North Carolina Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

It is possible to spend time on the Internet attempting to find the legal record design that fits the state and federal needs you want. US Legal Forms gives 1000s of legal forms that happen to be evaluated by specialists. It is simple to download or print the North Carolina Clauses Relating to Capital Withdrawals, Interest on Capital from the support.

If you have a US Legal Forms profile, it is possible to log in and click on the Acquire option. Following that, it is possible to full, revise, print, or indicator the North Carolina Clauses Relating to Capital Withdrawals, Interest on Capital. Each legal record design you buy is your own for a long time. To obtain one more duplicate of the purchased kind, go to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms site for the first time, stick to the straightforward guidelines beneath:

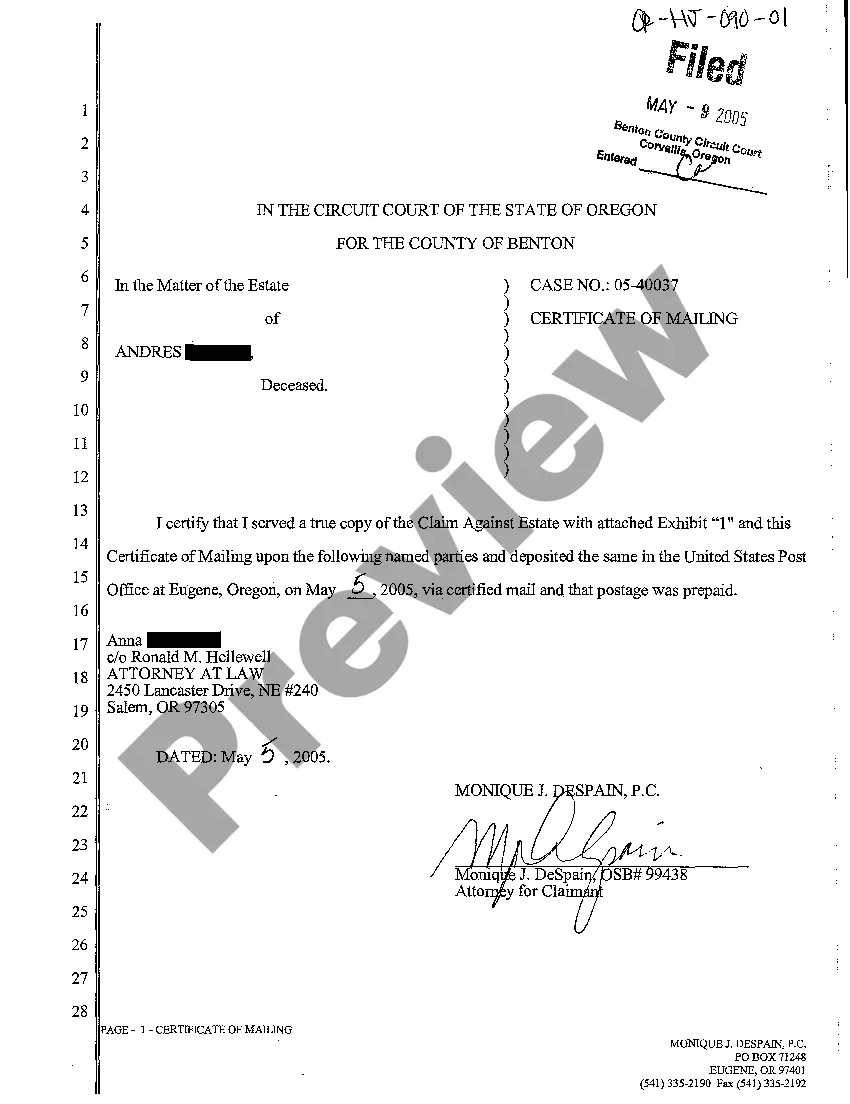

- Initial, ensure that you have chosen the right record design to the area/city of your choice. Read the kind explanation to ensure you have picked out the proper kind. If available, use the Review option to search from the record design also.

- If you want to locate one more version of the kind, use the Look for industry to find the design that suits you and needs.

- Once you have discovered the design you would like, click Purchase now to proceed.

- Find the pricing plan you would like, type your qualifications, and sign up for your account on US Legal Forms.

- Total the transaction. You can use your credit card or PayPal profile to pay for the legal kind.

- Find the structure of the record and download it to the device.

- Make modifications to the record if required. It is possible to full, revise and indicator and print North Carolina Clauses Relating to Capital Withdrawals, Interest on Capital.

Acquire and print 1000s of record templates utilizing the US Legal Forms Internet site, that provides the largest assortment of legal forms. Use professional and condition-distinct templates to deal with your organization or personal needs.

Form popularity

FAQ

§ 57D-2-22. Amendment of articles of organization. (a) An LLC may amend its articles of organization to add or change a provision that is required or permitted in the articles of organization or to delete a provision that is not required to be included in the articles of organization.

(b) A foreign LLC shall deliver with the completed application for the certificate of authority a certificate of existence or a document of similar import duly authenticated by the Secretary of State or other official having custody of limited liability company records in the jurisdiction under whose law it is ...

§ 57D-3-20. (a) The management of an LLC and its business is vested in the managers. (b) Each manager has equal rights to participate in the management of the LLC and its business. Management decisions approved by a majority of the managers are controlling.

§ 57D-6-06. Administrative dissolution. (1) The LLC has not paid within 60 days after they are due any penalties, fees, or other payments due under this Chapter. (2) The LLC does not deliver its annual report to the Secretary of State on or before the 60th day after it is due.

(a) A person who is a member, manager, director, executive, or any combination thereof of a limited liability company is not liable for the obligations of a limited liability company solely by reason of being a member, manager, director, or executive and does not become so by participating, in whatever capacity, in the ...

(a) Each local government and public authority shall operate under an annual balanced budget ordinance adopted and administered in ance with this Article. A budget ordinance is balanced when the sum of estimated net revenues and appropriated fund balances is equal to appropriations.

§ 57D-6-09. Upon dissolution of an LLC, the LLC shall deliver articles of dissolution to the Secretary of State for filing. The articles of dissolution must provide the following information: (1) The name of the LLC. (2) The effective date of the dissolution. (3) Any other information the LLC elects to provide.

§ 57D-2-20. Formation. (a) One or more persons may cause an LLC to be formed by delivering executed articles of organization to the Secretary of State for filing in ance with this Chapter and Chapter 55D of the General Statutes.