust.

A North Dakota property owner may transfer or retitle real estate during the owner's life using a signed, written deed. A North Dakota deed must satisfy the legal requirements described below to be eligible for recording and to legally transfer title to the new owner.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.