North Carolina Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

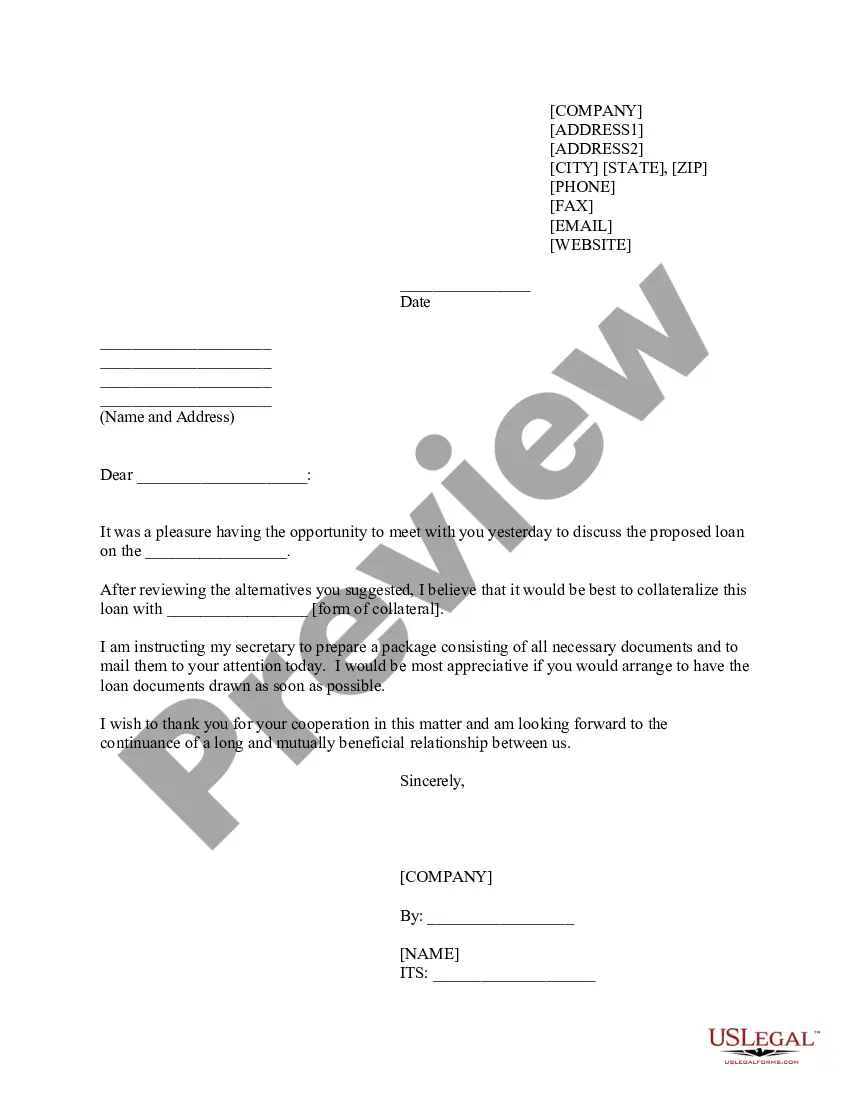

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

Choosing the best legitimate papers design might be a struggle. Obviously, there are a variety of layouts available on the Internet, but how will you discover the legitimate develop you need? Use the US Legal Forms web site. The service offers a huge number of layouts, such as the North Carolina Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest, that you can use for organization and private requires. All of the types are checked out by experts and meet up with federal and state needs.

If you are presently authorized, log in to the profile and then click the Download switch to get the North Carolina Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. Make use of profile to appear through the legitimate types you have ordered earlier. Go to the My Forms tab of the profile and acquire another version in the papers you need.

If you are a fresh consumer of US Legal Forms, here are simple guidelines for you to stick to:

- First, be sure you have selected the right develop to your city/region. It is possible to look over the form using the Preview switch and study the form information to ensure it will be the best for you.

- In case the develop will not meet up with your needs, utilize the Seach area to get the proper develop.

- When you are certain that the form would work, click the Get now switch to get the develop.

- Opt for the rates plan you need and enter the needed information and facts. Make your profile and pay for the order making use of your PayPal profile or credit card.

- Pick the data file format and obtain the legitimate papers design to the gadget.

- Total, modify and produce and indication the obtained North Carolina Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

US Legal Forms is the most significant collection of legitimate types for which you can find various papers layouts. Use the service to obtain appropriately-created paperwork that stick to state needs.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.