North Carolina Deed and Assignment from individual to A Trust

Description

How to fill out Deed And Assignment From Individual To A Trust?

You are able to commit hours online searching for the legal record template which fits the federal and state specifications you want. US Legal Forms supplies 1000s of legal kinds which are examined by specialists. It is simple to acquire or print out the North Carolina Deed and Assignment from individual to A Trust from our service.

If you have a US Legal Forms bank account, you can log in and click the Down load option. Afterward, you can comprehensive, edit, print out, or signal the North Carolina Deed and Assignment from individual to A Trust. Each legal record template you get is your own property for a long time. To get yet another backup for any obtained form, check out the My Forms tab and click the related option.

If you use the US Legal Forms internet site the very first time, adhere to the basic instructions below:

- Initial, ensure that you have selected the proper record template for that state/town of your choice. See the form information to make sure you have selected the right form. If available, make use of the Review option to appear with the record template as well.

- If you would like get yet another variation from the form, make use of the Look for discipline to get the template that suits you and specifications.

- When you have identified the template you need, simply click Get now to carry on.

- Find the costs prepare you need, key in your qualifications, and register for a free account on US Legal Forms.

- Complete the purchase. You should use your Visa or Mastercard or PayPal bank account to purchase the legal form.

- Find the format from the record and acquire it in your gadget.

- Make modifications in your record if necessary. You are able to comprehensive, edit and signal and print out North Carolina Deed and Assignment from individual to A Trust.

Down load and print out 1000s of record layouts utilizing the US Legal Forms site, which offers the largest variety of legal kinds. Use skilled and state-distinct layouts to handle your company or individual requires.

Form popularity

FAQ

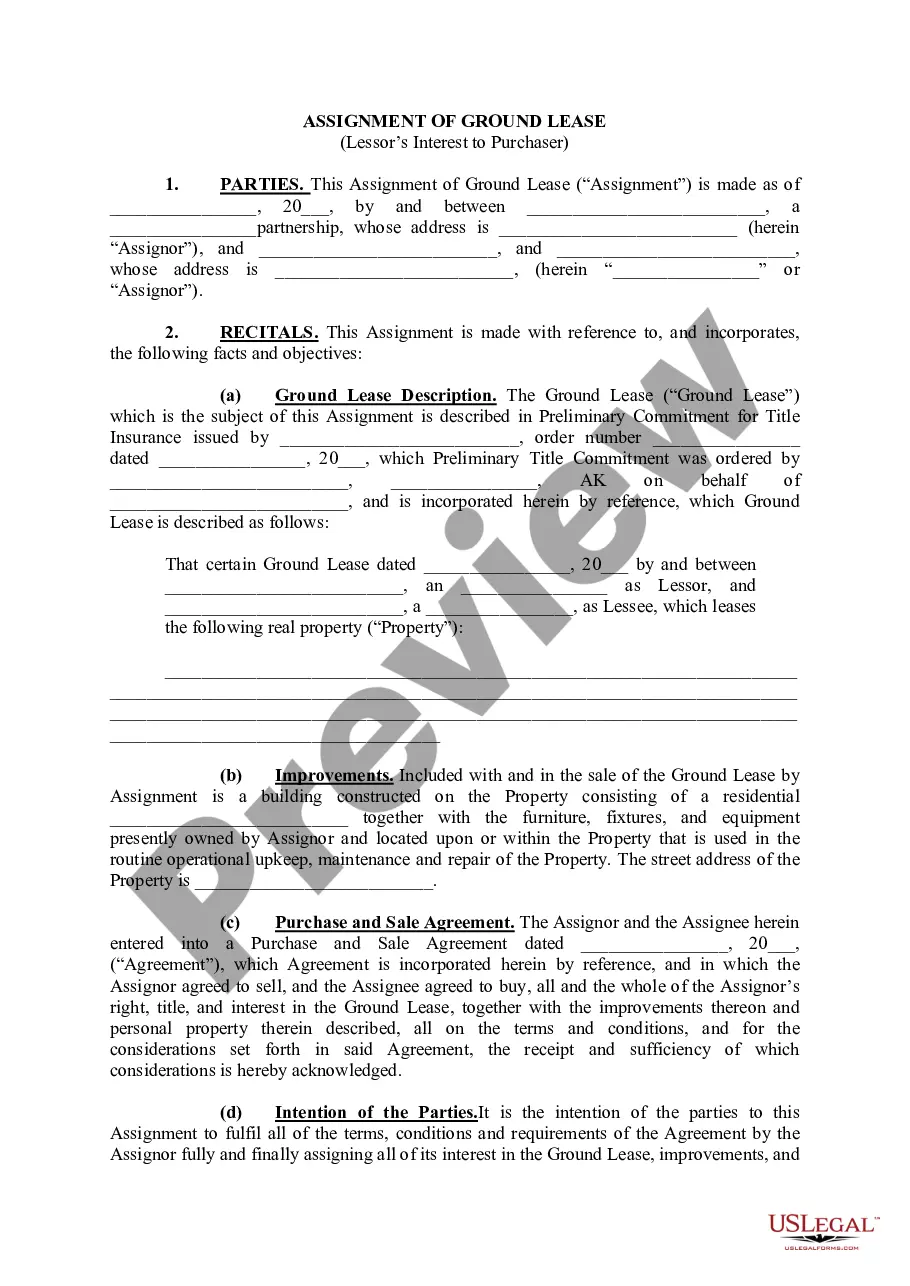

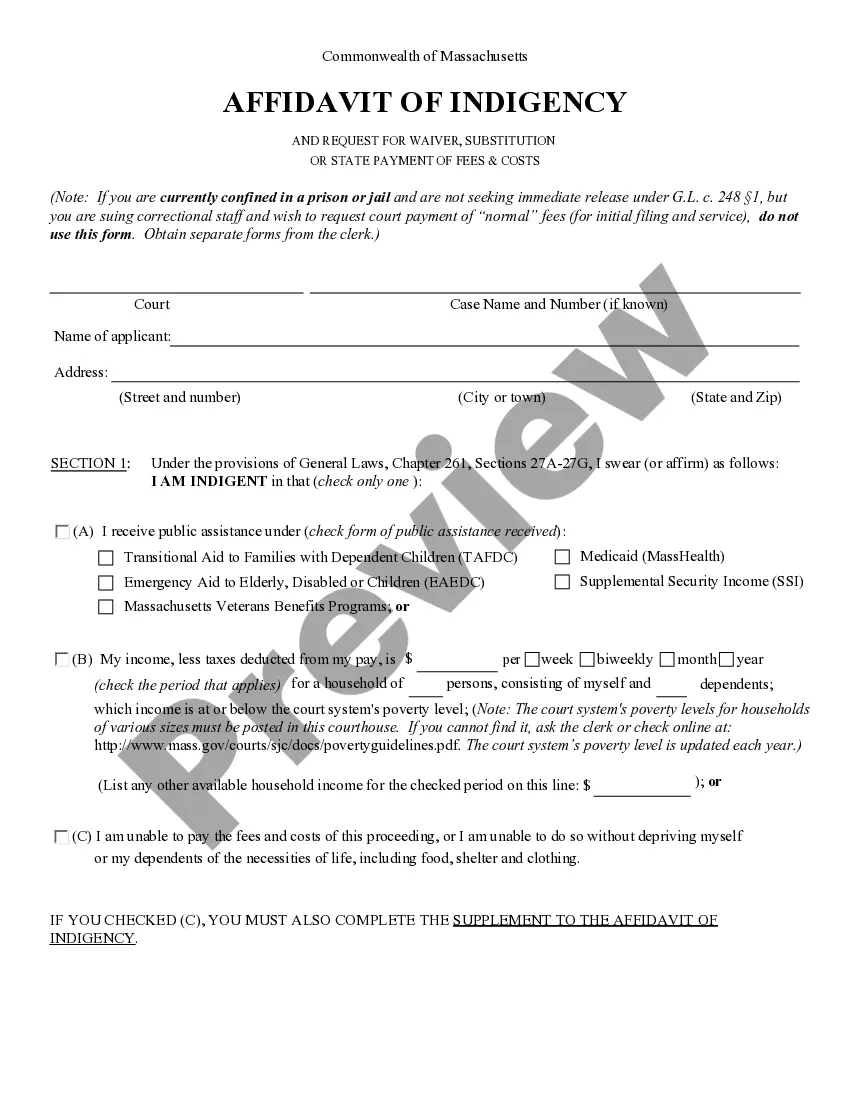

A Deed of Assignment is a legal document that transfers or assigns the legal rights and obligations to another party. And it varies depending on your situation. For example, an assignment could work for simple things like intellectual property.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

An assignment of trust deed is necessary if a lender sells a loan secured by a trust deed. It assigns the trust deed to whoever buys the loan (such as another lender), granting them all the rights to the property. It is recorded along with the original, making it a matter of public record.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

For instance, personal property is relatively simple to transfer into a trust. It merely requires a signed statement that lists the assets being transferred. If the personal property is titled in the grantor's name, such as a boat or a motor vehicle, it must be transferred with the correct type of deed.